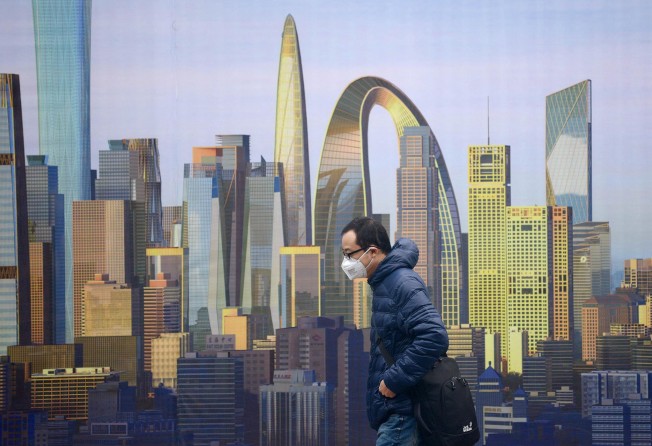

China's services sector attracts strong foreign investment flows

Foreign investment shift reflects China's economic rebalancing away from a reliance on investment-led growth and exports

Scratch below the downbeat figures for investment flows into China and there are some nuggets that will hearten policymakers in the face of talk of the diminishing appeal of the country in the eyes of international investors.

Foreign direct investment grew just 1.7 per cent to US$119.56 billion last year, the slowest rate of expansion in two years, Ministry of Commerce data shows. It is a far cry from the 23.6 per cent growth notched in 2008.

However, the services sector drew inflows of US$66.2 billion, up 7.8 per cent from the previous year. The surge lifted the sector to 55.4 per cent of total investment into the mainland, professional services firm KPMG said.

The result should buoy the Beijing leadership in its efforts to achieve a rebalancing of the economy towards services as part of a shift away from fixed-asset investment. Increased investment in inland provinces also proved a bright spot and may help soften perceptions that foreign firms face discrimination after some high-profile firms fell foul of mainland regulators over the past year.

Overseas investment in the manufacturing sector - long the driving force of China's economic miracle - fell 12.3 per cent to US$39.9 billion and accounted for 33.4 per cent of total inflows, KPMG said.

"The growth of service sector FDI reflects an underlying shift in China's economy," it said. "For much of the past 30 years, China's economic policies tended to emphasise investment activities and export-led manufacturing over domestic consumption.

"This economic model generated high rates of growth, but also led to an economy in which consumption accounted for a relatively small part. However, the emergence of a sizeable middle class has helped to spur the development of the service sector."

KPMG, noting the FDI growth of 7.5 per cent for central China, said companies were increasingly moving to the central provinces, or expanding their operations there, to take advantage of cheaper labour and land costs and improved infrastructure.

In December, US semiconductor giant Intel announced plans to invest US$1.6 billion to upgrade its factory in Chengdu, Sichuan province. In contrast to the money flowing into central China, the well-developed east coast and less-developed west saw FDI increases of just 1.1 per cent and 1.6 per cent, respectively, according to KPMG.

Despite the brighter picture for services and central China, the anaemic FDI growth for the mainland as a whole underscores the difficulties faced by policymakers in shoring up economic growth.

The mainland's GDP expansion of 7.4 per cent last year came in at the slowest pace in 24 years.

With the economic downturn already making investors wary of China, heightened official scrutiny on the operations of foreign companies over the past year has compounded their concerns.

"2014 was a challenging year for foreign businesses in China. Across many industries, foreign companies reported a rise in legal and administrative investigations," Dan Harris, a founding partner of US law firm Harris Moure, told a hearing organised by the US-China Economic and Security Review Commission in Washington last month.

"For larger companies, a rise in enforcement of China's Anti-Monopoly Law added complications for mergers and acquisitions.

"This increase in enforcement actions has led many in the foreign business community to conclude that business in China is becoming more difficult, with some even suggesting multinational companies are under selective and subjective enforcement by Chinese government agencies."

Still, foreign investors in the services sector appear to be undaunted. German health care company Artemed Group signed an agreement in July last year to set up a wholly foreign-owned hospital in the Shanghai free-trade zone that would open next year, KPMG cited as example.

FDI growth was expected to continue in the services sector, as China rebalanced its economy away from a heavy reliance on exports and investment-led growth, it said. "China plans to open its service sector wider to foreign investment."

In November 2013, the Central Committee of the Communist Party encouraged foreign companies to invest in services, including financial services, tourism, entertainment and health care.

In contrast, the reduced foreign direct investment in the manufacturing sector last year reflects the decline of China's status as the world's factory.

In 2010, the mainland's manufacturing FDI grew 6 per cent, KPMG said, noting the sharp contrast with the 12.3 per cent fall last year.

"China is taking measures to tackle industrial overcapacity, and apply more rigid environmental standards, at the same time that rising costs and a tightening labour market have greatly impacted many manufacturing activities," it said.

"FDI in the real estate sector was the single most important contributor to the decline in inbound [mergers and acquisitions] value, which fell from US$8.36 billion in 2013 to US$4.31 billion in 2014. This was in line with the sluggish property market in China."

Despite the slow growth of FDI in China, the country overtook the US as the world's largest recipient of outside investment last year, according to the United Nations Conference on Trade and Development.

The US fell to third place last year, because FDI in the country plunged by nearly a third, according to Unctad.

Those who watch investment flows factor in that a portion of FDI into China is investment by mainland businesses routed through Hong Kong and offshore havens back into the mainland.

A spokesman for the Ministry of Commerce said the government had made great efforts to simplify investment approval procedures, further open up the domestic market to foreign companies and to protect the rights of foreign investors.

Joshua Eisenman, a senior fellow for China studies at the American Foreign Policy Council, told the US-China commission hearing that the Chinese government had been making it harder for foreign firms to operate on the mainland by disproportionally targeting them in crackdowns on corruption, food safety and other areas.

However, Harris said: "A good part of my law firm's clients' claims of anti-foreign bias often stem from a misunderstanding of China and its laws rather than actual discriminatory action."