Stocks sink in Hong Kong, mainland China as Covid spreads to Beijing with district lockdown adding to cracks in economy

- Beijing, a city of more than 20 million people, has locked down dozens of residential compounds and told residents in eastern Chaoyang district to undergo tests

- Lockdowns are weighing on the economy with broken supply chains, factory closures and port congestion

Stocks in Hong Kong slumped and those in mainland China tumbled by the most in more than two years as Covid-19 outbreak spread to Beijing with some areas in the capital coming under lockdown, heightening economic losses.

The Hang Seng Index sank 3.7 per cent to 19,869.34 at the close, its lowest level since March 15, while the Hang Seng Tech Index plunged 4.9 per cent.

The Shanghai Composite Index retreated 5.1 per cent to 2,928.51, the steepest sell-off since February 2020 as the financial hub reported record fatalities overnight. In Shenzhen, the Component Index plunged 6.1 per cent while the nation’s currency weakened to a one-year low of 6.553 per US dollar.

“The market is panicking and worried if the pandemic will get out of control,” said Wang Chen, a partner at Xufunds Investment Management in Shanghai. “The market needs to correct further as expectations on reopening are too optimistic. The lockdown measures will cause permanent damages to some supply chains.”

All but four of the 66 Hang Seng Index members fell. Alibaba Group Holding slid 5.5 per cent to HK$81.85 and Tencent Holdings lost 3.9 per cent to HK$327.40 while hotpot restaurant chain Haidilao crashed 16 per cent to HK$12.92.

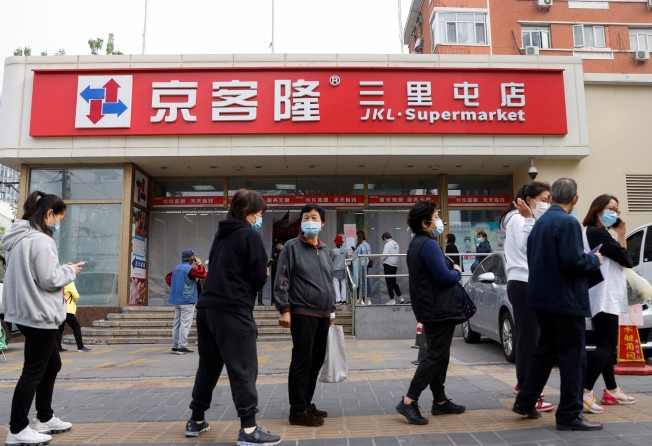

Beijing, a city of more than 20 million people, has locked down dozens of residential compounds and told residents in eastern Chaoyang district to undergo three tests this week following an outbreak over the weekend. The local government has warned of more cases in the coming days.

Monday’s sell-off pushed nearly half of the stocks in Shanghai into the oversold zone, according to Bloomberg data. It erased all of the gains since the market recovered from a 5 per cent rout on March 15. The Shanghai Composite has now lost 20 per cent in 2022, the worst among major indices in Asia.

China Merchants Bank sank 10 per cent to HK$46.70 after Tian Huiyu was placed under anti-corruption probe. The lender removed Tian as president and director last week without giving a reason. The bank’s Shanghai-traded stock shed 8.6 per cent to 38.83 yuan.

Some investors have cut their positions on Chinese stocks as lockdowns challenged existing forecasts on corporate earnings and hurt the country’s biggest companies while also sending start-ups on ChiNext board in Shenzhen deeper into a bear market.

The situation in Beijing risks deepening the crisis, as Shanghai enters a full month of total lockdown. Residents have scrambled for food and medicines, while factories halted output amid supply-chain breakdown. The IMF and private economists have trimmed their growth forecasts, citing lockdown impacts.

The Shanghai Composite has lost 8.8 per cent in value since the financial hub first came under a partial lockdown on March 28. The city of 25 million people still reported elevated cases of about 20,000 daily, with deaths climbing to a record 51 on Sunday, according to government officials.

Contemporary Amperex Technology slumped 6.1 per cent to 390.10 yuan in Shenzhen after Soochow Securities cut its earnings forecast for the lithium-ion battery maker, citing the pandemic fallout on operations. It also trimmed its price target by 25 per cent.