Chinese retailers are eschewing the 2018 IPO boom to go private. Here’s why

Analysts expect a wave of buyouts and privatisations in China’s fast-changing retail market as booming online sales hit traditional vendors

When Chinese footwear retailers Belle International and Pou Sheng International (Holdings), and department store chain Intime Retail Group listed on the Hong Kong stock market years ago, they were riding on a rebound spurred by Beijing’s shift towards a consumption driven economy. Little did they know then their fortunes would reverse amid the boom in online sales.

Since the beginning of last year, Belle and Intime have delisted, pledging to revive a shrinking business hit hard by e-commerce, while Pou Sheng is considering it. The privatisations come despite the city’s main Hang Seng Index hitting a record high and amid optimism that Hong Kong is about to regain its former IPO glory.

It is unlikely these companies will be the only ones affected by the rise of online shopping. Industry observers expect the wave of buyouts and privatisation initiatives will continue in China’s fast changing retail market.

“This is just the beginning. Whoever can be bought out and transform themselves will survive,” said Pascal Martin, partner, OC&C Strategy Consultants.

This is just the beginning. Whoever can be bought out and transform themselves will survive

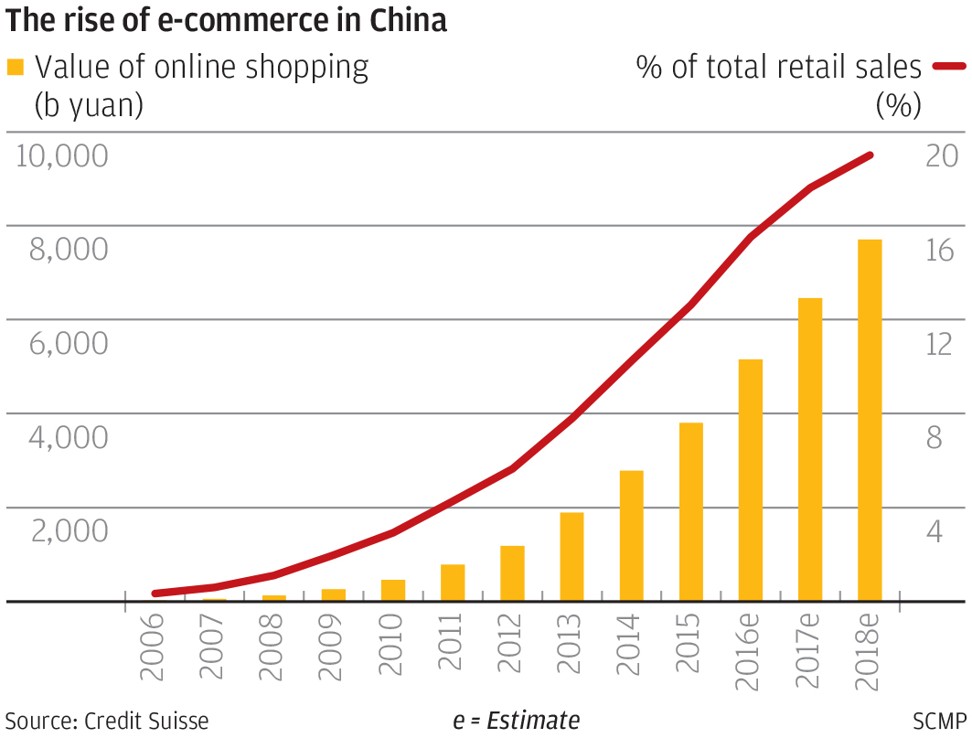

According to the Ministry of Commerce, online sales surged 26.8 per cent in 2017 on year, up 3.2 percentage points from 2016, while sales at brick and mortar shops rose 4.6 per cent on year.

In 2010, the gross merchandise volume of e-commerce totalled 461 billion yuan (US$73.43 billion), with a penetration rate of just below 3 per cent. Thanks to online retailing infrastructure and the proliferation of mobile payment services, sales volume jumped to 7.18 trillion yuan in 2017, accounting for 19.6 per cent of the total sales of consumer goods across the country, according to a survey by China-based analysis firm Jiguang Data. Credit Suisse predicts online gross merchandise volume in the country will increase to 7.7 trillion yuan this year.

Despite fears that online platforms such as Alibaba and JD.com siphon sales from traditional retailers, there are signs that consumer brands are fighting back with strategies that are finding traction in the online world.

With the speed of change that is happening in the retail sector, we are seeing disruption and challenges brought on by online sales channels

These transformations include the concept of “New Retail”, defined by Alibaba Group Holding executive chairman Jack Ma as the pursuit of “the integration of online, offline, logistics and data across a single value chain”.

Essentially, the trend adds up to a wave of buyouts, usually followed by privatisation initiatives.

“With the speed of change that is happening in the retail sector, we are seeing disruption and challenges brought on by online sales channels, and in some cases the online re-positioning of the traditional operating model by retailers,” said Colin Banfield, managing director and head of M&A, Asia-Pacific at Citi. “This trend is forcing retailers to rethink how in the longer term they can balance the online and offline model.”

Citi is exclusive financial adviser to Taiwan-based Pou Chen Group, which proposed on January 21 to privatise its mainland sports shoe retail network in a deal costing around HK$11 billion (US$1.41 billion).

The retailer, which was listed in Hong Kong in 2008, said it would need “significant investments” to transform its business and that it would have more flexibility and advantageous financing if it were to be taken private, according to the proposal.

In a similar case in April last year, a consortium led by Chinese private equity firm Hillhouse Capital Group offered to buy out Belle in a takeover valued at HK$53.1 billion.

Hillhouse teamed up with CDH Investments and two Belle executives as part of the takeover. They said the takeover would allow them to be more effective in revamping the business, with a view to incorporating new technology investment.

Belle, which sells brands including Staccato, Joyce & Peace and Mirabell, has been hit hard by online competition over the past five years, as struggling bricks-and-mortar stores remain its primary sales channel.

In a speech to staff by Hillhouse boss Zhang Lei in October last year, Zhang, now chairman of Belle, said Hillhouse would help the latter to establish a data and technology-based management, decision-making and analysis system in a bid to enhance its operational efficiency.

At the same time, Zhang highlighted the importance of Belle’s strong network of more than 20,000 shops in China, and its heavy daily foot traffic of six million customers a day.

Eric Wang, managing director of Alvarez & Marsal, expects more buyouts and privatisation in the retail market because transformation takes time and requires capital investments; struggling retailers may need a third party’s money to pay for a revamp.

“It makes a lot of sense from owners’ perspective and from investors’ perspective to privatise the companies. If you close a store or open a store, that business will be directly affected. By doing so, you will face pressure from minority shareholders,” said Wang, who heads the China restructuring and performance improvement practices of the consulting firm.

“Yes, you might see more [privatisations] especially for retail distributors.” he said.

Instead of purely expanding online, Wang said the trend is increasingly towards focusing on the symbiotic growth of both offline and online channels.

“I think the offline retail distributors should think about what they really have. They are the connecting point between the products and the customers. They should think of how to build on the retail experience and access new customers,” he said.

“Online players do not know how to do it, and that explains why online platforms such as Alibaba and JD.com are investing in the offline retail market.”

E-commerce giant Alibaba Group Holding led a US$2.6 billion bid to privatise department store operator Intime Retail Group in January last year and bought an 18 per cent stake in supermarket chain operator Lianhua at the end of May. It also launched its first offline store in Hangzhou, named House Selection.

Alibaba owns South China Morning Post.

“Anybody who thinks that online is the only way to shop is from Mars,” said Hong Kong-listed Hang Lung Properties chairman Ronnie Chan Chi-chung. The company owns a number of luxury shopping malls in China.

“Human beings are social animals, of course you want to interact with each other, so I think the physical stores will always have a very good place in the total scheme of things,” he said.

Online vendors eventually figure out they need to have physical stores as well, said Chan.

This week, Tencent Holdings, together with JD.com, Suning Commerce and Sunac China joined forces to invest in mall operator Wanda Commercial for 34 billion yuan, in what has been billed as one of the largest ever deals between internet companies and physical retailers.

Additional reporting by Georgina Lee and Louise Moon