Enough! LeEco’s white knight admits defeat, refuses any more funding for troubled group

Investors should brace themselves for further losses as Leshi will resume trading on Thursday with mutual fund managers already marking down the stock price by 74 per cent.

Sun Hongbin, the white knight who came to the rescue of troubled entrepreneur Jia Yueting – also known as ‘China’s Steve Jobs’ – with a 15 billion yuan (US$2.3 billion) investment in Leshi, has refused to make further financial commitments.

“People should admit defeat because sometimes it works, sometimes it doesn’t,” Sun, the Chinese property tycoon behind Sunac China Holdings, told retail investors of Leshi Internet Information & Technology on Tuesday morning via an online conference link through the Shenzhen bourse.

Sun said that while he was not willing to increase his stake in Leshi, he would try his best to push for a “solution to the capital problem and normalise operations”.

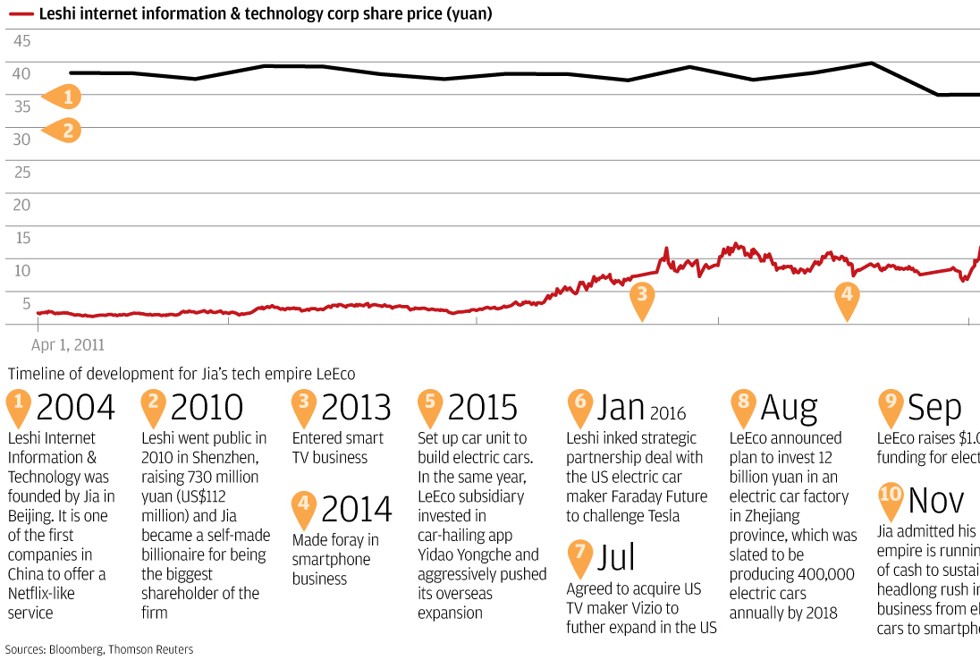

Leshi is the Shenzhen-listed arm of LeEco Group – the internet-based conglomerate founded by Jia, a video-streaming and sports broadcaster that expanded into making smartphones and electric cars.

Sun poured 15 billion yuan to buy an 8.56 per cent stake in Leshi and other LeEco subsidiaries in January and provided it with another 1.29 billion yuan in loans in November.

The reluctance of the property magnate - Sun’s business is among China’s most highly geared private companies - to pour more funds into LeEco and Leshi would choke off the lifeblood that’s keeping the beleaguered group alive.

“Anything could happen, including delisting of the firm,” Leshi said in a statement.

Leshi’s shares have been suspended from trading since April last year after the company’s cash crisis became apparent. The company’s shares will resume trading on Thursday.

Sunac China rose by 5 per cent in Hong Kong to HK$36.3 within minutes of Sun expressing his desire to provide no further investment.

Jia resigned as chairman of Leshi to hand over the position to Sun, but remains a controlling shareholder with a 25.67 per cent stake. More than 99 per cent of Jia’s holdings had been pledged to financial institutions for capital, according the firm’s financial report for the third quarter.

Leshi is also owed 7.5 billion yuan by companies related to the LeEco Group.

“The unpaid receivables, and troubles of the related parties under LeEco Group has weighed on the cash flow and the reputation of the listed company, causing losses of 1.6 billion yuan for shareholders in the first nine months,” the financial report said.

During Tuesday’s conference, Sun said he “was aware of the receivables owed by unlisted parties of LeEco, but had wrongly assumed that they would be paid”.

Sun and his colleagues said they would urge Jia to make those repayments through the disposal of stakes in his other companies, including the Las Vegas-based Faraday Futures, which is involved in the development of an electric sports car.

Meanwhile, mutual fund managers had slashed their price for Leshi’s shares to 3.91 yuan, from 15.33 yuan before trading was halted, as the firm had aborted a restructuring plan, and is still showing no sign of recovering its debts, resuming normal operations or regaining market share.

Central Huijin Asset Management, a subsidiary of China’s main sovereign wealth fund, could feel the brunt of the stock’s decline as it is the sixth-largest shareholder with a 1.4 per cent stake.

Two asset management plans set up by the state-owned Industrial Bank, Agriculture Bank of China and China Post Fund are also among the top 10 shareholders.