Head of Hong Kong-based brokerage Guotai Junan International ‘missing’ in case linked to probe of CSRC vice-chairman

Shares hammered, closing down more than 12 per cent, after company says it has been unable to contact chairman since Wednesday

The crackdown in the mainland’s financial sector is intensifying, with Guotai Junan Securities reporting the head of its overseas subsidiary has gone missing.

Sources said they believed the case was related to an earlier probe of a high-ranking official at the mainland’s securities watchdog.

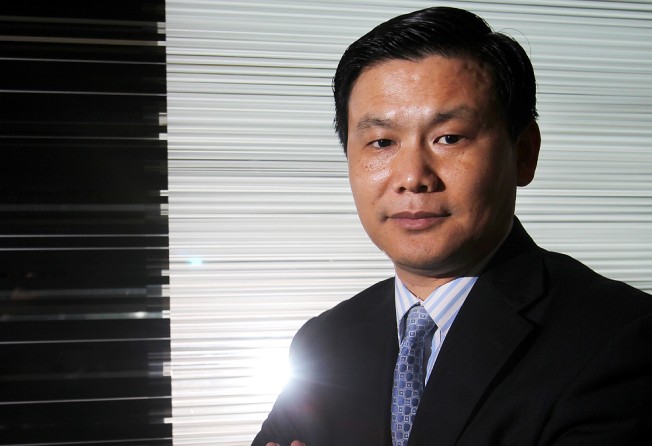

Hong Kong-based Guotai Junan International said it had not been able to reach its chairman and chief executive Yim Fung – also known as Yan Feng – since Wednesday. The company, part of the mainland’s third-largest securities brokerage by total assets, said it had appointed deputy chief executive Qi Haiying as chairman, and Wong Tung Ching, another deputy chief executive, as chief executive.

Yim’s disappearance follows the investigation of Yao Gang, a vice-chairman at the China Securities Regulatory Commission, and a former Guotai Junan executive. Yao was being investigated for suspected “serious violation of party discipline” – a euphemism for corruption – the Central Commission for Discipline Inspection, the Communist Party’s anti-graft watchdog, said 10 days ago.

Yim’s disappearance and the Yao investigation were believed to be related, a source at Guotai Junan said.

“It’s an open secret that he was one of the few trusted aides of Yao during Yao’s tenure at Guotai Junan,” the source said. “The close relationship between them could probably pave a way for certain wrongdoings all the way from corruption and insider trading to collusion between the two to manipulate the stock market.”

Yao is the highest-ranking official to fall from grace on the mainland in the wake of the authorities’ ham-fisted attempts to stem a stock market rout in the summer that wiped out US$5 trillion in market value. Zhang Yujun, an assistant chairman at the CSRC, as well as several senior executives at Citic Securities, the largest brokerage on the mainland, have also been taken away by the party graft watchdog in the past two months.

Yao served as the first president of Guotai Junan from 1999 to 2002 – after it was formed by the merger of Guotai and Junan securities in 1999 – before being appointed head of the CSRC department overseeing new share offerings.

Yim, 52, joined Guotai Junan in 1993 and was appointed chairman of the Hong Kong-based international subsidiary in 2012.

He is honorary life chairman of the Chinese Securities Association of Hong Kong, and enjoyed a high public profile, regularly addressing the media and speaking at public occasions.

“He is well-versed in Hong Kong’s securities industry,” Christopher Cheung Wah-fung, the legislator for the financial services constituency, said of Yim.

Cheung said he last spoke to Yim on the phone after a November 4 financial forum hosted by China Central Television in Hong Kong.

“I was scheduled to have dinner with several friends from the Chinese Securities Association tonight and Yim was supposed to join too, until I was notified today that he wouldn’t come,” Cheung said.

A Hong Kong permanent resident and a Justice of the Peace, Yim had registered to cast his vote in the Sunday’s District Council elections, according to records from the Registration and Electoral Office. He is also registered to vote in Legislative Council elections on behalf of Guotai Junan Securities (Hong Kong) in the Financial Services Constituency and Financial Services Subsector, the records show.

At Yim’s registered residency, in a tightly secured, high-end neighbourhood in Kowloon, building managers told a South China Morning Post reporter that they could not reach Yim and that they had not seen him recently.

In the mainland’s securities sector, Yim is known as a bold and capable fund manager with an eagle eye for investment opportunities.

He is also well-known for his role in identifying and grooming Zhao Danyang, dubbed the father of China’s hedge funds.

Guotai Junan, with 481 billion yuan (HK$583 billion) in total assets and 12 billion yuan in net profit as of September 30, was one of the main forces in the “national team” that was mobilised to buy shares when the market went into freefall from mid June. The firm poured approximately 18 billion yuan into China Securities Finance Corp, as part of a government-mobilised effort to arrest the market crash.

Guotai Junan International said “the current operations of the company are normal and stable”. Its share price took pounding on Monday, closing down 12.62 per cent at HK$2.84.