Chinese investments in the US shrink 92 per cent as deals come under greater scrutiny amid trade war

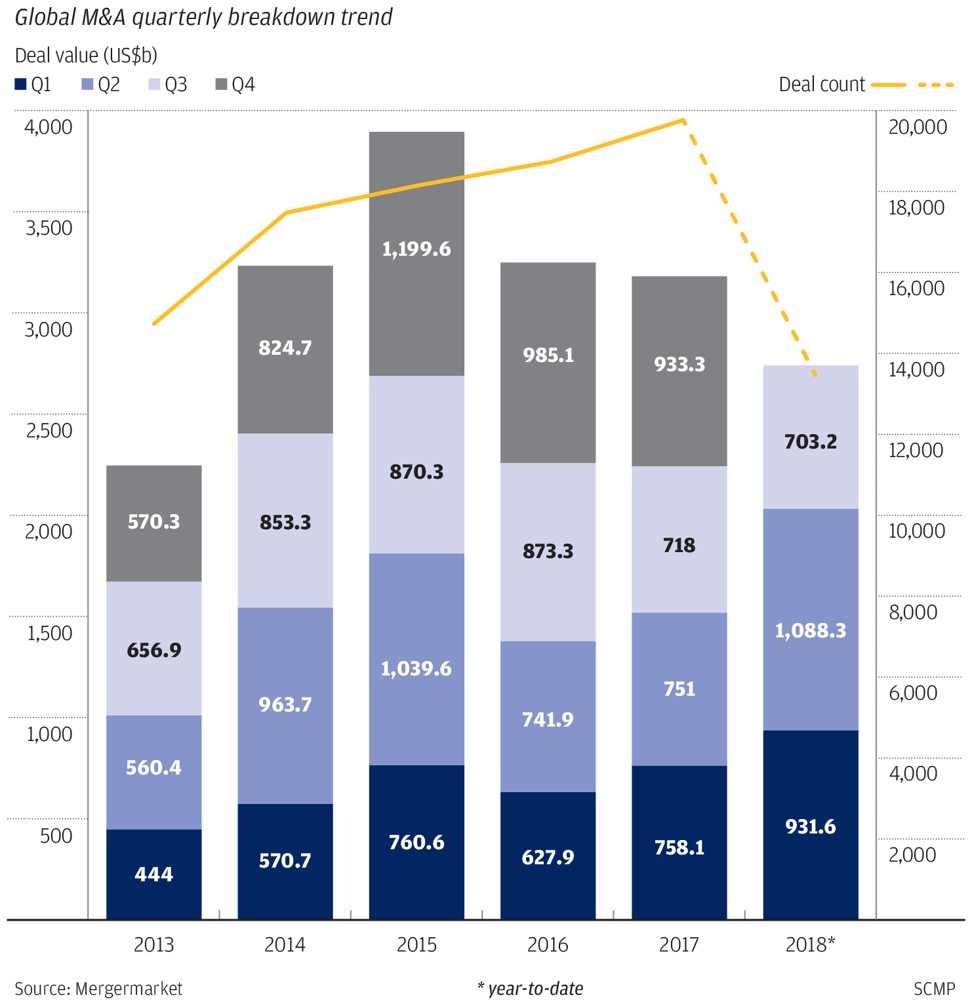

Global M&A activity also hits the lowest level for any single third quarter since 2013

Chinese investments in the US plummeted 92 per cent in the first nine months of 2018 from its peak two years ago, as the escalating trade war and Washington’s intensifying scrutiny of tech investments significantly dampened deal making activity, according to data from Mergermarket on Wednesday.

Chinese M&A in the US reached US$2.67 billion for the first three quarters of this year compared to the all-time high of US$34.4 billion in the same period of 2016. It also reflected a year-on-year drop of 55 per cent from US$5.9 billion achieved in 2017.

“China’s economy is slowing, its currency weakening, and the trade regime is faltering,” said Brock Silvers, managing director at Shanghai-based Kaiyuan Capital, explaining the reasons for the decline in Chinese investments. “This doesn’t indicate a broad foundation for aggressive international expansion. Beijing has also made it difficult to finance offshore deals.”

The funding channels formerly used by giants such as HNA or Anbang are no longer viable.

He added that the US has also adopted a policy of tougher regulatory measures for Chinese acquisitions, while Beijing seems to be encouraging top conglomerates to focus more on domestic investment.

“Given these factors, it’s not surprising that Chinese deal makers are putting less capital to work in the US, and this probably won’t change until we see an agreement on trade.”

This year has already seen several high-profile Chinese acquisition deals collapse because of the heightened US scrutiny.

The US$1.2 billion acquisition of US money transfer firm MoneyGram by Ant Financial, an online payment affiliate of Alibaba Group Holding, fell apart in January after a US government panel rejected it over national security concerns.

It was followed by Sino IC Capital’s failed merger with semiconductor maker Xcerra, and HNA Group’s unsuccessful bid to buy former White House aide Anthony Scaramucci’s SkyBridge Capital.

“With Trump’s controversial trade policies and Chinese government’s capital outflow curb continuing to cast a shadow on the relationship between the two powerhouses, Chinese dealmakers’ interest in the US continued to fall,” said Melissa Yan, research analyst at Mergermarket.

Jasmine Wu, research editor for Asia at the data provider, added that China’s inbound M&As have also been affected, as total deal value dropped by more than 20 per cent quarter on quarter in the three months to September.

Wu expected deal making activity may be further affected because of the trade war.

While Chinese interest in the US continued to fall, Canada has become a key target for energy assets, data from Mergermarket showed.

During the first nine months, there were eight Chinese acquisitions in Canada’s energy sector worth US$2.2 billion, a six fold increase from the US$390 million in the first three quarters of 2017.

The escalating US-China trade war is also taking a toll on global M&A activity, as the total deal value plunged to the lowest third-quarter level in five years.

About US$703 billion worth of deals were concluded in the July to September period, the lowest figure for any single third quarter since 2013. It was down 35 per cent from the second quarter’s US$1.09 trillion.

During the third quarter, the number of big deals dropped significantly. Only four deals worth more than US$10 billion took place over the past three months, after 28 such deals were reached in the first half.

“The third quarter saw subdued M&A activity as growing geopolitical tensions, trade wars and protectionism all dampened spirits and caused corporates to pause over the summer,” said Jonathan Klonowski, an analyst for Europe, the Middle East and Africa at Mergermarket.

Tariffs introduced by the US and China crept further into deal making considerations, and advisers had to contend with much harsher conditions.

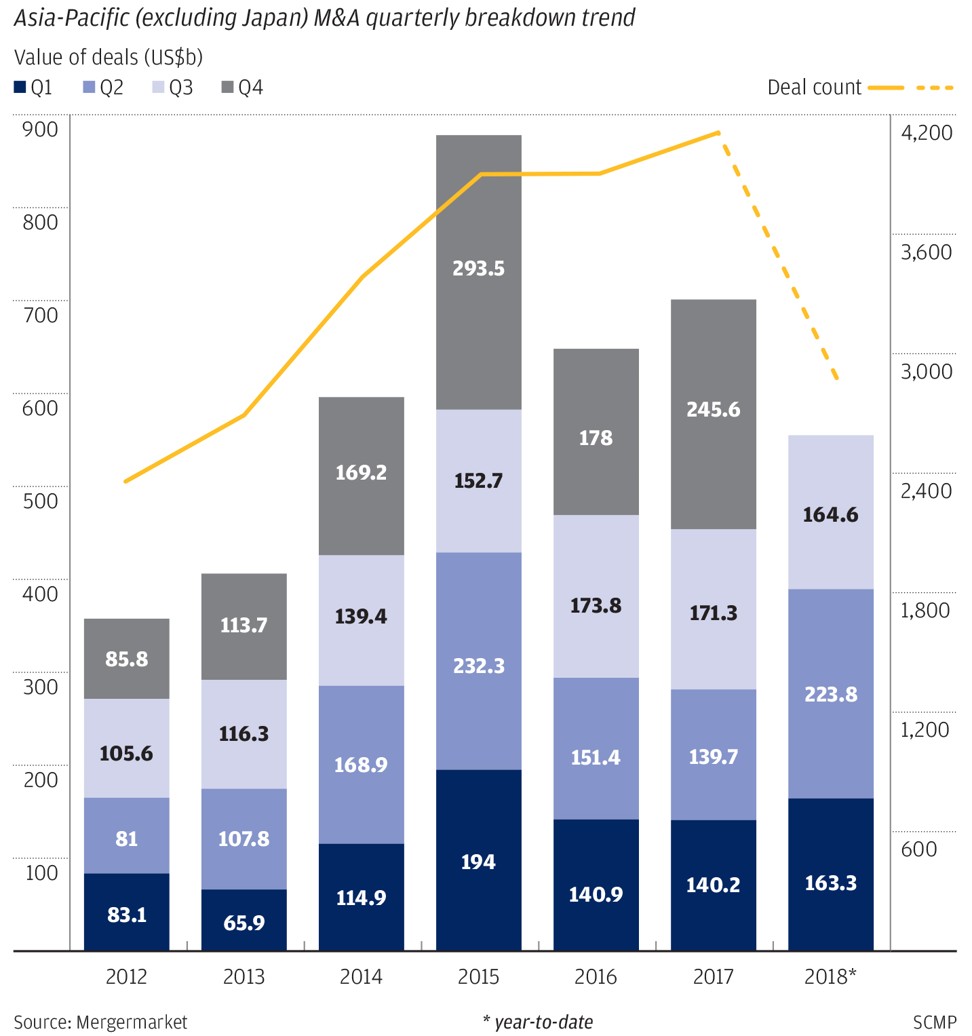

By region, M&A in Asia-Pacific, excluding Japan, experienced a significant downturn. Deal value decreased 26 per cent quarter on quarter to US$164.6 billion over the past three months.

Nonetheless, the US still saw a very active M&A market in the third quarter.

Both deal value and count reached the second-highest on record, with US$1.1 trillion and 4,100 transactions tallied.

This was mainly because of several high-profile deals, including Broadcom’s US$18 billion acquisition of B2B software firm CA Technologies, Brookfield Asset Management’s US$9.5 billion purchase of Forest City Realty Trust, and Renesas Electronics’ takeover of Integrated Device Technology for US$7 billion.

Analysts said with macro concerns escalating, companies around the globe have been considering more domestic consolidation than cross-border deals, as the former receives much lower levels of scrutiny.

Consequently, domestic M&As surged to a record high for the first nine months of 2018, reaching US$1.67 trillion in value, up 31 per cent year on year.

Cross-border deals, meanwhile, saw their share of global M&As shrink to 38.6 per cent, 4 percentage points lower than the same period last year.