HKEX targets wealthy investors and mega IPOs amid bid to diversify

Hong Kong Exchanges and Clearing has set its sights on becoming a wealth management centre for rich mainlanders, and will also diversify its income sources and expand the profile of new company listings, according to HKEX chairman Chow Chung-kong.

In an exclusive interview with the South China Morning Post, Chow said HKEX has been very successful over the past 20 years in promoting initial public offerings but he conceded that the bourse is not diversified enough.

In the past five years, mainland companies accounted for 90 per cent of the funds raised, while over the past decade only 3 per cent of funds were raised by technology firms.

“The challenge ahead for the HKEX, like other stock exchanges, is to attract new economy firms to list here,” Chow said. The bourse operator last Friday issued a consultation paper proposing establishment of a new third board with flexible regulations to attract start-ups and larger tech companies with dual shareholder structures, such as Google or Facebook. The new board, if it receives support from the market, would be launched in 2018.

“HKEX and the government is trying all efforts to fight for all mega IPOs, including Saudi Aramco which will be the biggest IPO worldwide next year,” he said.

Chow said another challenge for HKEX was to diversity its business which is why it wanted to expand into commodities through the acquisition of the London Metals Exchange in 2012.

Commodities represents 14 per cent of HKEX income now, up from nothing before the LME acquisition.

Income from stocks represented 24 per cent of its total income in 2016, down from 56 per cent in 2000 when the HKEX was established through the merger of the stock and futures exchanges and their related clearing houses.

The exchange has launched six metal products in Hong Kong and plans to add two gold contracts in July, while it is in the process of launching a commodities platform in Qianhai.

“It is not easy to expand into the commodities market. However, since mainland China is the largest consumer of many commodities, the room for future growth in this area is huge. This will be a major development for the HKEX in future,” Chow said.

“HKEX needs to diversify into commodities trading, clearing and other new business lines. Like any other commercial company, HKEX will be successful only if it can keep seeking out new business lines and new income,” he said.

The opening up of China’s capital market would remain the key to success for HKEX, which already has a solid track record as the preferred fund raising platform for Chinese companies.

Of the HK$3.269 trillion (US$420 billion) raised from new listings over the past 20 years, 78 per cent was from mainland firms, which showed the important role of Hong Kong as a fund raising centre.

Chow believes this role will continue under the New Silk Road initiative, in which China wants to work with 65 neighbouring countries to establish roads, railways, power plants and other infrastructure in coming years. The initiative is seen as boosting new listings and fund raising needs.

“China is now the world’s second largest economy and many mainlanders are getting wealthy and they have demands for investment. Hong Kong is a natural choice as we have the two stock connects to tie up with the bourses of Shanghai and Shenzhen... while the bond connect will develop this year,” Chow said.

“There will be more product launches at HKEX to fulfil the role as a wealth management centre for the mainlanders,” he added.

In reviewing the 20-year anniversary of the local bourse since the handover, Chow said HKEX “has come a long way and developed in a way that was better than expected”.

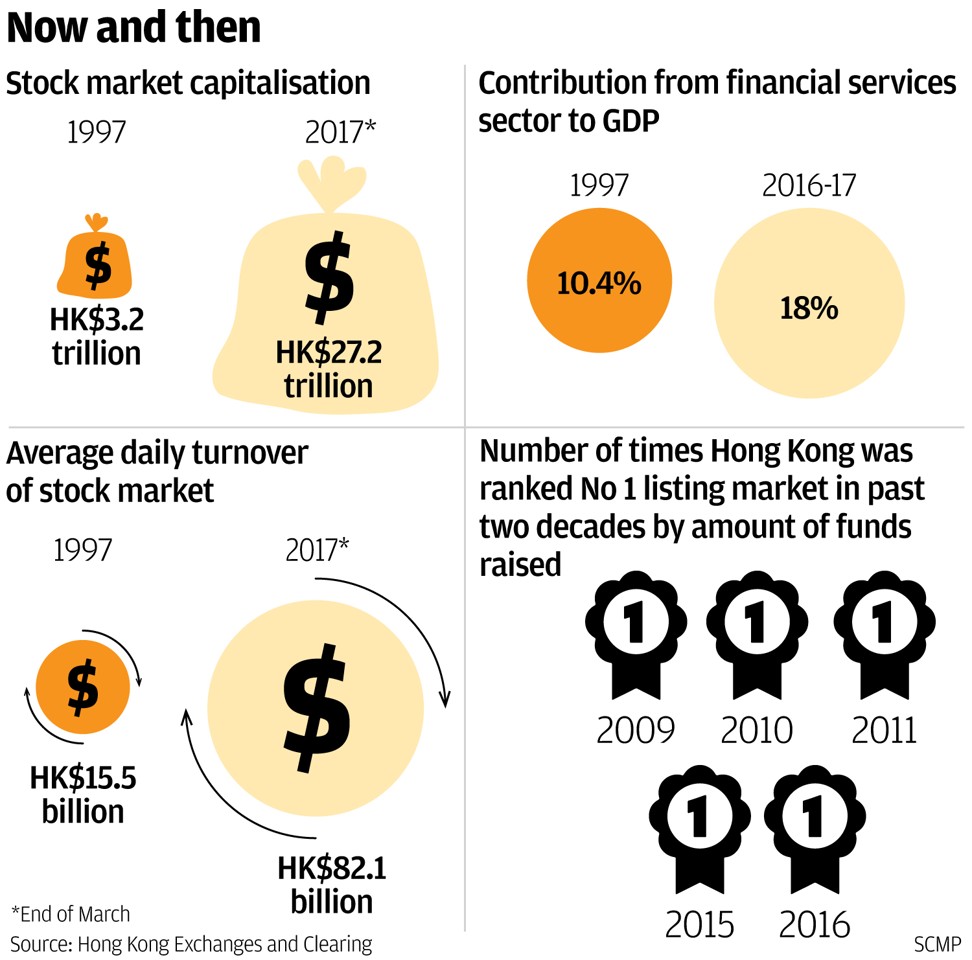

Total market capitalisation has risen eight-fold to HK$27 trillion now, up from HK$3 trillion in 1997, while average daily turnover stands at HK$82.1 billion compared with HK$15.5 billion at the handover.

The financial sector now represents 18 per cent of Hong Kong’s GDP, up from about 10.4 per cent 20 years ago.

Since mainland China is the largest consumer of many commodities, the room for future growth in this area is huge

Hong Kong also ranked as the world’s No 1 IPO market from 2009 to 2011 as well as in 2015 and 2016, in terms of total funds raised.

Chow’s only regret came in 2015 when the Securities and Futures Commission rejected the exchange proposal to launch a second consultation on dual class shares for Hong Kong. However, the SFC chairman Carlson Tong Ka-shing supports the consultation launched last Friday because this time the proposal is for dual class shares structure firms traded on a new board, not trading on the market as a whole.

Chow added that it would be desirable if the government could play a more active role in helping the market find the right balance between market development and regulation.