China picks its battles, to ease monetary policy amid trade war

Yuan at level where investors can consider buying it as long-term investment, according to one industry watcher

Beijing is likely to shift its monetary policy from deleveraging to one “buttressing” growth, after its ongoing trade war with the United States cooled economic growth in the second quarter, according to a research report released by DBS on Tuesday. Deleveraging was adopted to curb shadow banking and excessive borrowing by local governments and companies.

“The People’s Bank of China is likely to shift its stance from deleveraging to buttressing growth. Local companies have been facing serious liquidity issues amid deleveraging and the forthcoming tax season. The amount of medium-term lending facilities due in the next 12 months will rise to 4.2 trillion yuan,” Samuel Tse, an economist at the bank, said in the report.

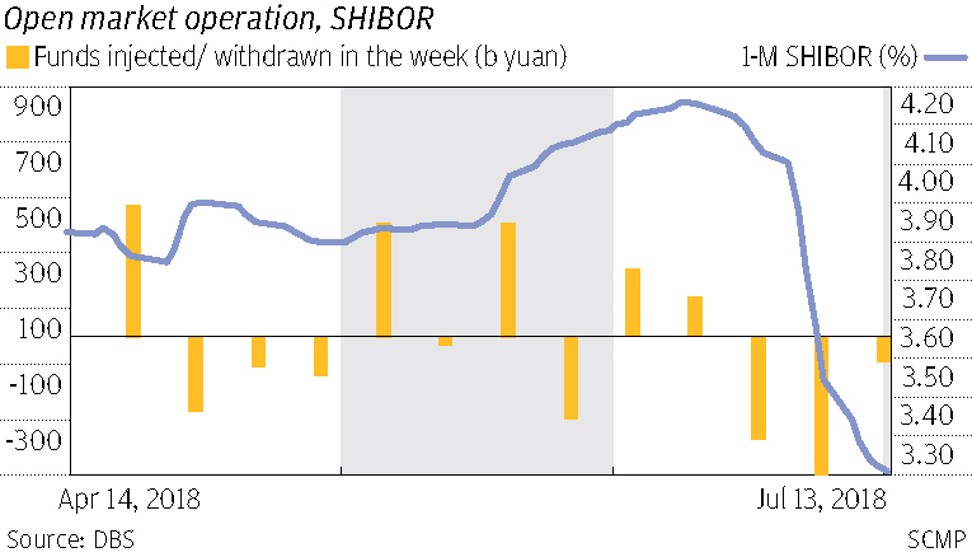

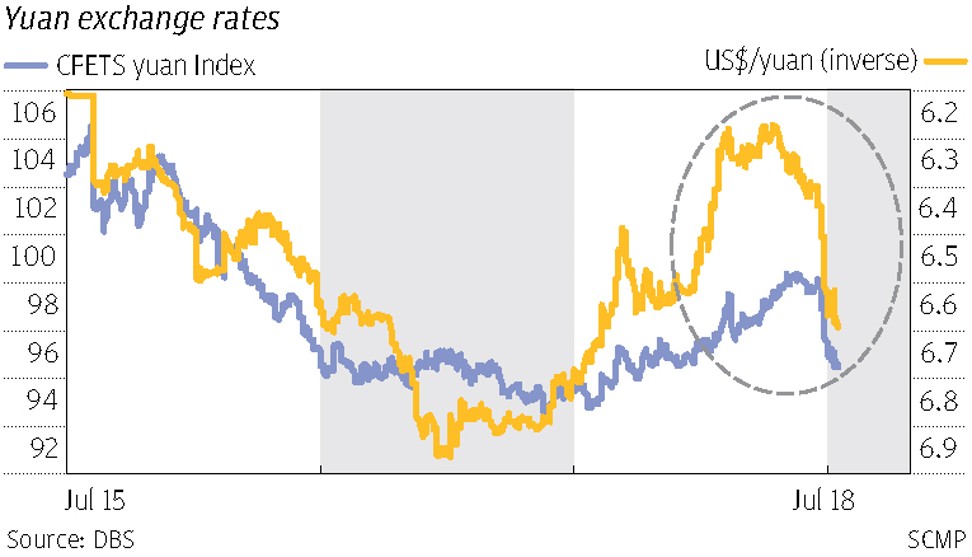

“Indeed, the market has started to price in the changing signals of its monetary policy stance. The Shanghai Interbank Offered Rate has dropped by 95 basis points within three weeks. In response, the yuan has depreciated from 6.27 in mid-April to 6.69 in mid-July. Expect the yuan to remain under pressure,” said Tse.

The report follows yuan deposit rate cuts at HSBC, Hong Kong’s biggest bank, on Friday, and at local mid-tier lender Wing Lung Bank, which cut the rate several times over the past two weeks. Other major banks, such as Hang Seng Bank, Standard Chartered Bank and ICBC Asia, have not changed their rates, but currency traders believe they will follow the trend and lower their yuan time deposit rates, because the People’s Bank of China is likely to continue with a low interest rate and monetary easing regime amid the ongoing trade war.

HSBC cut rates across all tenures, with the one-month yuan time deposit rate down to 2 per cent from 2.7 per cent, the three-month rate down to 2.9 per cent from 3.35 per cent, the six-month rate down to 3.1 per cent from 3.4 per cent, and the 12-month rate down to 3.4 per cent from 3.45 per cent.

“We have adjusted the yuan time deposit rates in response to the recent movement of yuan interbank rates in Hong Kong,” said a bank spokeswoman.

Wing Lung Bank cut its one-month yuan deposit rate to 2.15 per cent from 2.55 per cent, the three- month yuan deposit rate to 2.85 per cent from 3.45 per cent, and its 12-month deposit rate to 3.15 per cent from 3.7 per cent.

We have adjusted the yuan time deposit rates in response to the recent movement of yuan interbank rates in Hong Kong

“The PBOC cut the reserve requirement ratio last week to unlock billions in cash for the market. This has lowered the onshore yuan interest rate in Shanghai, and also the interest rate for the offshore yuan in Hong Kong,” said Tommy Ong, managing director of treasury and markets at DBS Hong Kong.

The one-month offshore yuan interbank interest rate now stands at below 3 per cent, down from 4.8 per cent on June 19, said Ong.

“Besides the ongoing trade war with the US, economic growth on the mainland is not good. This has led the PBOC to adopt a policy of monetary easing. The central bank may be pressured to further cut interest rates or the reserve requirement ratio this year. This will continue to bring the mainland and Hong Kong yuan interest rates to a lower level,” he said.

Ong said the lower yuan deposit rate was also related to the demand for the currency, which has decreased after the end of the half-year settlement period.

Jasper Lo Cho-yan, chief investment strategist at Hong Kong-based Eddid Securities and Futures, said China’s monetary easing policy will continue to offer cheap money and will led to lower interest rates, and this means the exchange rate of the yuan will continue to remain at the recent low level of 6.7333 per US dollar – or it may go further down to 6.90 this year.

“However, I do not believe the PBOC will let the yuan go down any further, below the 6.90 level, as this may lead to a serious capital outflow problem. The PBOC will intervene in the market if the yuan falls to such a low,” said Lo.

The offshore yuan fell by 5.4 per cent over a period of 14 days, its longest losing streak, after the Chinese central bank opted not to follow the US Federal Reserve and increase interest rates on June 14. It has also been affected by the trade war between Washington and Beijing.

The Chinese currency touched a low of 6.7333 against the US dollar on July 3, prompting the PBOC to issue a statement saying it would defend the yuan if needed. The currency bounced back before falling once again last week after US President Donald Trump said the US was considering tariffs on Chinese goods worth US$200 billion.

But Eddid Securities and Futures’ Lo said the yuan was at a level where investors could consider buying in to the currency as a long-term investment.