Verdict turns jailed tycoon into private capital’s touchstone in quest for role in Communist China

Gu Chujun, who bought five listed firms more than a decade before China’s outsize asset purchases made headlines, was jailed for seven years. He explains in an interview with the Post why he’s on a quest for justice

Gu Chujun, feted more than a decade ago as China’s role model in applying private entrepreneurship to revive sickly state companies, may become the country’s new poster boy for a second act: a crusade to protect private property in the nation governed by the world’s largest Communist Party.

A week before the new year, China’s highest judicial body ruled that it would review a 2005 case previously tried in a lower court, which convicted Gu and jailed him for seven years. The review could be the first tentative step towards returning justice to the 59-year-old financier, who had been on a quest since 2013 to overturn what he called trumped up charges by corrupt officials leery of his fortune.

The verdict by the Supreme People’s Court, operating as an adjunct of the Chinese state, is the latest olive branch by Xi Jinping’s government to assure private enterprises that they are safe to conduct business in an economy governed by a Communist Party and headed by the party’s most powerful strongman in several generations.

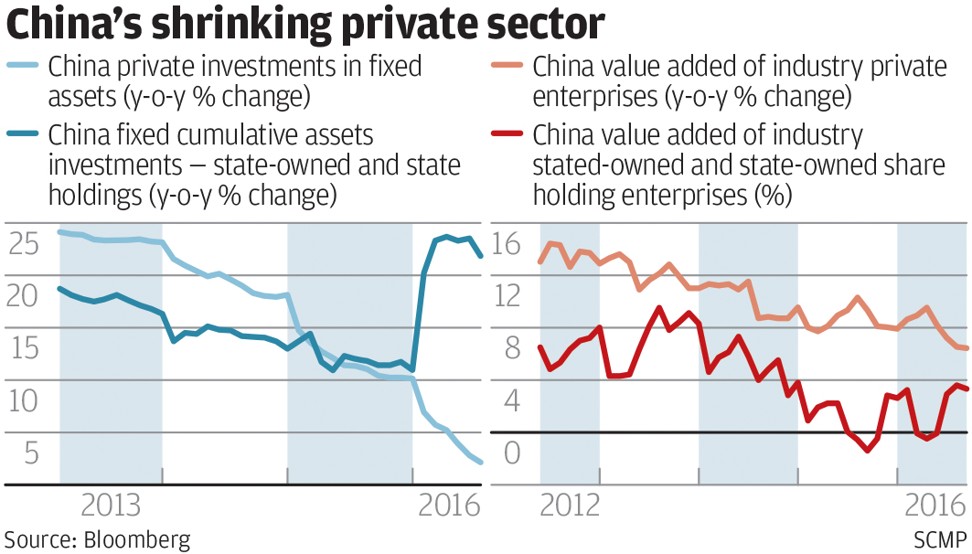

Xi’s government had good reasons to assure private businesses. Their combined investments in China had declined steadily after reaching a peak in 2011, coinciding with Xi’s promotion to the party’s top post in November 2012. Instead, the trickle of funds heading offshore turned into a flood, causing China’s foreign exchange reserves to shrink by 25 per cent starting in June 2014. It would take 18 months of crackdowns and concerted administrative efforts by China’s currency and banking regulators to stem the slide and restore stability in the reserves.

The private, non-state sector makes up more than 60 per cent of the output in China’s US$12.3 trillion economy, contributes to half the government’s tax receipts and provides more than 80 per cent of jobs, state news agency Xinhua reported in December. But the protection of private property wasn’t written into China’s constitution until 2004, more than half a century after the founding of the People’s Republic, and wasn’t enacted as law until 2007.

“Ownership of private property fundamentally contradicts the very basis of communist governance, so the private economy is a supplement to the public economy in the eyes of the government,” said Hu Xingdou, professor of economics at the Beijing Institute of Technology and author of the China Problem, a study about the nation’s economic woes. In this context, Gu’s case “is a clear signal that Beijing is trying to comfort and reassure entrepreneurs that they are safe to do business in China, at a time when their confidence has sunk to a low,” he said.

Gu, an engineer-turned-entrepreneur, was riding high back in 2001. Then 42 years old and in the prime of his career, he founded Greencool Enterprise Development, turning it from a producer of refrigerator coolant fluid and compressors into a financial powerhouse and asset buyer.

Over four years, he would use his US$170 million fortune to buy five listed companies in China. This was a decade when China’s outsize asset acquisitions made headlines.

The jewel of his crown was his 26.4 per cent controlling stake in Guangdong Kelon Electrical Holding, then one of China’s biggest makers of white goods and appliances, bought from the government of Shunde in Guangdong province.

Nine months after the takeover, Kelon reported a profit, reversing two years of losses. Gu was celebrated in the Chinese media as a role model for entrepreneurs and a turnaround artist, rising to the top of Hurun’s list of China’s 50 Wealthiest people in 2004.

With his expanding profile also came the brickbats and criticisms. Greencool won a HK$300,000 settlement in 2002 after suing UBS Warburg for libel. Starting in 2004, Gu began a very public spat with Larry Lang Hsien-ping, the Chinese University of Hong Kong professor who made his name through taking down China’s largest companies from TCL to the D’Long Group to Greencool. Lang accused Gu of embezzling China’s state assets, a charge that Gu denied. Lang, who in recent years had been endorsing several peer-to-peer loans platforms that ultimately went under, did not respond to several emails requesting for comments.

The China Securities Regulatory Commission, the stock market watchdog agency, began an investigation in 2005 into Gu and his business dealings. Gu was convicted on charges of falsifying Kelon’s financial reports, violating disclosure rules and for illegal diversion of funds. He was sentenced to 10 years in jail, for which he served seven years.

His business empire collapsed. Kelon briefly returned to the Shunde government before being sold to one of China’s largest electric appliance makers Hisense for 900 million yuan, but the capital was seized by a local court to repay Gu’s debts.

Greencool, the flagship company Gu founded in Canada in 1992, was expelled by the Hong Kong stock exchange in 2007, seven years after its listing.

Gu pointed to former CSRC vice-chairman Fan Fuchun as the official who colluded with Guangdong officials to set him up to grab his Kelon stake. Fan, who retired from the CSRC in February 2009, could not be reached for comment.

Fan himself was under investigation and prevented from leaving Beijing since retiring, the Takung Pao reported in June 2009. His son Fan Xiaowei, the managing director of Guotai Junan Securities Hong Kong, was taken away for investigations, the paper reported. Spokespeople at the regulator’s office in Beijing did not respond to questions sent by fax by the Post.

While he was petitioning his case, several of China’s biggest private companies - Anbang Group, Dalian Wanda Group, Fosun Group and HNA Group - were on tenterhooks as they were put under regulatory scrutiny one by one for their outsize acquisitions.

Xiao Jianhua, the founder of the Tomorrow Group of companies, left his serviced apartment at the Hong Kong Four Seasons Hotel on the eve of the 2017 Lunar New Year for investigations in mainland China into unspecified financial misdemeanours. The financier, whose group owned stakes in dozens of Chinese listed companies, remains out of public sight, while no charges have been laid on him.

The investigation of Xiao was followed by the downfall of Anbang’s chairman Wu Xiaohui, arrested in April for investigations into how one of China’s biggest insurance groups sold unregulated financial products to amass war chests for buying overseas assets. Wanda, owned by Wang Jianlin, one of China’s wealthiest men, had to sell 13 of his theme parks and 75 hotels, in a US$9.3 billion fire sale that would be the biggest property transaction in China’s corporate history. HNA, which spent US$25 billion since 2015 buying assets from stakes in Deutsche Bank to Hilton Hotels, was compelled to abandon its shopping spree.

To assure nervous entrepreneurs, China’s State Council issued an unprecedented set of directives on September 25, just before the ruling Communist Party was scheduled for its twice-a-decade conclave to select the country’s leaders for the next five years, including Xi for a second term as head of the party.

More recently and specifically, the Central Economic Work Conference - China’s most important annual meeting for economic planning – raised a key task for officials in its closing report- that is to identify and correct property disputes that has strong social influence.

At the heart of Gu’s petition is the CSRC’s reason and motivation for commencing investigations into Kelon, which the regulator had sealed off as state secret, denying access to Gu’s defence team.

While the highest court ordered its review, the Beijing Intermediate People’s Court also delivered Gu a favourable verdict, ordering the CSRC to make public the reason and disclose all internal discussions for initiating its 2005 investigation of Kelon.

“This Supreme Court’s direct review is a positive step. It is a concrete measure to implement the report of the 19th Party Congress to protect the legitimate property rights of enterprises. We have full confidence on the final outcome,” said Chen Youxi, defence lawyer of Gu, director of Hangzhou-based Capital Equity Legal Group, also one of China’s most prominent lawyers.

China’s party mouthpiece People’s Daily and Xinhua News agency respectively issued editorials on Thursday, following the Supreme Court’s announcement, applauding the decision as a “significant move” in implementing the spirit of the Party on improving protection on entrepreneurship, entrepreneurs, and their properties.

Gu had been living in the Chinese capital with his younger brother since his release, earning a living by giving advice to companies, friends and former associates, he said. He also published a book in 2016 on fundraising, and how China can acquire advanced technology from overseas to transform the nation’s economy.

“I have never been regretted about returning to my country -- the unfairness I experienced is caused by some individual corrupted officials, but I have faith in the overall Party and social system,” he said.

“Thanks to the Party’s Central Committee’s determination to push forward ruling by law, I believe I will be announced innocent soon,” Gu said.