Is Xiaomi partner Huami Technology’s IPO a toe in the water for smartphone maker?

Listing suggests Xiaomi and related companies ‘want to be out there quickly’

Huami Technology, a major smartwatch maker for Chinese smartphone maker Xiaomi, has filed for an initial public offering in the United States, as Xiaomi itself prepares for a potentially huge flotation, in an indication that the smartphone maker and its suppliers are ready to tap capital markets and build their brands overseas.

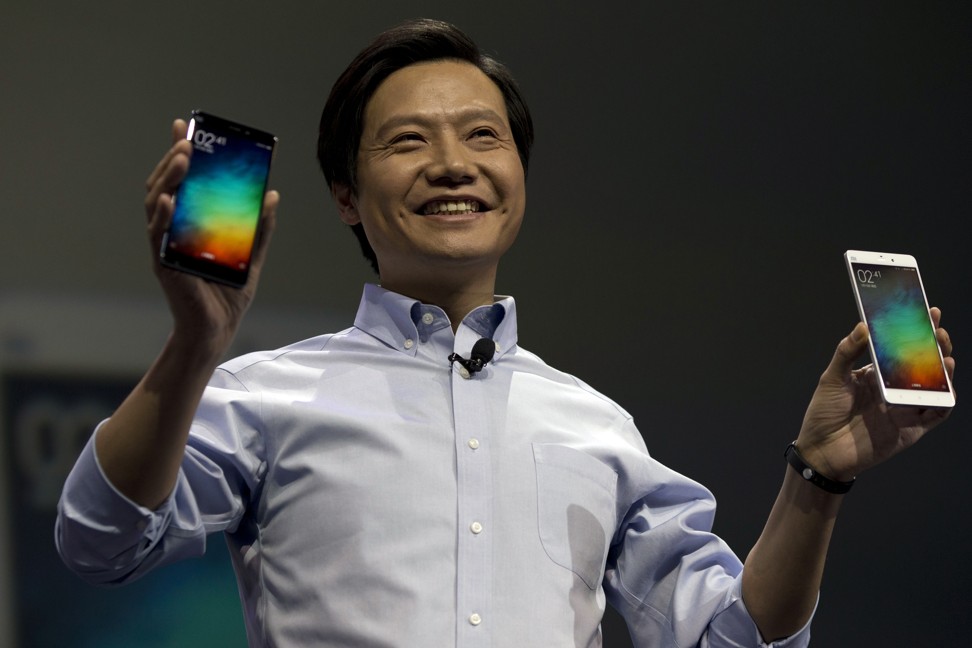

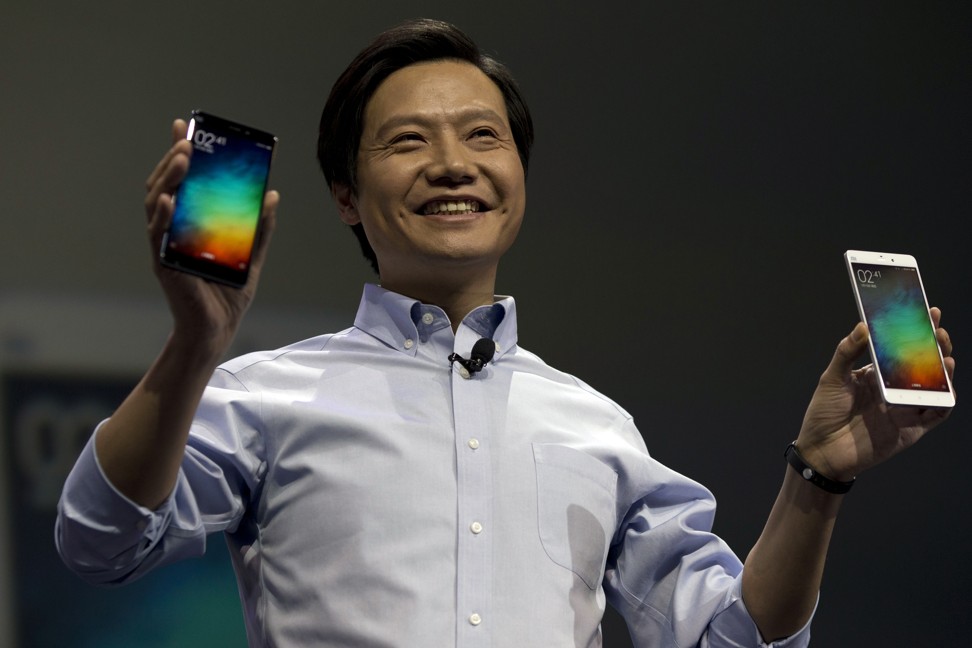

Huami, backed by Xiaomi and its founder Lei Jun, aims to raise US$150 million on the Nasdaq, according to a prospectus released last week. The size of the IPO is yet to be revealed.

“Huami’s [IPO] is not a big offering. But it just shows how much they [Xiaomi and related companies] want to be out there quickly,” said Ken Wong, an Asian equity portfolio strategist at Eastspring Investments. “An overseas IPO could have a great impact on building brand awareness and the potential to help better engage stakeholders.”

Xiaomi is preparing its own flotation, which could be the biggest technology listing since Facebook’s in 2014.

Its global sales jumped by 102 per cent year-on-year in the third quarter last year to 27.6 million units, helped by aggressive expansion in markets such as India and a sped up drive into bricks-and-mortar stores, according to figures from the International Data Corporation.

Analysts said a successful IPO will help Xiaomi’s global ambitions.

In December, Lei Jun said the company planned to enter more international markets after sharing the No. 1 spot with Samsung in India; he also said the company is prepping for entry into the US market.

When it comes to listings by Chinese technology companies, Hong Kong has a good chance of winning deals, analysts said.

Xiaomi is a growth company and has high potential, but how much can it be valued still depends on market conditions and investors’ response

Chinese issuers usually prefer the city as it is closer to their home market and enables access to a larger pool of international as well as mainland investors, who typically have a good understanding of the business models and products that tend to be relevant locally, said Mervyn Chow, co-head of investment banking and capital markets, Asia-Pacific, and Greater China chief executive of Credit Suisse.

“This has been important for Chinese technology firms, which are largely ‘product companies’ focused on building and selling products to consumers.”

Xiaomi has picked Morgan Stanley, Goldman Sachs, Deutsche Bank and Credit Suisse to handle its IPO, according to Bloomberg, which some banks expect to value the company at US$100 billion.

But Wong said he had reservations about this valuation. An estimate by bankers put Xiaomi’s net profit for 2018 at US$2 billion, doubling its profit for 2017, according to Reuters.

If valued at US$100 billion, Xiaomi could have a price to earning ratio of about 50 times. That is a lot higher than other consumer electronics companies, such as Samsung, which has a current ratio of between six and seven times, said Wong.

“Xiaomi is a growth company and has high potential, but how much can it be valued still depends on market conditions and investors’ response.”

Correction: Huami aims to raise US$150 million from IPO. A previous version incorrectly said US$1.5 million.