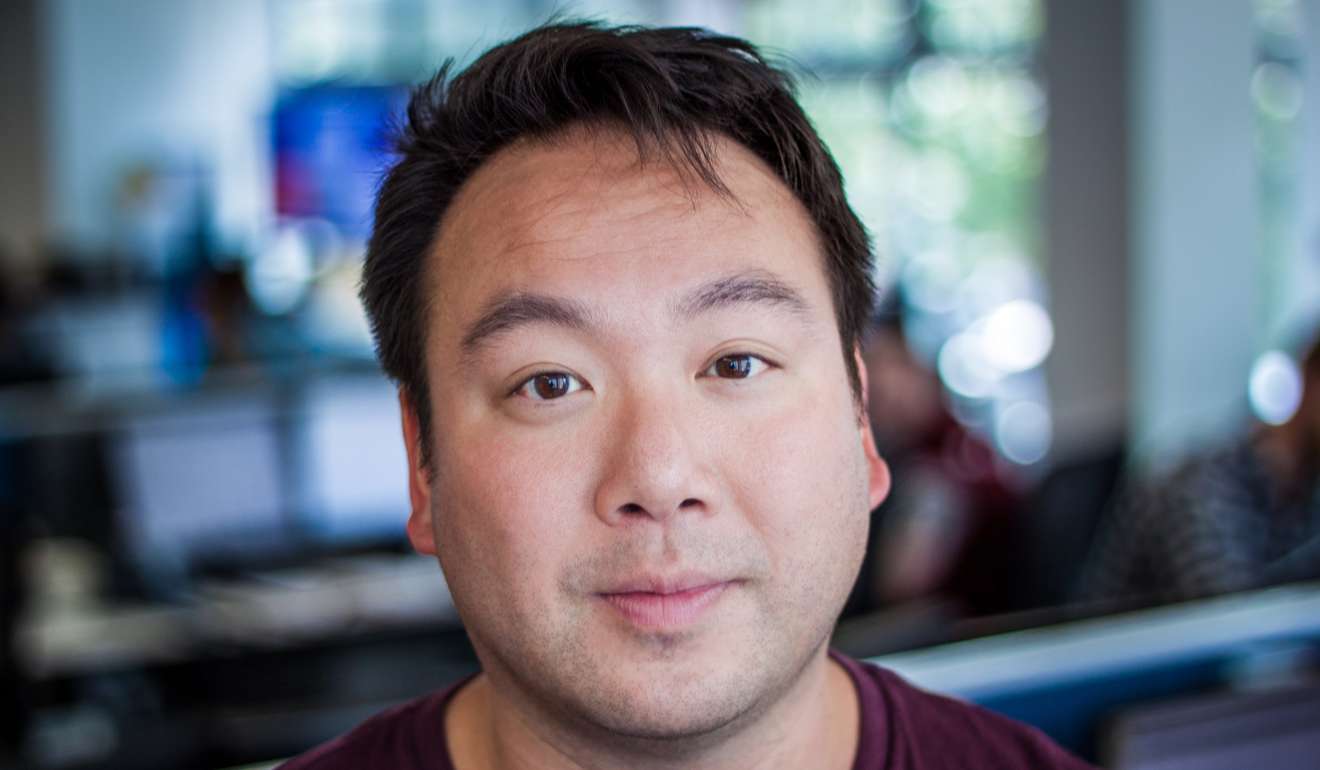

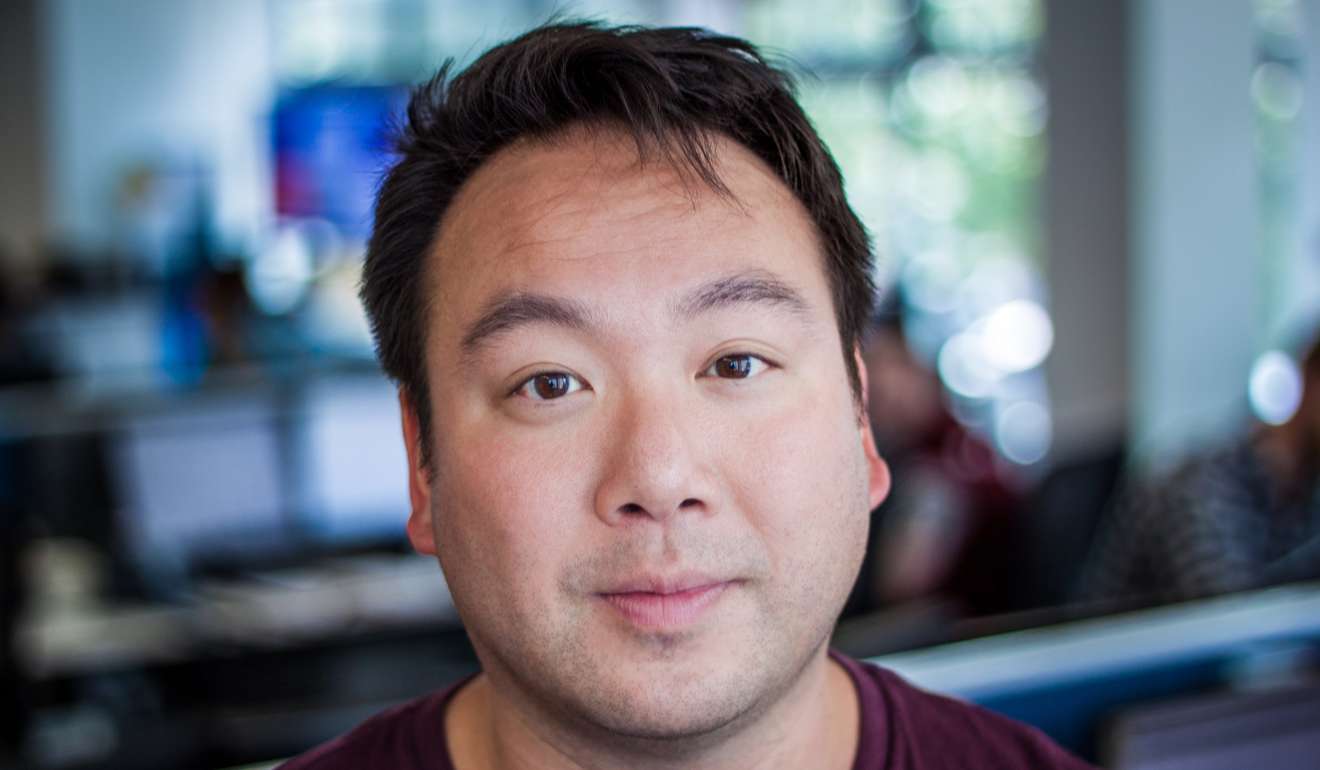

‘Quitting banking for something different’ led Deliveroo founder Will Shu to a whole new industry

For almost a decade, Will Shu was living the dream of an aspiring financier. Fresh out of college, he landed a job at Morgan Stanley in New York as an investment banker. The American then transferred to the Wall Street bank’s London office, and eventually became a hedge fund manager overseeing millions of dollars in assets in his late 20s.

By 30, Shu, who was born to Chinese parents, was ready to jump into something more adventurous, even if that meant giving up income security in a well paid industry.

Shu quit his job as a hedge fund manger in 2010 to attend the Wharton Business School, where he received an MBA in 2012. He launched London-based food delivery start-up Deliveroo in 2013 with childhood friend Greg Orlowski, a former software engineer.

“I spent nine years in finance, and I wanted to do something different,” he told the South China Morning Post in an interview in Hong Kong.

“Ultimately it was not motivating to me full time,” he said, referring to his exit from the banking industry.

Today, the 37-year-old has established himself as a leading tech entrepreneur in the food-delivery market. He heads a courier service that manages more than 13,000 food delivery staff on bicycles or scooters in 130 cities, including Hong Kong, Sydney and Singapore.

In the latest funding round in August, Deliveroo raised US$275 million from private equity firms and venture capitalists, including early investors in Facebook and Airbnb, breaking into the rare league of “unicorns” – start-ups worth more than US$1 billion.

One reason for the valuation is the huge untapped potential in meal delivery services. According to Morgan Stanley, about US$210 billion in food takeaways are ordered on an annual basis in the US. The investment bank estimates around 5 per cent of orders are placed online, although that should rise to 9 per cent by 2020.

The transition from banker to a boss of a delivery company hasn’t been a smooth ride, however. He stocked up on the same sort of plain T-shirts and jeans favoured by Facebook founder Mark Zuckerberg, shelving the brand name suits and ties of the banker’s world.

During the first nine months following launch, Shu took a hands-on role, helping to make food deliveries via scooter in London’s core business district of Canary Wharf to the upscale neighbourhood of Chelsea where he resided.

“I was the first courier for my company, and I’m still doing it for fitness,” he said, occasionally sipping from can of Coke Zero.

You have to really trust certain decisions that can seem really crazy sometimes

“You have to really trust certain decisions that can seem really crazy sometimes,” he said, adding that only three restaurants signed up for the service in the early days.

Though ubiquitous in New York even before online marketplaces started to thrive, food delivery appeared a thought from the distant future in the British capital when Shu relocated there in the 2000s.

While working on Wall Street, Shu came to rely on gourmet takeaways to help sustain him through long working days.

He discovered London was devoid of the food options he had cherished in New York.

“Within the first five days of arriving in London, we realised we could not get food delivery,” Shu said. “For anyone who has lived in New York for a long time, this is something you take for granted.”

Shu said he was inspired by the differences in the service culture between London and New York.

“It is more like I have a problem, and I want to solve it,” he said.

While admitting running a start-up is “more fun”, Shu said his banking job did endow him with the analytical skills essential to solving business problems.

But unlike banking, a successful entrepreneur needs to have a high tolerance for risk.

“In finance what you think a lot about is risk communication and hedging - especially at a hedge fund,” Shu said. “When you are building a company, especially at the beginning you are not trying to mitigate risks otherwise you wouldn’t do anything.”