PetroChina’s shares fuelled by move to increase natural gas prices for commercial users

China’s top producer lifts prices of the commodity by up to 15 per cent

Shares of PetroChina, the nation’s largest natural gas producer, rose after it raised the price of the cleaner burning fuel by 10 to 15 per cent this winter, amid strong demand and tightened supply spurred by Beijing’s campaign to reduce pollution by curbing the use of coal.

Distributors will have to pay 10 per cent more for the fuel from this winter (November to March 2018) on so-called base volumes equal to their purchases between April to September 2017, according to a notice issued late last week by the energy giant.

They will have to pay 15 per cent more for the difference between the base volume and actual consumption last winter (October 2016 to March 2017), it said.

The price increase applies to commercial users only.

For any additional requirements, distributors will have to bid at the Shanghai Petroleum and Natural Gas Exchange to buy the volumes they need, subject to a maximum cap of 20 per cent above the regional benchmark.

Deals struck in recent weeks at the exchange have all been conducted at the maximum allowed prices, distributors said.

“We have already signed procurement contracts with PetroChina for all cities in Hunan, Hebei and Jiangsu provinces in addition to Luoyang in Henan province and Huludao in Liaoning province,” a spokeswoman for the distributor ENN Energy Holdings told the South China Morning Post.

The average procurement cost increase agreed until now averaged around 15 per cent, she said. ENN expects to pass on the increase in costs to most of its customers except some major clients to whom it will give some discounts.

So far, the distributor has obtained consent from the municipal governments of Langfang in Hebei where ENN is based, as well as Luoyang in Henan and Huludao, on the plan.

PetroChina shares on Monday closed 3 per cent higher at HK$5.44, while ENN edged up 0.5 per cent to HK$58.15, bucking a 0.02 per cent fall in the Hang Seng Index.

ENN’s rivals, China Gas Holdings and China Resources Gas Group, also said they were in discussions with PetroChina on gas procurement agreement and with local governments on passing on the price increases.

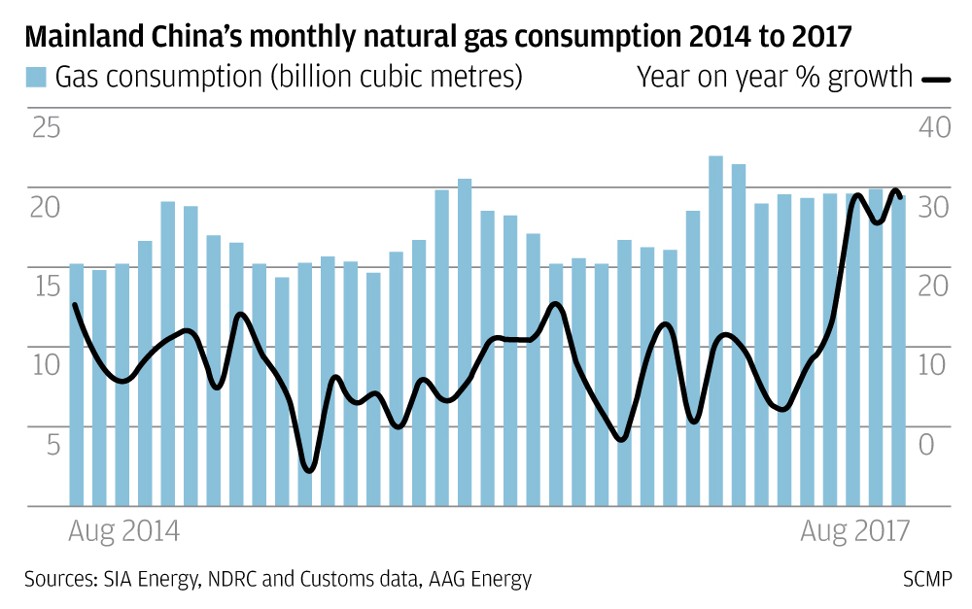

Gas consumption in mainland China jumped 18.4 per cent year on year in the first nine months, up from 6.6 per cent for all of last year, according to industry regulator National Development and Reform Commission.

“Given the tight gas supply in northern China this year under the coal to gas initiatives as indicated by the recent hot piped gas bidding at [the gas exchange], [the industry] had already expected that [PetroChina] would repeat its price hike this year during the heating season,” Dennis Ip, Daiwa Capital Markets’ head of Hong Kong and China utilities, renewables and environmental research, wrote in a note.

The energy giant last winter had also raised wholesale gas prices by 10 to 15 per cent.

The spokesman at rival China Petroleum & Chemical (Sinopec) said he was not aware of any move by the firm to follow suit and raise gas prices.