Iconic Waldorf Astoria hotel is part of China's US property fire sale - but don't expect a bargain

Spooked by Beijing’s tightened grip, Chinese firms are exiting the American market, but some are still seeing a profit

When Wu Xiaohui, Anbang Insurance Group’s billionaire founder, bought Manhattan’s landmark Waldorf Astoria in 2015, he said he planned to hold onto the hotel gem for 100 years.

Only two years later, however, the Chinese auto-insurance-salesman-turned-business-tycoon was arrested. Anbang was officially taken over by the Chinese government in February, and Wu pleaded guilty in March to fraud and embezzlement, facing a potential life sentence. The company’s US assets – including the famed hotel – are back on the block.

Anbang is among a list of Chinese conglomerates that went from buying up billions of dollars of hotel and office buildings in the US to collectively selling them off in just a couple of years.

From HNA Group to Dalian Wanda Group, Beijing’s tighter grip on capital outflow has brought down once high-flying deal makers and prompted Chinese companies to reverse course and to exit their briskly obtained overseas assets.

“Few could have predicted Chinese buyers’ fast entry” a few years ago, said Richard Hightower, a real estate analyst at the New York-based investment bank Evercore ISI. “And few could have predicted their quick exit either.”

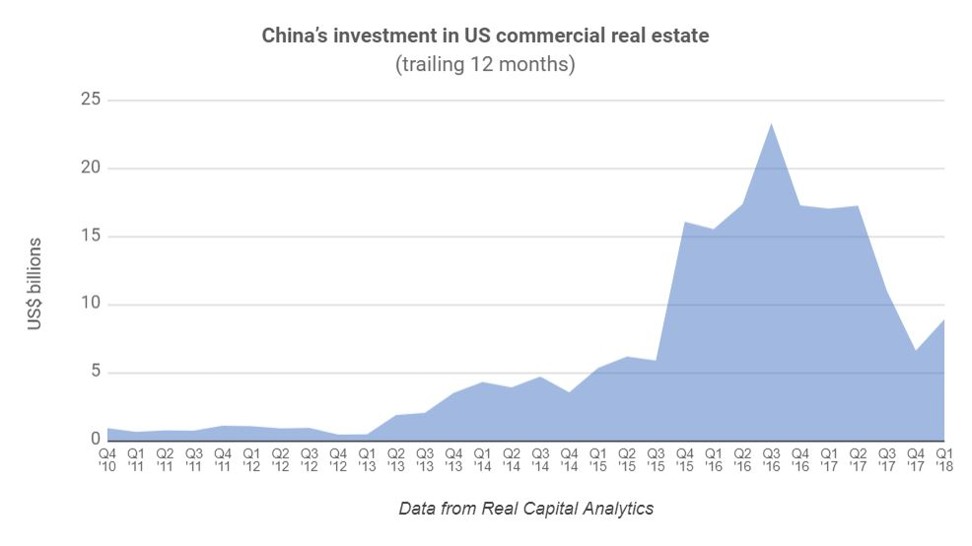

At the height of the buying spree, Chinese companies invested a total of US$37 billion in US real estate from 2014 to 2016, according to Real Capital Analytics, a New York-based commercial property data provider.

Many of the assets are now in the market to be sold as the Chinese government reins in the risks imposed on the companies as well as the financial system as a whole from the debt-fuelled acquisitions.

The sharp reversal has sparked hopes among US investors that a potential fire sale of these assets could create buying opportunities, offering rare dislocations in asset value.

Hopes were especially high for Wall Street’s investment powerhouse Blackstone Group, which had sold a number of big-name hotels to Anbang in 2015 and 2016, to buy back the assets. The group’s chairman, Stephen Schwarzman, said in February on Bloomberg TV that “if they are selling, we are taking a look”.

But while talks are continuing about buying back San Francisco’s Westin St. Francis in San Francisco and JW Marriott Essex House in New York – two hotels Blackstone sold to Anbang through Strategic Hotels & Resorts in 2016 – Waldorf Astoria is a much harder deal, according to people with knowledge of the matter.

The Waldorf Astoria, part of which is being converted into condominiums, is hard to value because it’s no longer entirely a hotel, analysts said. That, combined with financial factors like the lack of cash flow during the construction, makes it a difficult property to assess for real estate buyers specialising in hotels.

Wall Street investors acknowledge that despite the pressure on Chinese companies to sell, many have managed to turn a profit.

“If you look at our sales to Chinese buyers – particularly European logistics, the Hilton stake and Japanese residential – the vast majority have been highly successful investments,” a spokeswoman at Blackstone told the South China Morning Post.

HNA’s unloading of its stake in Hilton Group stands to generate US$2 billion in profit. The Chinese conglomerate, which bought the stake for US$6.5 billion in 2016, continues to own a quarter in Hilton, valued at about US$6.9 billion. That remaining stake is also up for sale.

HNA, one of the most acquisitive Chinese companies, borrowed heavily to fuel its speculative investments. Its interest expenses rose to a record of US$5.1 billion in 2017, topping all Asian companies.

As a result, the once-acquisitive Chinese company has sold US$13 billion of assets in recent months and is continuing to sell more.

Anbang is also under pressure to restructure and will start looking for private capital. With close to US$10 billion in capital supplied by Chinese authorities, it isn’t in as much as a financial bind.

At the time of its takeover in February, the government said it would control the business for at least a year, providing leeway to wait for a good offer to show up.

That wiggle room also helps Anbang as the US hotel sector, which saw a dip due to hurricanes and political turmoil in 2017, sees an uptick this year, according to a report by the National Association of Realtors.

“In the most recent quarter, we’ve seen transactions picking back up,” said Richard Barkham, global chief economist at CBRE, a commercial real estate services company based in Los Angeles, California.

“There is a huge amount of capital targeting real estate. Buyers are coming back with a changed mindset willing to accept current pricing.”

The amount of private capital targeting North America real estate investment rose to a record high at US$176 billion as of Tuesday, according to estimates by the data provider Preqin.

For [some firms], losing some money isn’t good, but they’d rather get out of the area that’s seen as problematic by Beijing

Another potential upside to waiting is the pending changes in the US tax code, which reduces the corporate federal income tax rate from 35 per cent to 21 per cent.

This change helps property sellers because valuations are likely to go up “as lower taxes have a positive effect on cash flows, resulting in greater returns for sellers,” according to a McKinsey report on tax reform’s impact on asset sales in April.

And waiting for a higher valuation is crucial as most of the Chinese-owned properties were acquired at the peak of the market around 2015.

To be sure, “some firms are forced to sell,” said Geoffrey Sant, a lawyer at Dorsey & Whitney who represents Chinese clients in cross-border transactions. “For them, losing some money isn’t good, but they’d rather get out of the area that’s seen as problematic by Beijing.”

Some private equity firms have already taken advantage of buying smaller and lesser-known assets back from the Chinese. In March, the New York-based real estate investor Northwood Investor bought HNA’s 1180 Sixth Avenue office for US$305 million. The price dropped from US$320 million as cash-strapped HNA was in a bind to service its debt.

Northwood is also said to be considering purchase of another property, 245 Park Avenue, which HNA bought just last year for US$2.2 billion from the private equity house Brookfield Asset Management. The estimated valuation is lower than what the Chinese company paid, according to real estate analysts.

Spokesmen for Northwood and Brookfield did not respond to requests for comment.

US private equity and investment firms have long been the dominant investors in commercial real estate properties.

As of the third quarter of 2017, as much as 56 per cent of the US$3.97 trillion equity-based investment in commercial real estate was owned by private equity firms, continuing a trend a year earlier, according to a report published by Deloitte, the National Association of Realtors and the valuation consultancy Situs RERC.

Wall Street investors such as Blackstone and Brookfield have profited from Chinese investors’ buying binge.

In 2016 Blackstone sold the two hotels it owned through Strategic Hotels & Resorts for US$6.5 billion, about US$450 million more than it had paid for them just a few months earlier.

It also sold 747 Fifth Avenue, a midtown office building steps away from the Trump Tower, to Anbang to be its US headquarters a year earlier.

Waldorf Astoria had brought the single highest price tag in US hotel deals at US$1.95 billion. Blackstone, which had owned Hilton before selling it to HNA, made back the US$6.4 billion it had invested in the hotel operator with that sale.

Today, in a frothy real estate market, only a few firms are able to write the checks big enough to buy Waldorf Astoria. Blackstone, which has more than US$450 billion in assets under management and US$120 billion in real estate investments alone, definitely fits the bill.

But buy back the iconic hotel when the nature of the property has significantly changed? That’s a different story.

“The Chinese were buying [the real estate] for non-economic reasons and are selling for non-economic reasons, which creates difficulty for US investors, who traditionally have a financial return objective in mind,” said Evercore’s Hightower.

“I don’t think Blackstone will do a deal just for the sake of owning Waldorf Astoria again.”