Chinese tariffs risk US$200 billion of US gas investments, may spoil America’s ambition to become top global exporter

- Two-thirds of the 310 million tonnes of planned US LNG annual capacity spread over 25 projects have not yet secured funding

- The natural gas projects require more than US$200 billion worth of investment

China’s sharp retaliatory tariff hike on US liquefied natural gas (LNG) will make it challenging for US exporters to secure purchase commitments and project financing, analysts say.

A 25 per cent tariff starting June 1 – up from 10 per cent in September – will make it uneconomical for Chinese buyers to import from the US, forcing US sellers to seek long-term purchase commitments elsewhere, a prerequisite for getting project financing.

The hike, part of Beijing’s retaliatory tariff increase on US$60 billion of US imports, came after the Trump administration raised tariffs from 10 per cent to 25 per cent on US$200 billion of Chinese goods earlier this month.

US LNG supply is part of the ongoing trade talks aimed at finding solutions to narrow the bilateral trade deficit in China’s favour and resolve other trade and investment disputes.

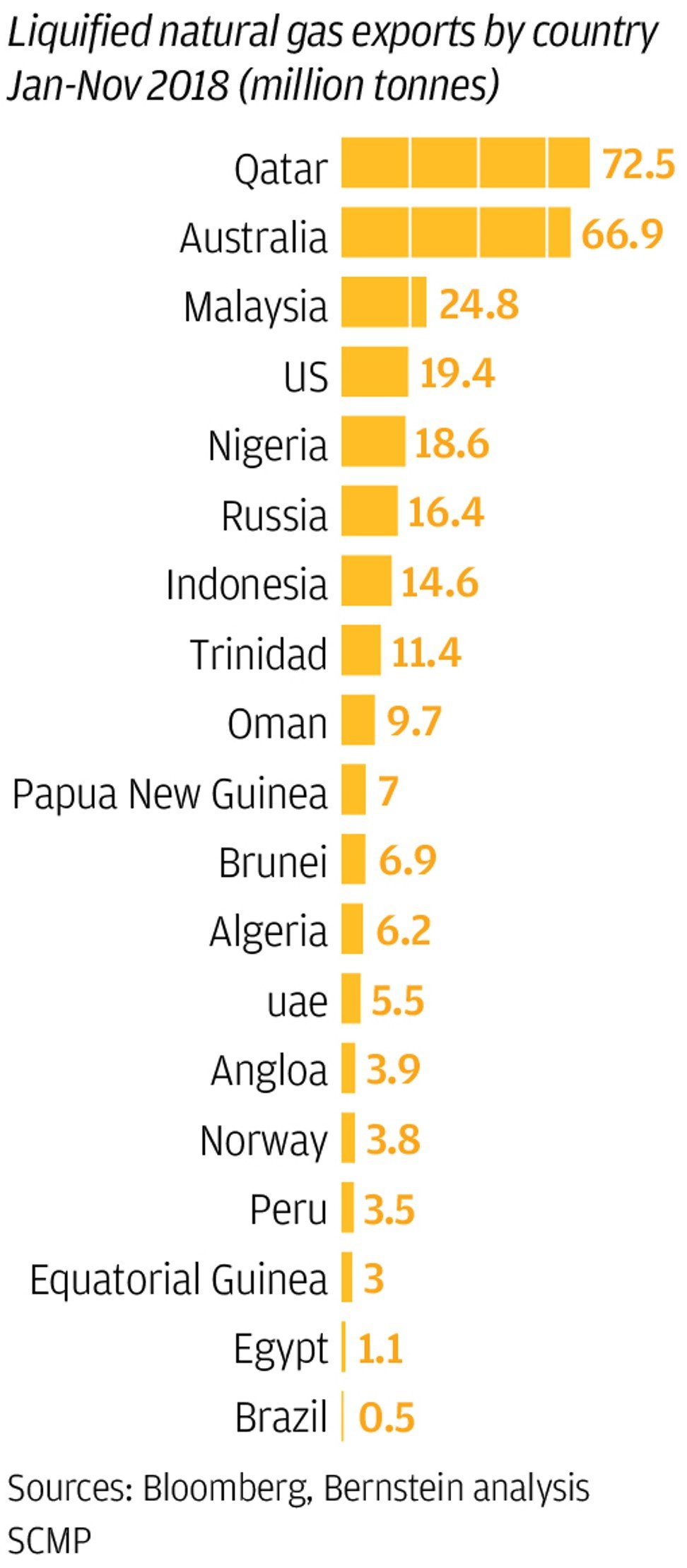

While European buyers have bought a lot more LNG from the US last winter, they are also well-supplied by Russian gas – mainly via pipelines but also increasingly in chilled liquefied form and delivered by vessels.

According to natural resources consultancy Wood Mackenzie, some two-thirds of the 310 million tonnes of planned US LNG annual capacity, spread over 25 projects and requiring more than US$200 billion of investment, have not yet secured financing.

“They would very likely want to have Chinese investment or buyers,” said Nicholas Browne, Asia gas and LNG director at Wood Mackenzie, who is based in Singapore.

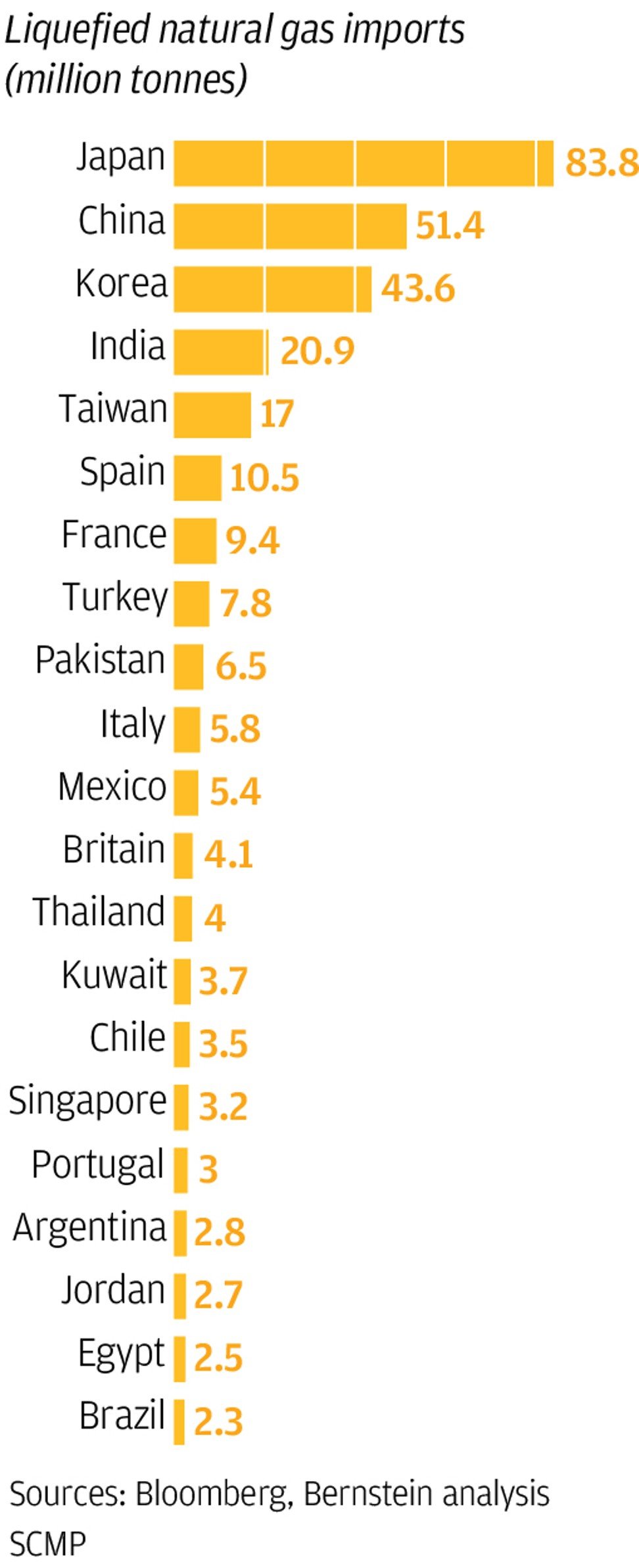

Losing access to China, the world’s fastest growing and second-largest LNG market, may also mean that US LNG starts trading at a discount and pares project profitability, said analysts at energy and commodities information provider S&P Global Platts.

“In the medium to long term, the big question is whether the tariffs discourage non-Chinese buyers from investing in US LNG export projects,” they said.

The US Henry Hub benchmark natural gas price has fallen 13 per cent since China imposed a 10 per cent tariff on US LNG.

US LNG exports to China fell 77 per cent, year on year, last winter, and forced buyers to swap their cargoes to avoid paying the tariff.

Since nearly all companies have already “optimised” their cargo flows through trading with others to ensure their US LNG does not get delivered to China and avoids being subject to any tariff, the increase to 25 per cent will not further affect trade flows, Browne noted.

“But if the 25 per cent tariff persists, it will start to have a longer term impact on the final investment decisions of the US LNG projects that are looking for Chinese financial support,” he said.

Still, some projects have made progress without Chinese funding. Saudi Aramco, the state-owned energy giant of Saudi Arabia, last week inked a preliminary agreement to invest in a 5 million tonnes a year project in Port Arthur, Texas.

“It shows that even without Chinese investment there are other parties that are interested in investing in US LNG,” Browne said. “We still expect a strong development pipeline regardless of the tariff war.”

China could surpass Japan as the world’s largest LNG importer by 2025, while the US is expected to be the third largest exporter this year and has the potential to rise to number one in the longer term, according to Sanford Bernstein senior analyst Neil Beveridge.

“A lot will come down to politics besides price,” he said. “Much of the trade discussion is for China to import more LNG from the US … it is not going to solve the US-China trade deficit but can certainly help.

“Without the Chinese stepping in, it will be difficult for some of these [US] projects to come to market.”