Hong Kong Mandatory Provident Fund scores best return in four years during April as stock market rallies

- MPF returns 4.6 per cent in April, best monthly performance since March 2016

- April’s gains fail to make up for heavy loss in first quarter

Hong Kong's Mandatory Provident Fund reported its most robust monthly performance in four years during April, scoring each of the 3 million workers covered by the scheme an average HK$14,864 (US$1,917) from their pension investment funds.

This windfall is, however, only 42 per cent of what they lost in the first quarter and the outlook remains uncertain amid the ongoing coronavirus pandemic and the tense trade relationship between the US and China, according to analysts.

The 414 MPF investment funds earned 4.6 per cent on average last month, according to data company Lipper. This means that the fund gained HK$44.595 billion based on its total assets of HK$969.46 billion at the end of last year, the best monthly gain since March 2016 at 5.2 per cent.

“The strong bounce of the MPF in April was mainly caused by the increase in equity,” said Kenrick Chung, general manager of employee benefits at Realife Insurance Brokers.

Hong Kong and Asia-Pacific stock markets recorded their first month of gains in April since the outbreak, lifting the MPF over 70 per cent of whose assets are invested in stocks.

Hang Seng Index rose 4.4 per cent last month, the Shanghai Composite advanced 4 per cent and Tokyo's Nikkei 225 jumped 6.7 per cent. In the US, the Dow Jones Industrial Average had a substantial 11 per cent gain last month, while Nasdaq Composite surged 15.5 per cent during the month.

This rebound came after a gloomy first quarter when Hong Kong's Hang Seng Index dropped 16 per cent, while indices in Japan and South Korea both plunged 20 per cent. The Dow Jones Industrial Average lost 23 per cent in the quarter, its worst quarterly loss since the fourth quarter of 1987.

The turnaround was due to many governments carrying out relief measures to boost their economies, according to Gordon Tsui, chairman of Hong Kong Securities Association.

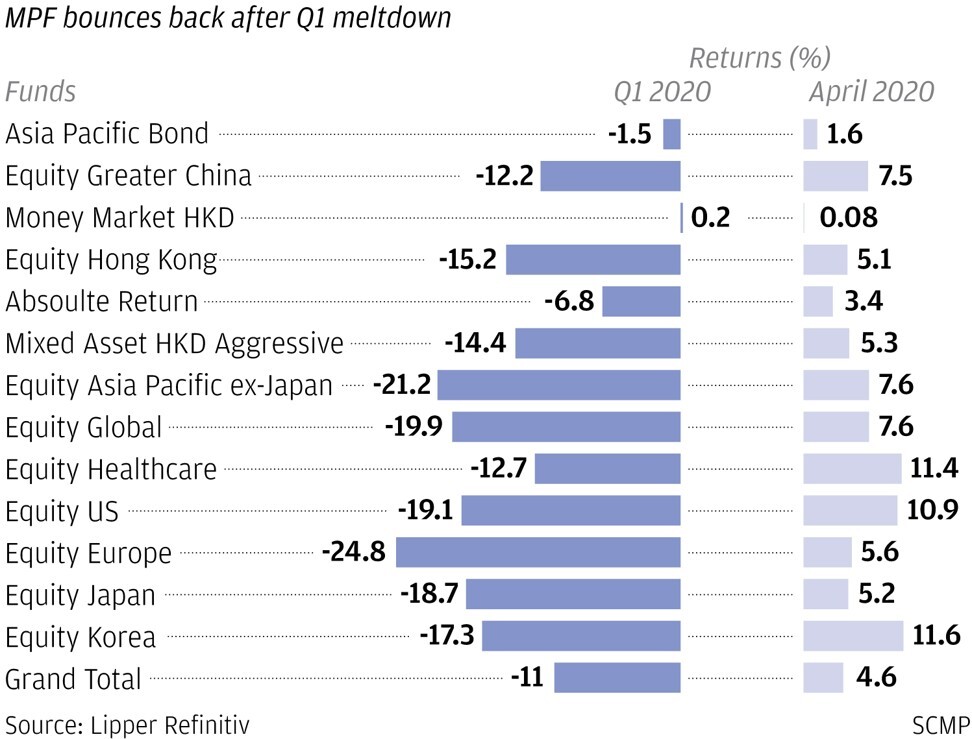

An MPF equity fund investing in South Korea was the best performer in April with an 11.6 per cent uplift, next a health care fund at 11.4 per cent and US stock funds on average rose 10.9 per cent during the month. Asia-Pacific stock funds rallied 8.6 per cent, while equity fund in Hong Kong and China both gained about 5.1 per cent.

Mixed-assets funds, another popular fund choice which invests in both stocks and bonds, had an average return of 4.9 per cent last month.

Bond funds investing in the Asia-Pacific region only had a modest return of 1.6 per cent, but they still beat money market funds at 0.08 per cent. No MPF fund suffered a loss in April.

In stark contrast, the MPF on average lost 7.3 per cent in March alone and plunged almost 11 per cent in the first quarter.

But Chung warned the bounce back may not last and urged MPF members to take a balanced approach to diversify risk.

“Even after the Covid-19 pandemic may be more under control, the trade war between the US and China is prepared to come again. Furthermore, the US presidential election and Hong Kong’s Legislative Council election in September will also bring more uncertainties to the investment market,” he said.