Chinese box office slows, after fewer blockbusters and an official clampdown on inflated prices

Despite strong pipeline of titles, a 7pc second quarter decline in sales leaves analysts with mixed views on film industry’s outlook

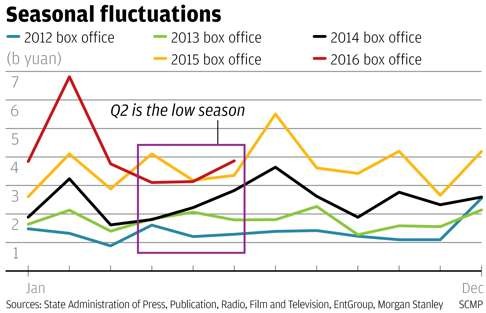

The mainland’s fast-growing cinema market stuttered during the second quarter, after a lack of any new blockbuster titles and a government crackdown on inflated ticket sales.

Filmmakers insist their pipeline of upcoming titles remains strong, which still makes China the world’s second largest film market.

Analysts, however, now have a mixed outlook for the sector.

The mainland box office declined by 7 per cent year on year in the second quarter to 10.2 billion yuan, a dramatic slowdown compared with the 51 per cent rise in the first quarter, to 14.5 billion yuan.

The result means that in the first half of the year, overall growth was 21 per cent to 24.6 billion yuan, but that compared with 48 per cent year-on-year growth in the first half of 2015.

Last year, several were released in the period, including Furious 7 which sold tickets worth 2.4 billion yuan, Avengers: Age of Ultron, which earned 1.5 billion yuan in box office receipts in May, and Jurassic World which sold 1.4 billion yuan worth of tickets in June last year.

The only highlights this year were Captain America: Civil War (1.2 billion yuan in May) and Warcraft (1.5 billion yuan in June).

Zhang said the slowdown was also due to regulations imposed in March by the State Administration of Press, Publication, Radio, Film and Television aimed at stamping out inflated figures.

The action was taken after the distributor behind the film Ip Man 3 admitted buying 56 million yuan in tickets, to bump up its sales.

“We see meeting the earlier target of 30 to 35 per cent box office growth as a tall order,” Zhang said. “We are expecting 26 per cent full-year growth in China.”

The poorer second quarter has also led BOC International to recommend investors “sell” shares in Imax China.

Dong Ping, chairman of listed filmmaker Huanxi Media Group, said the second quarter is traditionally a poor season for the market.

“The best domestic films show at the Lunar New Year, and so this is the best season for cinema goers. The summer would be another peak season, while the National Day Holiday in autumn also attracts movie goers. That’s why so few blockbusters are shown in the second quarter,” Dong said.

The film industry is still doing well in China. Our company and other filmmakers are busy producing a lot of films at the moment. As long as you can make good quality movies, people will go to the cinema

He is still projecting annual box office growth of 30 per cent to over 52 billion yuan, after a bounce in

in the summer.

“However, I believe the growth rate may slow after annual box office receipts reach about 60 billion yuan. After annual 30 per cent growth for so many years, the mainland box office should consolidate at about this level,” he said.

“The film industry is still doing well in China. Our company and other filmmakers are busy producing a lot of films at the moment,” he added.

“As long as you can make good quality movies, people will go to the cinema.”

HSBC analyst John Liu also thinks the Chinese movie industry is still on the rise, after 8,000 new screens were added in the first half of the year, a 25 per cent rise on last year.

“The third quarter looks better: more films in the pipeline, including animation. We expect the box-office growth rate in the third quarter to improve,” Liu said in a research note.

He is expecting 40 new films in July alone compared with 30 last year, including three blockbusters from Hollywood.

“The impact of a slowing box office has already been factored into our pricing models. We expect to see sequential improvement from the third quarter, with Wanda Cinema, Huace, Enlight Media and Imax China benefiting most from the strong pipeline in July,” Liu said.

Morgan Stanley equity analyst Gary Yu also said: “Despite the weak second-quarter box office raising market concerns about a slowdown in the mainland film industry, we remain bullish on the medium-term growth outlook in the next 2 to 3 years, with some monthly fluctuations around major blockbuster releases.

“We also expect Imax to outgrow the industry, driven by higher Imax screen penetration,” Yu said.