Why is short selling fashionable in Hong Kong?

In less than an hour on Monday, shares of Cogobuy Group, an e-commerce platform for electronic goods, slipped 22 per cent to HK$7.89 before trading was suspended.

The sharpest intraday drop for Cogobuy shares in nearly two years followed a report by short seller Blazing Research, which projected the company’s stock price at a mere 53 HK cents on account that it had been a “fraud” for more than a decade, an allegation refuted by Cogobuy.

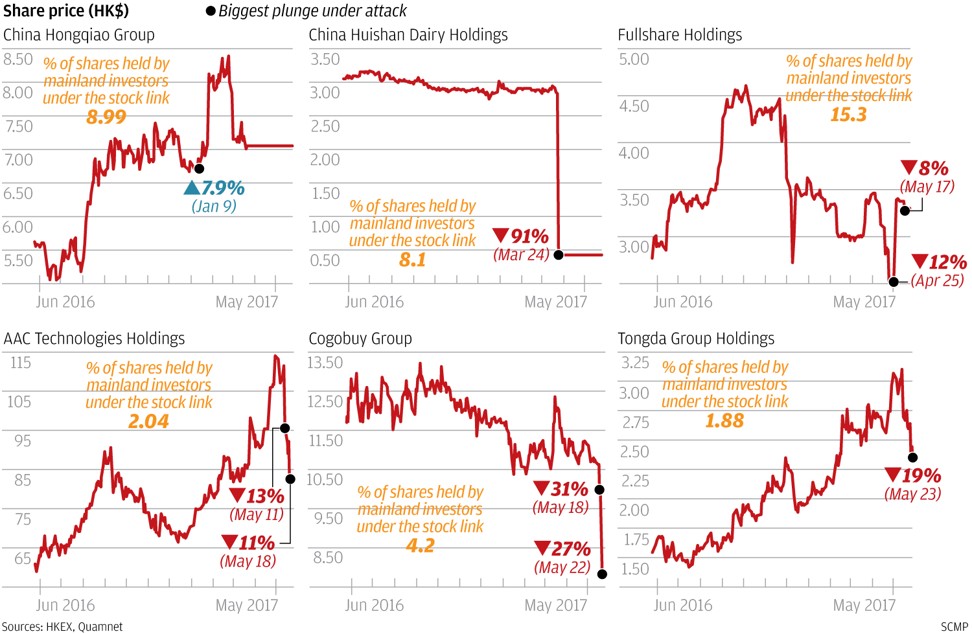

Before Cogobuy, the casualty list of stocks that had been short sold included the world’s largest aluminium smelter China Hongqiao Group, the country’s largest operator of dairy farms China Huishan Dairy Holdings, property developer Fullshare Holdings and Apple’s component supplier AAC Technologies Holdings.

Hong Kong’s listed companies were becoming increasingly vulnerable to short sellers due to a highly combustible mixture of inexperienced mainland Chinese capital, the impulse to lock up earlier gains, as well as weak disclosure and accounting practices from the city’s laissez-faire regulatory framework, analysts said.

At least six Hong Kong companies had fallen victim to short sellers in the past three months, wiping out substantial amounts of capital from their market value and hurting shareholders, making the frequency and efficiency of short attacking “unusually high”, said Kevin Leung, director of global investment strategy at Haitong International Securities.

Short sellers profit by selling stocks at high prices and then buying them back when prices have plummeted, pocketing the difference. To nudge stock prices into steep declines, they typically release damning reports or scandalous information to cause panicked shareholders to dump the stocks.

The most powerful way to attack a company included challenging its accounting or proving the target had been faking financial numbers, Leung said.

“Mainland investors like chasing momentum stocks,” he said. “When you’re chasing a stock, it is likely to downplay the fundamentals, and that makes investors easy to panic once the short sellers attack from the fundamentals.”

Southbound capital outstrips northbound funds 64 to one under the mutual fund scheme, a major channel through which mainland and Hong Kong investors trade stocks in each other’s markets, according to data by China’s currency regulator.

“[They] are less prepared when attacked by short sellers, and easier to panic,” Leung said.

That was why China’s stock market rout in July 2015 was particularly painful for the country’s traders, prompting the regulator to restrict the transactions of stock index futures to deter “malicious” short sellers.

China’s yuan-denominated A-share market ran on a “one-way street, where you buy low and sell high”, unlike Hong Kong where short selling was an effective hedge and an integral part of a trading strategy, said Frank Xu, analyst with Hong Kong-based hedge fund Q Fund. “The only way a mainland investor can short sell a stock is through securities lending. The selection of stocks available for lending is narrow and the costs are higher than in Hong Kong.”

Fullshare, the Nanjing-based developer, had seen 35 per cent of its turnover coming from southbound trade, which pushed its turnover to among the top 10 stocks in almost half of the trading days since April 10, under the Shanghai and Shenzhen connect schemes.

AAC’s share price has surged more than 36 per cent from early March to a high of HK$112 on May 10, a day before short seller Gotham City Research questioned the company’s accounting.

The stock dropped 10 per cent within a few hours after the report, wiping out HK$14.2 billion of value.

In its short sell report, Blazing said Cogobuy’s website had extremely low traffic and its gross merchandise volume, or the amount of goods sold, was a work of fiction.

Cogobuy refuted Blazing’s claims on a conference call, explaining that its web traffic was low because its sales were done through social media platforms, like Tencent’s.

Trading in the stock is still halted.

Although short sellers are causing market turbulence and stir up complaints by retail investors, they are an integral part of the financial market that helps hedge against risks.

“The ‘invisible hand’ of the market, through mechanisms such as short selling, not only allocates resources but also affects and disciplines managers” of earnings manipulation, scholars from INSEAD, UNSW Business School and Tsinghua University said in a thesis published in Review of Financial Studies in 2015.

It was counter-intuitive to Hong Kong’s average traders but some of them were catching on, Leung said.

“It is gaining momentum in Hong Kong in recent months,” he said. “An important reason is the changing constitution of the market participants.”