China tech IPO boom to continue for at least another year, says China Renaissance CEO

More big tech IPOs are in the pipeline, including Didi Chuxing, Jinri Toutiao, and Kuaishou, says Bao Fan

The boom in Chinese technology IPOs in Hong Kong is likely to continue for at least another year following a record number so far this year, says Bao Fan, CEO and founder of China Renaissance.

“The [IPO] window is open in Hong Kong, and will stay open,” Bao, whose investment bank has built a reputation as a key adviser on Chinese tech IPOs and M&As, said in an interview.

One of the main reasons for the boom is the reform in Hong Kong’s listing rules, which came into effect in April. The new rules allow companies with dual class shares to list and also makes it easier for pre-profit biotech firms to launch their IPOs.

Another driver is the development stage of the Chinese companies.

“In the past few years, many of these firms have made great progress under the support of financing from private equity funds. They have matured and reached the IPO stage.

“They are ready now. ”

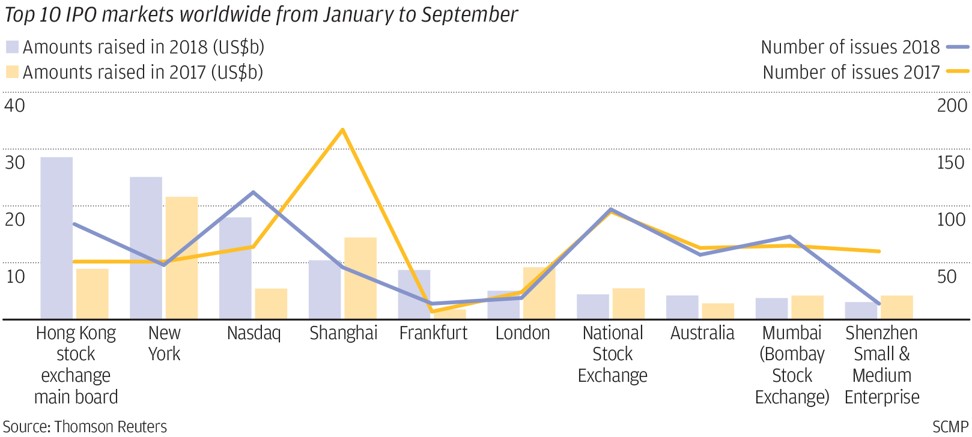

By the end of last week, 13 Chinese tech and related companies had made their stock market debut in Hong Kong this year, raising a combined US$6.86 billion. The number and value were both the highest on record since 1995, according to data compiled by Dealogic.

During the same period, 15 Chinese tech and related IPOs were launched in the US market, matching the record set in 2015.

Some of the star start-ups to list in Hong Kong this year include smartphone maker Xiaomi, which raised US$5.4 billion in July, and food delivery service app Meituan Dianping, which raised US$4.2 billion last week.

Pinduoduo, an online discounter, mopped up US$1.6 billion from its US listing in July.

China Renaissance advised on both the Meituan and Pinduoduo deals.

Even more big IPOs are in the pipeline, including ride-sharing giant Didi Chuxing, news aggregation app Jinri Toutiao, and video-sharing app Kuaishou.

“There are still many more next year,” Bao said.

The Hong Kong market sentiment, however, has changed significantly since earlier this year.

The Hang Seng Index traded at 27,762 on Thursday morning, slightly lower than the previous close. The index recently entered a technical bear market, reaching a low of 26,613 earlier this month, down more than 20 per cent from a high of 33,484 on January 26.

The volatility, largely because of the US-China trade war, currency turmoils in emerging markets and fear of further interest rate hikes, have dampened interest for new listings.

Many of those that have debuted recently have seen their share price drop.

The 10 biggest IPOs in the past 12 months – China Tower, Xiaomi, Meituan Dianping, ZhongAn Online P&C Insurance, Ping An Good Doctor, China Literature, Haidilao, Jiangxi Bank, BeiGene, and Yixin Group – are all trading below their offer prices.

China Renaissance also fell heavily on the first day of trading on Thursday, down as much as 20 per cent to HK$25.60, compared to its offer price of HK$31.80.

But Bao said he was not concerned about short-term price volatility for Chinese tech IPOs.

“I don’t think that’s an issue. The volatility often occurs in the price discovery process, and in the end the market will reach a consensus about the valuation,” he said. “The key is whether the tech company has real innovation.”

Volatility often occurs in the price discovery process, and in the end the market will reach a consensus about the valuation

Besides, he said, volatility is not necessarily a bad thing.

“The capital market always has cycles. It helps eliminate the inferior and lets the fittest ones survive.”

Bao said he is bullish on both China’s new economy sector, which is driven by the new round of industrial and technological revolution, and relevant financial services, which still underserves the sector.

“As China’s new economy grows and household wealth increases, the relevant financial services sector will also grow fast. I think the sector will double in size in five years,” Bao said.

China Renaissance currently has three principal business lines – investment banking, investment management, and Huajing Securities, the onshore securities platform.

Bao said investment management and wealth management will be the two main focus areas for the bank. Going forward, the firm plans to increase investments in emerging technologies, particularly AI, biotech, internet of things, and blockchain.

The bank is currently raising funds for its second private equity fund focused on health care, which will be “significantly larger” than the first fund’s 1.1 billion yuan (US$160 million). But he declined to reveal the exact size.

“Health care has big potential, ” he added.

It also wants to expand its product portfolio from advisory services to credit products, such as leveraged loans.

Other than that, it will continue to expand globally, including in the US, Hong Kong, and Southeast Asia.

“The US-China trade war does not affect our expansion plan,” he said.

Currently, it employs a team of close to 30 in the US, offering investment banking and sales and trading services for institutional clients, a big part of which are Chinese investors who want to trade American depositary receipts.