Forget Fire and Fury and focus on what matters: solid US jobs, wages and consumer spending

Michael Wolff’s explosive book may have dominated the news but the real story is that US economic data remains solid. And that’s good news for all of us

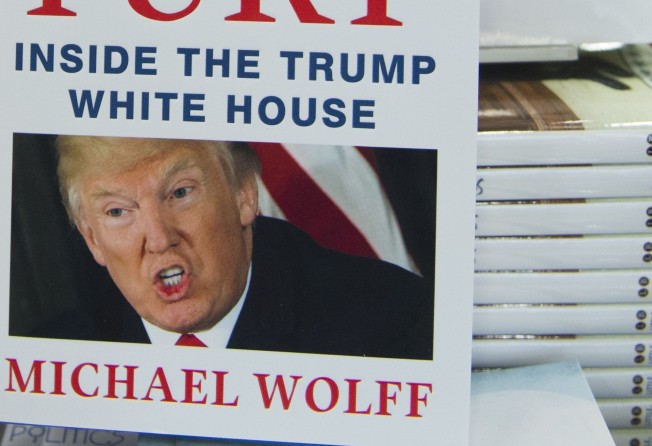

Michael Wolff’s Fire and Fury: Inside the Trump White House might have been dominating the US news cycle in recent days but markets should be more interested in a set of economic data which suggests a still healthy American economy which is underpinning a broader global economic expansion.

Even as Wolff’s scathing representation of the Trump presidency – though dismissed in a tweet as “boring and untruthful” by the US president himself – was hitting bookstores on Friday, data from the US Bureau of Labour and Statistics showed that “job gains have averaged 204,000 over the past three months.”

Admittedly, December’s 148,000 increase in non-farm payrolls was below the 190,000 rise forecast by economists polled by Reuters but the US unemployment rate remained at a 17-year low of 4.1 per cent and average hourly earnings rose 2.5 per cent in December year-on-year, up from November’s 2.4 per cent.

It should also be noted that the average hourly earnings increase didn’t take into account any impact from the tax legislation signed into law by Trump just before Christmas or, at the margin, the effect of individual states and cities raising the local minimum wage from the start of 2018.

In the latter case, as the US National Employment Law Project has pointed out, 18 states and nine cities raised their statutory minimum wage as of January 1, which should, according to the US’ Economic Policy Institute, provide “over US$5 billion in additional wages to 4.5 million workers across” the United States.

There’s also an argument that rises in minimum wages at times of very low unemployment will then encourage higher wages as a whole as the available labour force exploits the relative lack of competition in the jobs market to force employers to pay more for workers.

The combination of the low unemployment rate and the uptick in hourly earnings should keep the Federal Reserve on course for a further rate increase in March. In the meantime, Friday saw the Dow Jones Industrial Average, the Nasdaq Composite and the S&P 500 all powering higher.

Markets try to second-guess future developments. Perhaps last week’s buoyancy in US equity markets reflected a feeling that current, and potentially future, increases in US average hourly earnings could finally prefigure some degree of higher inflation after years when, despite tighter labour markets, it has stubbornly refused to approach the Fed’s 2 per cent target.

The combination of the low unemployment rate and the uptick in hourly earnings should keep the Federal Reserve on course for a further rate increase in March

Certainly the US bond market’s gauges of inflation expectations rose on Friday.

For example, according to data from Tradeweb, the 10-year inflation break-even rate, defined as the yield gap between 10-year US Treasury inflation protected securities (TIPS) and benchmark 10-year Treasuries, increased to 2.03 per cent, the highest closing level on the 10-year TIPS breakeven rate since last March.

Only time will tell whether price pressures in the United States will build but there can be no argument over the fact that, for whatever reasons, the American consumer is again spending money. In turn, that is driving an increase in the US trade deficit.

On Friday the US Commerce Department revealed that the trade deficit had widened by 3.2 per cent to US$50.5 billion in November from October’s upwardly revised US$48.9 billion to reach its highest level since January 2012.

Given that American exports of goods and services increased to US$200.2 billion in November, the highest level on record, the deterioration in the US trade deficit lies at the feet of a rise to US$250.7 billion in the country’s imports bill. A major component of that latter increase was caused by the value of imported consumer goods hitting their highest point since March 2015.

The increased US appetite for imports is certainly benefiting China and the European Union. The US’ trade deficit in goods with China expanded to US$35.4 billion in November from October’s US$35.2 billion while with the European Union it rose to US$14.7 billion from US$13.7 billion.

There’s a case to be made that with the yuan having already hit a 20-month high versus the US dollar last week and with the euro trading well against the greenback in recent months, the foreign exchange markets have already calculated that sound US economic data no longer means the only game in town is the American currency.

But that doesn’t mean Chinese and European assets won’t remain attractive.

“Fire and Fury” may have dominated the US news cycle but the real story is that the country’s economic data remains solid. And that’s good news not just for the United States but for other economies too.