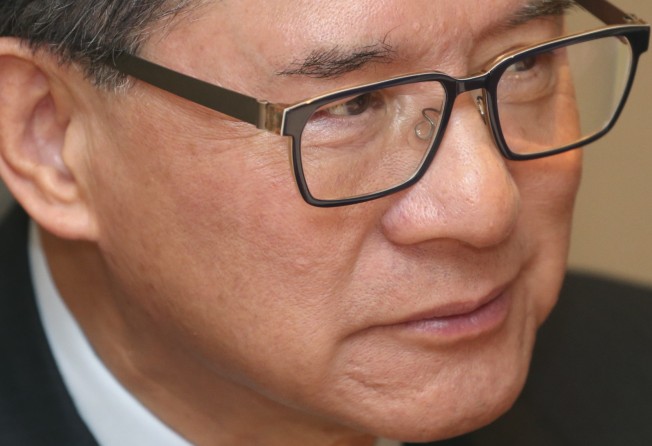

Shui On’s Vincent Lo, uncrowned ‘King of Guangxi’, still hungry to out-Trump his rivals

He broke away from the family fold at just 23 to form his own business, and now the fourth of nine children is set to hand over the reins of his burgeoning property empire to his daughter

Inside Vincent Lo Hong-shui’s office in the Shui On Centre in Wan Chai, traditional Chinese art lines the walls, and Lo rather favours wearing traditional Mandarin collared suits.

But in a corporate culture that prefers male heirs, he has left tradition behind in just appointing his daughter, Stephanie, as executive director and heir apparent.

She has more than 14 years of experience in property development in mainland China, and is also executive director of Shui On Management (SOM) and the vice-chairman of China Xintiandi (CXTD). Both SOM and CXTD are subsidiaries.

In person, Vincent’s sophisticated and genteel demeanour rather successfully hides what is obviously a combative gambling streak and fierce willingness to take big risks.

The fourth of nine children – five brothers and three sisters – he has been the most determined to carve out a path of his own.

In 1971, aged just 23, he founded Shui On Group to pursue his own ambitions outside the family business founded by his father, Great Eagle Holdings.

“We were brought up to be fairly independent, to all do our own thing,” he once said in a 2015 interview.

Lo harboured ambitions in mainland China long before it came firmly on the radar of many investors in the 1990s.

The Chinese characters for Shui On correspond to the characters used in the cities of Ruijing and Yan’an – the start and end points of the legendary Communist Party Long March of 1934.

In 1984, he partnered with the Communist Youth League in China to build a hotel in Shanghai at a time when most Hong Kong businessmen were focused on cheap labour and manufacturing.

In a 2004 profile story, The Economist magazine dubbed him “the King of Guangxi”, but his real breakthrough was the Xintiandi project in Shanghai, conjured up in 1996 and completed in 2002.

The idea was to take an old, rundown but traditional neighbourhood, and refurbish it into its original design and styling, while adding modern retail and food outlets.

It was a politically sensitive project, given that the neighbourhood was also the location of the first congress of the Communist Party, and the Beijing government wanted to preserve the ambience of the area.

I love work, but I don’t want to always carry the flag myself. I’m starting to hand over [responsibility] in a more organised way, rather than just finding a CEO and saying, ‘you do it now’

In the end, it was successful enough that Lo tried several other such “tiandi” projects in other cities across the country, though none appear to have matched the enduring success of the original.

Lo was even referred to as “the Donald Trump of China”, thanks in part to his big vision, dalliances with debt, and a much-tabloid-chronicled second marriage to a beauty pageant winner.

Ironically he and Henry Cheng of Chow Tai Fook did actually carve out a deal with Trump, that ended in a lawsuit.

The two Hongkongers helped Trump in 1994 when the now US President was unable to service payments on a 77-acre swathe of land in New York known as Riverside South, following a crash in the real estate market.

The Hong Kong billionaires agreed to buy the land, assume the debt and pay Trump 30 per cent of any profits generated.

Lo and Cheng sold the development for US$1.76 billion in 2005, though Trump alleged that he could have got a better price, and sued.

The now White House resident famously does not like travelling – but Lo and Cheng dragged him to Hong Kong, where he had to attend Chinese banquets and drinking contests (Trump does not drink nor, reportedly, does he like Chinese food). It has even been suggested that the animus Trump feels towards China stems from the experience.

From those heady days, however, Shui On has maybe lost its lustre for headline grabbing.

For nearly a decade now, Lo has focused instead on slashing Shui On Land’s debt, selling property holdings, including his beloved Xintiandi project.

The Link Real Estate Investment Trust, for instance, bought two commercial buildings in Shanghai from Shui On Land for 6.6 billion yuan (US$967 million) in July 2015 – Corporate Avenue One and Two – next to the Xintiandi prime retail and entertainment area.

Lo even sold hotel assets to his elder brother, now Great Eagle chairman, Lo Ka Shui.

In 2014, long-time Shui On employee and chief executive Freddy Lee abruptly resigned from all his positions at Shui On, thanks in part to the debt and a falling share price. And a year later Shui On Land’s chief financial officer Daniel Wan left too, leaving Vincent handling the day-to-day affairs of the company.

But the founder’s famous lofty ambitions are still never far from the surface.

Last year he spoke of his expansive plans to create a network of “knowledge and innovation centres”, in the mould of a first he built 13 years ago in Shanghai. Shui On later sold a 49 per cent stake in the 48-hectare mixed-use project.

At that time, Lo had started to hope that China Xintiandi, a subsidiary of Shui On, could become more of a management company than a property investor. The new business model, he said, would be steered by his daughter.

“I love work, but I don’t want to always carry the flag myself. I’m starting to hand over [responsibility] in a more organised way, rather than just finding a CEO and saying, ‘you do it now’,” Lo said at the beginning of 2017.

In July this year, Shui On was a 25 per cent partner in a consortium that bid US$2 billion for a huge commercial plot in the heart of Shanghai.

After years of offloading assets, it appears his appetite to acquire is back, although the South China Morning Post reported the conditions of the deal could make the project challenging, as municipal authorities want the developer to hold the property for at least 20 years. Does Vincent Lo still have the connections to keep that project and his empire on track?

The big difference this time around is that he will be looking to his daughter to help him, as his ambition and hunger for success clearly continue unabated.