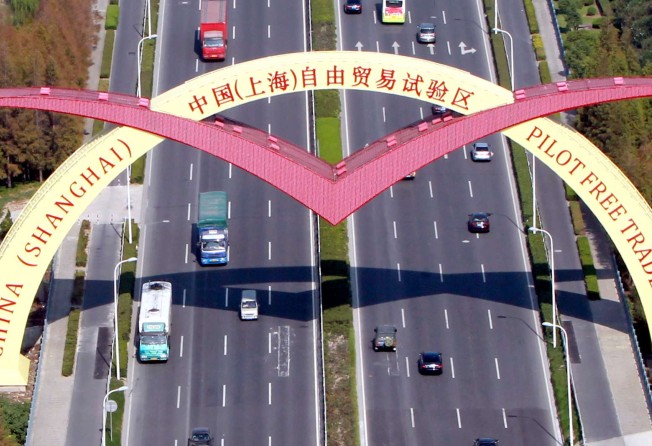

Shanghai FTZ firms’ overseas hopes dashed by policy U-turn

Pilot free trade zone faces currency flow curbs as authorities battle to slow yuan depreciation

After three years of development, Shanghai’s free-trade zone (FTZ) has refrained from delivering gleeful observations about its achievement.

Once billed as a path-breaking experiment for China’s economic and financial reforms, the project has entered a period of stasis as officials shifted focus from liberalisations to currency exchange control.

Wang Xiangjie, owner and chief executive of Shandong-based Yuanda Science, a maker of meat grinders, said he bore the brunt of the pain brought by policy changes, which disrupted his business plans.

“It is too bad that the free-trade zone turned out to be a place subject to tighter regulation,” the entrepreneur said. “It has a real and substantial negative impact on my business.”

Wang, 40, planned to set up a new business entity at the Shanghai FTZ and open a so-called FTZ account that could ease a planned overseas acquisition of a German meat grinder production facility.

German-made meat grinding machines could sport a price tag of 600,000 yuan (HK$670,000), nearly four times the price of a Chinese counterpart.

“I’ve found an acquisition target in Germany and hope to take advantage of the freer business atmosphere at the Shanghai zone to seal the deal,” Wang said. “The acquired business and technologies could help me set up similar production lines in Shandong to make grinding machines with the same quality. I am sure it’s a big deal and I can make a killing of the investment.”

But tightened control on foreign exchange at the 120-square-kilometre FTZ dashed Wang’s hopes of landing the lucrative deal soon.

Just before he set up the FTZ-based company in November, Wang was told by the intermediary firm he appointed to do the paperwork that it was impossible to use the FTZ account to secure overseas loans.

People’s Bank of China Shanghai branch chief Zhang Xin in November said banking authorities would step in to direct capital flows to result in a net inflow at the FTZ this year.

Facing mounting pressure on a weak yuan, Beijing imposed a de facto ban on money transfer abroad for investment worth more than US$5 million.

Company and banking officials said any remittance to accounts outside the mainland which are valued at more than US$1 million are now barred by the State Administration of Foreign Exchange.

The Chinese leadership gave a go-ahead to Shanghai to launch the country’s first FTZ in late 2013, envisioning the creation of a Hong Kong-style free marketplace with no customs intervention and financial deregulations including full yuan convertibility.

At the beginning of last year, Beijing took a bold step in throwing open the capital account at the Shanghai FTZ, allowing banks and companies to use the FTZ accounts to borrow money offshore, an apparent effort to bolster cross-border money flows.

Companies can direct flows of yuan or foreign-exchange money between the FTZ and offshore accounts freely.

Those with an FTZ account can use the yuan assets as a guarantee to borrow money offshore from an overseas branch of a mainland bank, enjoying lower interest rates and using the loans to fund their asset purchases abroad.

Wang planned to embark on this loan model to borrow €2 million (HK$16.32 million) for the buyout of a German business.

But the banking authorities also halted this kind of operation in November to slow domestic firms’ outbound pace.

“The U-turn by the authorities to step up foreign-exchange control showed that a freer marketplace is still a far-cry,” he said. “I kind of lose confidence in the domestic economy and policymaking now.”

In the past three years, the Shanghai FTZ has been surrounded by criticism for the slow reform process.

Local authorities kept touting it as a “highland” for economic reforms because of a streamlined business approval process that shortened the period of time for the registration of new companies inside the zone.

The zone’s administration commission said more than 370,000 new businesses were set up in the territory during the past three years, 80 per cent of which were Chinese privately owned businesses.

For Wang, the FTZ offered a platform and springboard for him to internationalise the business – freely buying assets abroad to help upgrade his production facilities and move the products up the value chain.

Zhangjiang Platform Economic Research Institute deputy chairman Zhu Dan said: “It’s of mutual benefit to both domestic privately owned and foreign companies if their efforts can be combined to tap the increasing consumer needs in China.

“The free-trade zone is supposed to be a bridge to make them connected.”

Wang is not alone.

Dozens of FTZ-based companies are complaining of the recent administrative measures by Beijing to stem capital outflows via the FTZ accounts.

In Shanghai, the local business community is increasingly aware that authorities’ popular narratives were not well supported by reality on the ground.

Shanghai seeks to transform itself into a global financial centre by 2020 but the promised liberalisations such as the establishment of an international board and a board for emerging industries at the Shanghai Stock Exchange never came to fruition.

“The government encouraged businesses to move to the zone to help it flourish, but without real policy breakthroughs and opaque policymaking it just seems as if only the ‘shells’ exist there,” said Chen Xiao, chief executive of advertising agency Shanghai Yacheng Culture which has a subsidiary at the FTZ. “It’s disappointing.”