A successful US-China trade deal would boost copper, aluminium prices, analysts say

- Two biggest risks to global metals and mining industries are China’s slowdown, trade war, many surveyed executives say

- Copper and aluminium prices are up this year, after steep falls in 2018

The recent rebound in prices of several key industrial metals will continue this year – and would get an added boost by a successful US-China trade deal, analysts say.

But prices of such metals may be volatile, analysts said, as the US and China try to work out difficult issues. Washington accuses China of behaving unfairly by forcing technology transfers for market access, applying non-tariff barriers, and violating intellectual property rights.

“Recent US equity market sell-offs and increasing threats to the US economy by the trade war may incentivise [President Donald] Trump to make a quick deal … but the number of issues at stake are not easy to resolve and will likely inject persistent volatility into markets,” Citi’s analysts said in a research report.

US President Donald Trump recently expressed optimism that world’s two largest economies will reach a deal. A 90-day trade truce expires on March 1, and more talks are ahead. However, the US’s chief trade negotiator Robert Lighthizer said the two sides have not even agreed on a draft framework for an agreement.

“The biggest impact this year [from trade tensions] will be on speculative pressure on commodity prices, rather than any erosion of underlying demand for the hard commodities,” White & Case partners Rebecca Campbell and John Tivey wrote in a report.

A survey by the international law firm found that 41.2 per cent of 51 senior executive respondents identified China’s economic slowdown and global trade tensions as the biggest risks facing the global metals and mining industries this year.

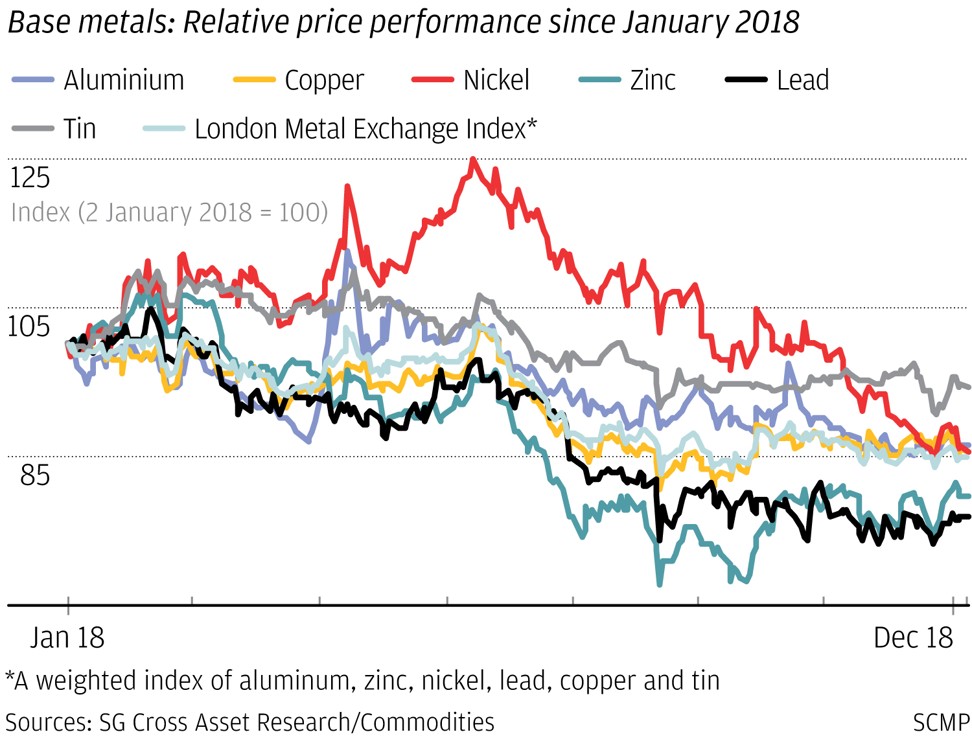

The bellwether of global growth is copper, which is widely used in construction, electrical and electronic sectors. Its prices have been climbing since the start of the year, after a steep fall of 20 per cent from the peak in June to the end of the year. Copper prices had rebounded about 6 per cent to US$6,116 a tonne this year as of Friday.

It is one of the most leveraged metals to an improvement in US-China trade talks, said Citi’s analysts who are expecting a “base case” US$6,200 a tonne cash market price if a “clean bilateral resolution” is agreed upon.

Meanwhile, prices of aluminium – used in the construction, transport and packaging sectors – have rebounded 4.5 per cent this year. They had plunged 30 per cent by year-end from last year’s highest level in April.

Societe Generale’s analysts expect rises in both metals. They predict copper will average US$6,800 this year, 3.8 per cent higher than last year. They forecast aluminium prices will average US$2,175 a tonne this year, a 2.4 per cent rise from last year.

“Markets remain hopeful that a trade deal between China and the US will be found and that such a deal could prove a positive tailwind for metals markets,” they said in a report.

“Were it not for the negative macro headwinds, prices would [have been] a good deal higher, with metals markets tightening due to underinvestment and producers’ attempts to rein in output,” the report continued.

Erik Norland, US futures and options futures exchange operator CME Group’s senior economist, expects industrial metal prices will be lifted by an economic rebound in China in the second half of the year. China consumes about half the world’s main industrial metals.

He noted the People Bank of China’s repeated cuts of the amount of funds that banks are required to keep as reserves have increased banks’ interest margins and incentivised them to give out more loans and drive growth.

“This is pointing toward stronger growth in this year’s second half and 2020 … my sense is that people have been too pessimistic on China,” he told the South China Morning Post.

He expects even precious metals, especially gold, will also be supported this year by a weak dollar, due to the US Federal Reserve halting interest rate hikes earlier than expected and the nation’s rising budget deficit.

But not all industrial metals will fare well.

Prices of lithium chemicals – key ingredients in batteries for electric vehicles and consumer gadgets – are expected to remain soft after plummeting from 160,000 yuan a tonne at the start of last year to 77,500 yuan by the end of the year.

“We expect a challenging year in terms of pricing as new supply ramps up,” battery raw materials analysts at London-based commodities consultancy Wood Mackenzie wrote in a note last week.

They forecast this year’s global supply growth to reach 110,000 tonnes of lithium carbonate equivalent – due mainly to higher ore supply from Australia and chemicals production capacity in China – much higher than demand growth of 33,000 tonnes.

Similarly, they expected the price of cobalt – another key metal in electric vehicle batteries – to remain weak in the short term due to ample supply, with prices recently sliding to US$36,000 a tonne from US$55,500 at last year’s end and the decade-high of US$95,000 seen last March.

They have forecast this year’s average for cobalt to be US$63,934, down from US$72,546 last year.