China’s top equity pickers say 2018 will be the year that sees the revenge of the small-cap stocks

Big-cap shares have beat smaller firms by the most since 2014 this year, but top-ranked analysts expect trend to be over in 2018 with a comeback of growth stocks

The year 2017 has been one of extreme divergence for China’s stocks, with large-cap companies beating smaller growth firms by a large margin. But such outperformance will probably end next year, as the nation’s most credible analysts and top-performing fund manager are predicting a comeback of small-caps.

Haitong Securities says growth stocks are likely to join blue-chip companies in the rally, while Shenwan Hongyuan Group argues that small-caps may be back in favour as accelerating reforms after the top leadership reshuffle have boosted investors’ risk appetite. Both brokerages took the top two spots on this year’s annual ranking by the New Fortune magazine for Chinese equity strategy research. HSBC Jintrust Fund Management’s Qiu Dongrong, whose fund has beaten 94 per cent of the rivals, is switching into growth firms out of bigger ones.

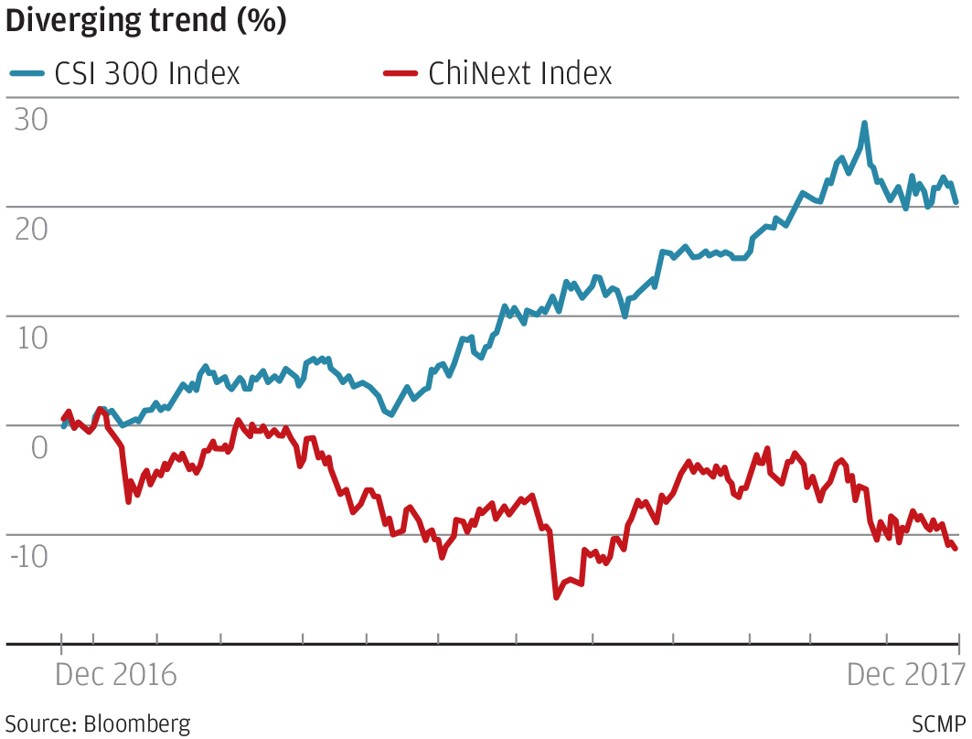

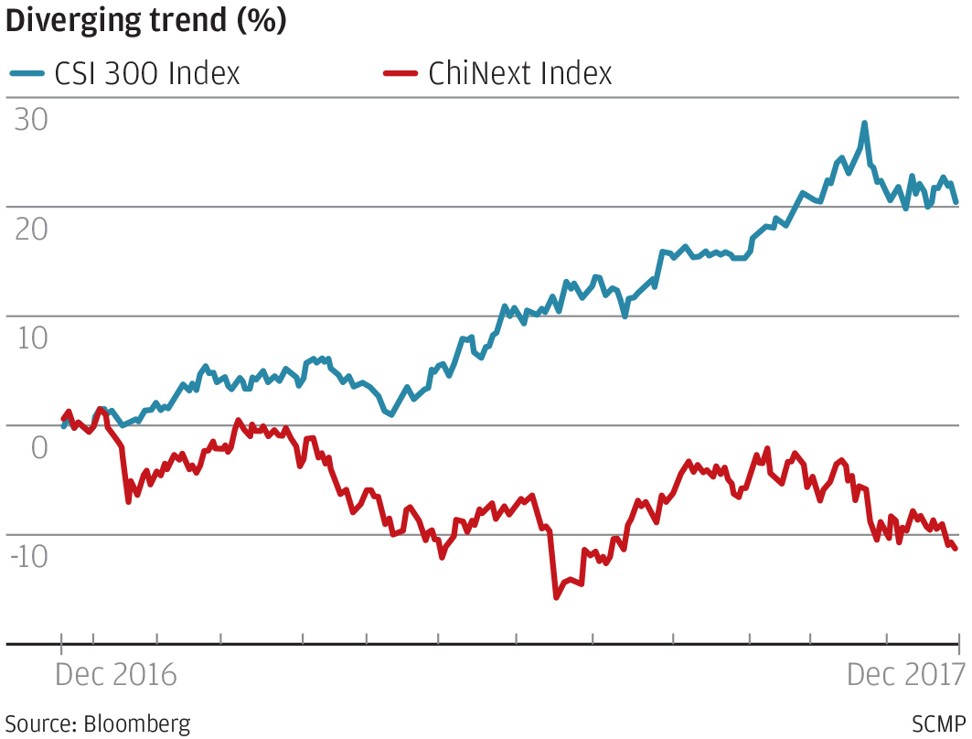

The performance of the two camps of stocks has not been so divergent since 2014. The CSI 300 Index of the most valuable 300 companies on the Shanghai and Shenzhen exchanges has climbed 21 per cent this year, beating an 11 per cent loss on the ChiNext gauge of start-ups. The gain on the SSE 50 Index, which tracks a smaller group of big-caps on the Shanghai bourse, has been more impressive, notching up an advance of 24 per cent.

Wu said he liked companies in the artificial intelligence, media and culture industries, without specifying any stock.

The ChiNext gauge is twice as expensive as its big-cap counterpart on the valuation basis, but the ratio of the relative value is already close to the lowest level, according to data compiled by Bloomberg. The measure of smaller firms is valued at 31.1 times estimated earnings, the data showed.

Such an extreme divergence in stock performances isn’t likely to repeat next year

Haitong Securities’ strategist Xun Yugen recommends buying stocks in high-end manufacturing and emerging consumer industries next year, saying that these growth companies will rise alongside with financial stocks that have the valuation edge among big-caps.

“The market will watch more closely earnings growth of leading growth companies,” he said. “Buying will probably expand to growth stocks from value stocks and the two are expected to move forward together.”

Xun predicts that the broader market will probably break out of the rangebound trading and progress to a “slow bull market” next year.

The benchmark Shanghai Composite Index has risen 5.6 per cent this year, with volatility dropping close to record-low levels amid intermittent state buying after the 2015 market crash. It closed down 0.9 per cent at 3,275.78 on Wednesday.

Policymakers’ accelerated implementation of reform measures after an October gathering that re-elected President Xi Jinping as party chief for a second term will bolster small-caps by fuelling thematic investment and boosting the risk appetite, said Fu Jingtao and Wang Sheng, Shanghai-based strategists at Shenwan Hongyuan.

“Small-caps will probably become an important source of above-the-average returns,” Fu said.

The outperformance of big-caps is not a common phenomenon in China’s stock market, as local investors have a long-standing habit of speculating on smaller firms that are deemed as a proxy for fast earnings growth and spikes in share prices.

The biggest victory scored by big companies over growth firms in history was in 2014, when the CSI 300 beat the ChiNext gauge by 39 percentage points. But the two gauges were almost even in performance for most of the year and did not diverge until the last two months, as a cut in interest rates by the central bank in November boosted the valuation of big-caps.

Buying will probably expand to growth stocks from value stocks and the two are expected to move forward together

Citic Securities, China’s biggest listed brokerage, does not agree with Haitong and Shenwan. Financial deleveraging and increased scrutiny of asset management products will hurt small-caps by restraining liquidity, said Qin Peijing and Yang Lingxiu, analysts at the brokerage.

“We don’t think that there will be a shift in investment styles or small-caps will systemically outperform big-caps,” they said. “It’s just that the divergence won’t be so extreme in 2018.”

The year’s biggest gainers on the CSI 300 includes LONGi Green Energy Technology, Jiangxi Ganfeng Lithium and iFlyTek, all of which had jumped at least 163 per cent this year through November 22 when the gauge hit the year’s high.

But some investors including HSBC Jintrust’s Qiu have already started to cut their holdings of the year’s market darlings on concern they have risen too much and too fast.

LONGi, a maker of mono-crystalline silicon for photovoltaic products, has dropped 14 per cent from its all-time high set in November, while lithium ore producer Jiangxi Ganfeng and artificial intelligence firm iFlyTek have fallen at least 16 per cent from their highs.

“Structural opportunities in small-caps will emerge,” said Hong Hao, Hong Kong-based managing director at Bocom International, who correctly predicted the boom-to-bust on China’s stocks in 2015. “Large-caps have run hard in 2017, and their relative outperformance is approaching extreme.”