Not finance, but Shanghai banks on manufacturing to reclaim commercial supremacy

After Shanghai’s industrial output dropped 7 per cent in the first-quarter of 2016, officials knew they could not just rely on the service sectors for growth

Shanghai, China’s most developed metropolis, is backtracking from its resolution to become a service hub, and falling back on its tested manufacturing base to grease the wheels of commerce and growth.

The city had boasted of unbending faith in the service sectors, which would transform it into a global financial and shipping centre by 2020. Gone are the upbeat rhetoric of such an ascension, but in its place, officials are quietly mapping out new plans to rejuvenate Shanghai’s manufacturing industry and reclaim China’s economic locomotive status.

The final wake up call came when Shanghai’s industrial output dropped seven per cent year on year in the first quarter of 2016. Officials knew it was time to act.

“There have been increasing questions about Shanghai’s manufacturing sectors following years of declines,” said Chen Mingbo, head of the Shanghai Commission of Economy and Information Technology. “We have an answer today: with efficient coordination, Shanghai’s manufacturing industry still has big growth potential.”

Addressing a press conference earlier this week, he stressed the importance of ensuring sustainability in driving the growth of Shanghai’s manufacturing businesses, albeit the city’s land scarcity for industrial development and rising living costs.

There have been increasing questions about Shanghai’s manufacturing sectors following years of declines

As he shed light on the development plan, Chen pointed out that 1 square kilometre of industrial area should generate at least economic output of 1 billion yuan (US$147 million) a year.

Outdated and creaky factories and companies would be replaced by high-tech and promising money spinners.

The city pledged to attract more than 60 key industrial projects with annual output of more than 1 billion yuan each between 2016 and 2020, Chen said.

Biotechnology, new materials, industrial internet, semiconductor, smart car and airplane manufacturing are singled out to propel Shanghai’s further growth.

They will feed into the government’s blueprint drawn up in May to reinforce the return of manufacturing businesses.

Under the grand scheme, Shanghai would reserve more land for promising companies, offering preferential rents and incentives such as lower tax payments for small technology firms to enhance their manufacturing might.

They had also actively pitched global industrial stars such as Microsoft to expand their investments in the city, Chen said.

“Shanghai’s reputation can be a draw to the Fortune Global 500 companies,” Chen said. “They are interested in working with us.”

Cen Fukang, a deputy director of the Shanghai Planning, Land and Resources Administration, said the city government would keep a flat fee on land-use for the prospective companies for the next 20 years, a departure from the current practice where fees are raised periodically.

Shanghai has over the past two years refrained from touting its efforts to build a world-class financial centre after the slow progress made in liberalising the financial markets. To be fair, financial deregulation entails central government decision makers, and is something beyond the authorities in Shanghai.

In 2009, the city had for the first time officially unveiled its global financial hub ambition, in tandem with Beijing’s efforts to internationalise the yuan.

Piggybacking on the city leaders’ focus on finance until now, Shanghai’s service sectors accounted for 67.8 per cent of the local gross domestic product (GDP) last year.

“A developed city can’t do without flourishing a manufacturing industry,” said Bob Zhou, chief executive of Shanghai-based investment group Yinshu Capital.

“It is necessary to go back to manufacturing businesses as the city attempts to regain its growth momentum.”

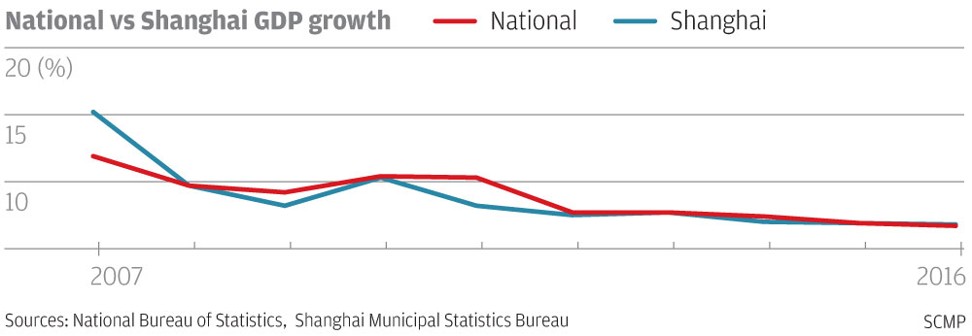

Shanghai has lagged behind its provincial-level counterparts in term of economic growth.

Between 2008 and 2015, its GDP growth was eclipsed by the national average as its manufacturing sectors slumped.

To move its manufacturing sectors up the value chain, the city has massively adjusted its economic structure since 1990s, closing down a large number of light-industry companies such as textile and daily necessities makers that were struggling with thinning profit margins.

Most of the brands have faded in oblivion due to cut-throat competition.

In 1985, Shanghai’s auto making industry was catapulted into international limelight after SAIC Motor established a joint venture with Volkswagen to produce sedans for the then fledgling car market.

Last year, the manufacturing sectors represented only a quarter of the city’s GDP.

Export-oriented businesses are increasingly finding themselves in a bind as the city loses its lustre as a gateway to the rest of the country.

Yuan Lamei, owner of a garment company that sells clothes to the European markets, said net profit margins had fallen to a scant 8 per cent from more than 30 per cent a decade ago.

“Wage inflation continues, and it’s increasingly difficult to get orders from foreign clients as they set eyes on the manufacturers in Southeast Asia,” she said. “For manufacturing businesses, it looks as if our days are numbered.”

City officials do not think so.

For manufacturing businesses, it looks as if our days are numbered

Chen said a year of efforts to bolster manufacturing businesses have paid off.

In the first quarter of this year, industrial output in Shanghai grew 6.7 per cent from the same period in 2016.

“The government has the power to push the development of mega projects,” he said, adding that corporate giants owned by the central government and foreign investors would be lured to help create new jobs and growth engines for Shanghai.

Last month, Shanghai officials relished a successful maiden flight of the country’s first self-made narrow-bodied passenger jet, signifying the country’s goal to compete for the global industrial crown.

The C919 aircraft assembled by Shanghai-based Commercial Aircraft Corporation of China (Comac) represents arguably China’s boldest attempt to break the duopoly of Airbus and Boeing.

The double-aisle plane is expected to conduct a first flight in 2022, with deliveries beginning as early as 2025.

Shanghai’s road to become a global financial centre had been a convoluted eight-year affair.

Expected liberalisation including the establishments of two new boards at the Shanghai Stock Exchange – the international board and board for emerging industries – never came to pass.

The qualified domestic individual investor (QDII2) scheme allowing mainland residents to directly invest in overseas stocks was shelve indefinitely after years of preparations on fears of rampant capital outflows that could exacerbate a weaker yuan.

The crude oil futures opened to foreign players to trade in have yet to be launched.

In 2013, Shanghai established the mainland’s first free-trade zone that aims to facilitate free commodity and capital flows across the border. Interests have been at best modest, with few foreign and domestic companies reaping substantial benefits from the freedom of doing businesses inside the so-called mini-Hong Kong.

It faces competition against another 10 similar zones across the nation.

“But the ground reality is that Shanghai is still a thriving marketplace to do businesses,” said Cao Hua, a partner at Unity Asset Management.

“Businesses all the way from catering to plane-making will gravitate to Shanghai, because it is the metropolis where millions of people have plenty of money to spend. The key lies in what products and services you can make to meet their needs.”