Why this Hong Kong tycoon’s family backed biotech firm ditches the city for Nasdaq listing

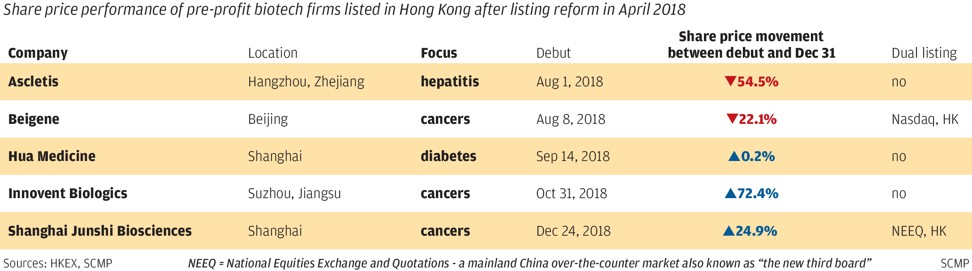

- Investment sentiment has soured for Hong Kong-traded pharma and biotech stocks on China’s drug price reforms

- Hang Seng Index has lost 13.6 per cent in 2018 versus Nasdaq’s 3.9 per cent drop

Stealth BioTherapeutics, a US-based mitochondrial diseases drug developer backed by Hong Kong property developer Hang Lung Group’s Chan family, has ditched its listing plan in the city for a flotation in the disclosure-based Nasdaq market that has fewer time-consuming approval hurdles.

The move comes after a sharp correction of pharmaceutical and biotechnology stocks in Hong Kong triggered by price cuts of major drugs in China brought about by reforms.

The soured investor sentiment for such stocks is a blow to Hong Kong Exchanges and Clearing chief executive Charles Li Xiaojia’s goal of overtaking Nasdaq on the number of listings of mainland Chinese biotech firms and their market capitalisation by April 2023, five years after reform allowed unprofitable biotech firms to list in Hong Kong.

Stealth, based near Boston, Massachusetts, aims to raise US$86.25 million in an initial public offering on the Nasdaq, according to its filing made last Friday and posted on US bourse’s website on Monday.

Its six-month validity of a Hong Kong listing application filing posted on July 3, 2018 on the Hong Kong stock exchange’s website lapsed and was moved to the “inactive” category on Monday.

The 12 year-old company had intended to raise US$200 million in the Hong Kong IPO, according to a May 2018 Bloomberg report citing unnamed sources.

“It is our policy to not comment on matters related to financing,” a spokeswoman for Stealth told the Post when asked if the Nasdaq filing meant it was abandoning a Hong Kong listing.

Stealth develops new therapies to treat rare genetic and common age-related defects in mitochondria, which are energy “factories” inside almost all cells in the body.

Age-related mitochondrial diseases are often manifested in Alzheimer’s, Parkinson’s, glaucoma, diabetes, skeletal muscle dysfunction, kidney and heart diseases.

Stealth’s most advanced product under development is targeted at primary mitochondrial myopathy, on which it has been conducting a phase-three clinical trial, the last phase before commercialisation.

Patients suffer from debilitating skeletal muscle weakness, which afflicts some 70,000 people in the US, according to Stealth’s website.

No therapies have thus far been approved by the US Food and Drug Administration. Stealth has received “fast track and orphan drug” treatment from the FDA as incentives to enhance its efforts to bring one of its therapies into market.

Stealth recorded accumulated losses of US$274 million by the end of March 2018, according to its preliminary listing prospectus filed in Hong Kong in July 2018, in which it said it needed “substantial additional funding”.

By the end of March 2018, it had raised US$307.6 million from shares issuances and US$20 million from debt instruments.

In June 2018, it raised US$100 million from two convertible note issuances led by Pivotal Beta of Nan Fung Technology, a unit of Hong Kong property conglomerate Nan Fung Group.

Lewis Ho, a Hong Kong-based lawyer at international law firm Loeb & Loeb who advises pharmaceutical and biotech firms on transactions, said the sector’s sharp stock price correction in recent months had slowed the progress of some biotech listings in Hong Kong.

The downtrend was spurred by generic drug pricing reform that saw steep price falls after bulk tender and open bidding were implemented.

“As a result, some candidates face a lapse in the six-month validity of their accounting track record filed with the stock exchange, which means they have to file updates and applications for extensions,” he said.

“Another reason some may also need an extension is the longer-than-expected time it takes to clear queries posted by the IPO vetting officials of the stock exchange and the Securities and Futures Commission … in extreme cases, this could take one to two years which meant hefty professional fees for the candidate.”

While uncommon, Ho said some companies opted for the Nasdaq after a long wait in Hong Kong, as US exchange’s disclosure-based IPO system could allow for a faster application process, against the city’s lengthier pre-listing vetting procedure to uphold investor protection responsibility.

The Chans invested in Stealth via Morningside Venture I Investments owned by a family trust.

Meanwhile, another company backed by the family, a San Francisco and Shanghai-based antibiotics developer against “superbug” infections, MicuRx Pharmaceuticals updated its financial data and extended its Hong Kong listing application filed in July 2018 on Monday.

Last year, the city’s benchmark Hang Seng Index posted a bigger 13.6 per cent drop compared with the Nasdaq’s 3.9 per cent decline.

Heading for a Nasdaq listing as well is seven-year old Hong Kong-based online brokerage Futu Holdings, according to its filing made last Friday, with a target to raise US$300 million.

The city’s fourth largest online retail brokerage by revenue according to consultancy Oliver Wyman had just over 124,000 registered users with assets in their trading accounts. It brokered HK$678 billion of trades for the first nine months of 2018.