Apple suppliers’ shares fall sharply in broad decline across Asia

Apple-related stocks mostly declined on Wednesday in Asia, with iPhone suppliers in China suffering sharp losses, weighed down by the delayed launch of the much-anticipated iPhone X as well as profit-taking.

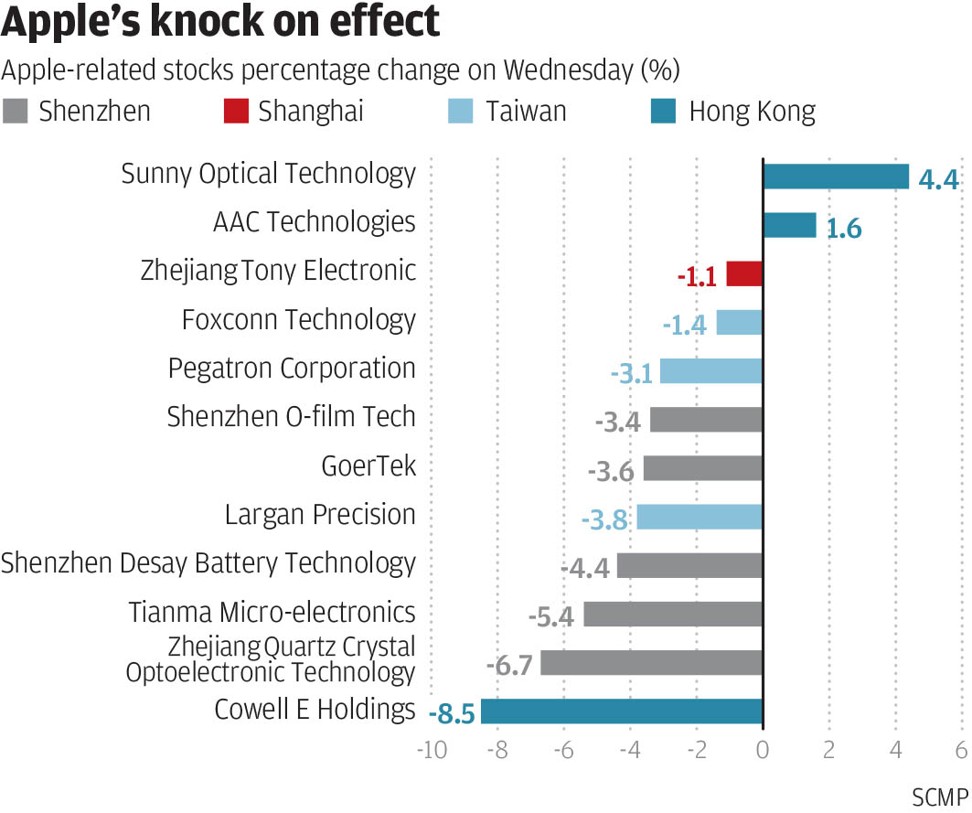

In mainland China, Zhejiang Quartz Crystal Optoelectronic Technology, which supplies optical filters to Apple, plunged as much as 9 per cent to 26.01 yuan earlier in the day. It closed off 6.7 per cent at 26.69 yuan.

Among other suppliers on the Shanghai and Shenzhen stock exchanges, Shenzhen Desay Battery Technology sank 4.4 per cent to 55.2 yuan, acoustic component company GoerTek declined 3.6 per cent to 20.72 yuan, touch-panel manufacturer Shenzhen O-film Tech dropped 3.4 per cent to 21.36 yuan, and ultra-fine conductor maker Zhejiang Tony Electronic fell 1.1 per cent to 67.72 yuan.

LCD product supplier Tianma Micro-electronics, which announced earlier this year it had been in talks with Apple about potential orders, also pulled back 5.4 per cent to 22.85 yuan.

In Taiwan, iPhone manufacturer Pegatron Corporation gave up 3.1 per cent to close at NT$89.

In Hong Kong, Cowell E Holdings, a Korean supplier of camera modules to Apple and Samsung Electronics, retreated 8.5 per cent to HK$4.19.

AAC Technologies and Sunny Optical Technology reversed early losses and climbed 1.3 per cent and 4.4 per cent respectively to finish the day at HK$141.3 and HK$124.

Apple launched two new iPhone 8 models on Tuesday night.

It also announced that its 10th anniversary iPhone X, priced at US$999, is scheduled for release on November 3, which is after the end of Apple’s financial year at the end of September. Apple traditionally releases its new iPhones in September, which can boost its financial-year performance.

Previously, some media reports had speculated that a production glitch related to organic light-emitting diode (OLED) panels could cause delays and stock shortages of Apple’s new iPhone line-up.

Shares of Apple closed lower after briefly rising more than 1 per cent, down 0.4 per cent to US$160.86.

“The delayed launch of iPhone X could deter demand for the iPhone 8, as people want to hold back and wait for the big phone to come out in November.”

Profit-taking also dragged on the stocks.

“Investors want to lock in profit now, as shares have gone up a lot,” he added.

Chris Weston, chief market strategist for IG Group, agreed that the retreat in stocks may also be related to the “buy the rumour, sell the fact” strategy, as investors booked gains after the actual news is released.

Nonetheless, both analysts suggested the dip could be a “buying opportunity”.

“The new facial recognition technology on iPhone is exciting. It can be applied elsewhere, on other devices such as cars,” Wong said.

“Related component manufacturers could receive a long-term boost from the application of the technology.”

Rex Wu, an analyst at Jefferies, also believed Chinese smartphone component suppliers such as Goertek, Inventec, and Hong Kong-listed AAC Technologies and Sunny Optical, could receive a boost from Apple’s new product launches in the longer term.