China Tower prices IPO at bottom of price range after weak retail interest, raising US$6.9 billion

At HK$1.26 a share, the world’s largest telecoms tower operator commands a market valuation of US$28 billion

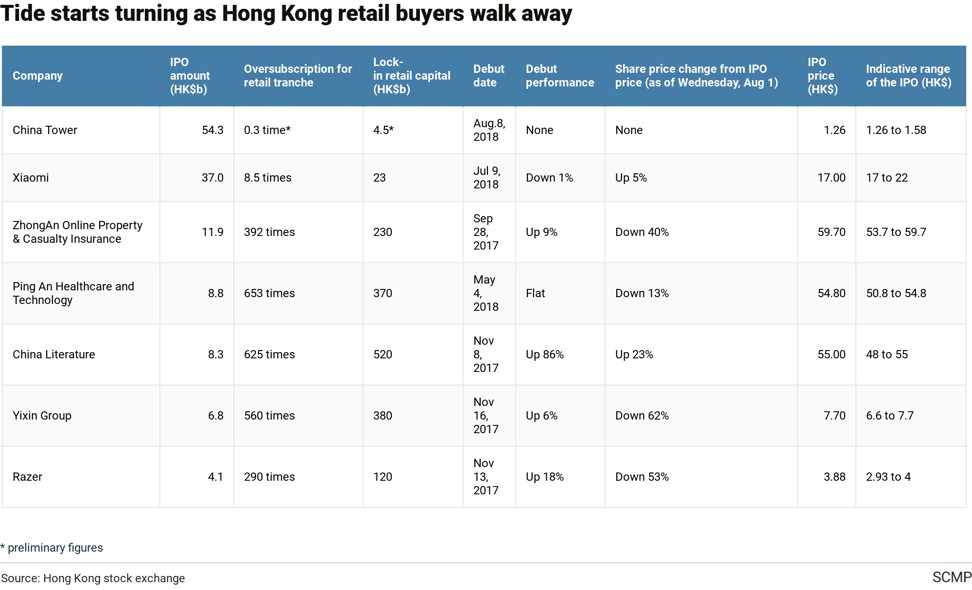

China Tower has priced its initial public offering at the bottom of the indicative price range, raising HK$54.3 billion (US$6.9 billion) amid lukewarm retail investor interests, according to several people familiar with the deal.

The world’s largest telecoms tower operator has sold 25 per cent of an enlarged share capital at HK$1.26 a share. The top of the price range was HK$1.58, a level which would have seen the company raising as much as HK$64.1 billion.

At HK$1.26 a share, China Tower operator would command a market valuation of HK$217.3 billion.

Its retail offering of around 2.16 billion shares – a modest retail book by value – was only just oversubscribed, as individual buyers placed orders worth about HK$4.5 billion, according to preliminary figures from people close to the transaction. The number could be subject to minor adjustments before final calculations were completed. The final tally will be announced next Tuesday, with the stock to start trading on August 8.

The international placement tranche was overbought by multiple times, according to the people.

Yet, compared with the mega IPOs in the past few years, overall response to China Tower’s listing would be seen as weak. In 2016, the global offering of the Postal Savings Bank raised US$7.4 billion and attracted retail orders worth HK$8.3 billion, representing an oversubscription of 1.6 times.

Earlier this month, Xiaomi drew retail investor orders worth HK$23 billion, 9.5 times the value of its retail tranche. The smartphone maker also set its IPO at the lower end of the range, valuing the firm at half of the amount that was initially sought.

The lukewarm retail response for China Tower signalled the public’s waning appetite for IPOs in the past few months.

In July, Hong Kong’s average IPO retail subscription was 29 times, the lowest since January 2016, according to data compiled by Bloomberg.

It marks a sharp turnaround from earlier in the year. Retail investors overbought IPOs by an average of 1,191 times in April. The ratio fell to 301 in May and slipped further, to 154, in June.

Three months ago, Ping An Good Doctor attracted HK$370 billion worth of retail orders and was overbought by more than 650 times, making it the city’s most sought-after large-scale IPO since 2009.

And China Literature, a unit of Tencent Holdings, locked in HK$521 billion of capital in its IPO last November, or around one-third of Hong Kong’s money supply.

Hong Kong’s benchmark Hang Seng Index has already tumbled 10 per cent since its recent peak on June 7.

Additional reporting by Yujing Liu