Li Ka-shing’s empire, Wharf play an outsize role at Hong Kong’s container port

- Hong Kong’s biggest landowner and the city’s richest man behind some of the biggest port operators in the city

- The city’s competition commission is investigating an alliance between four of those operators

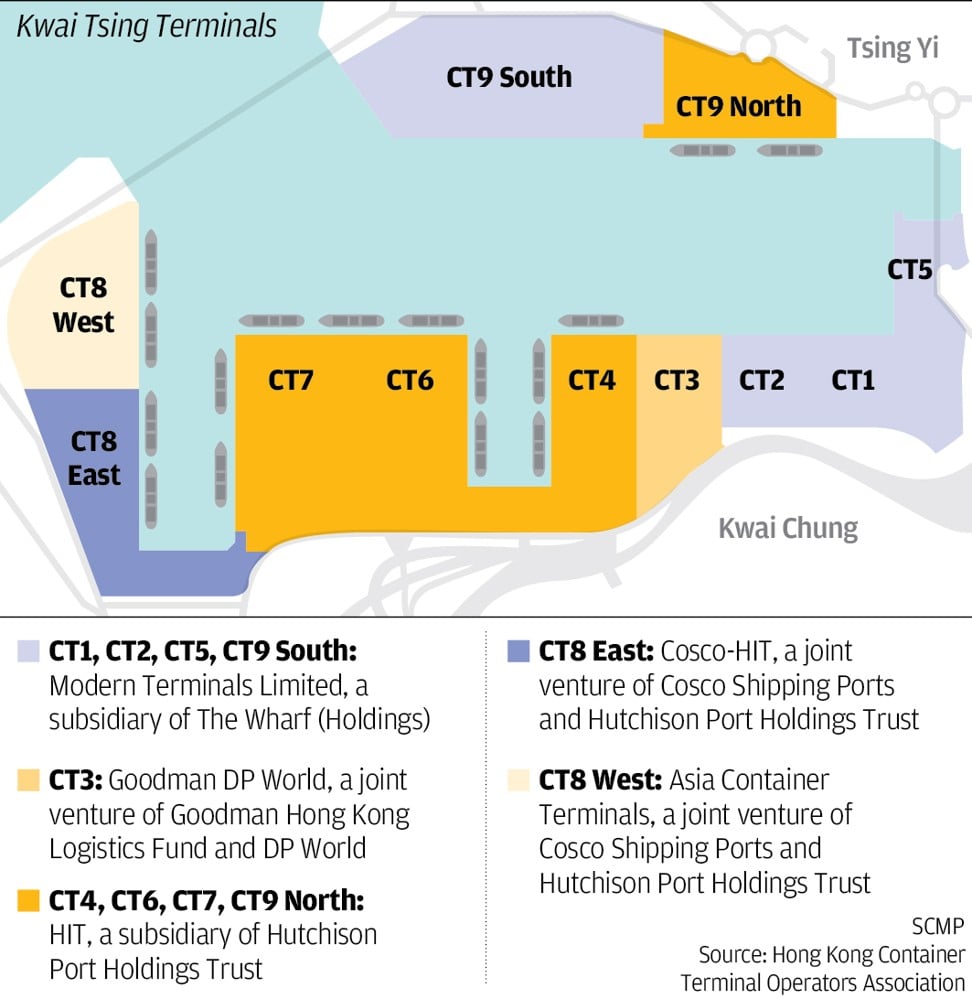

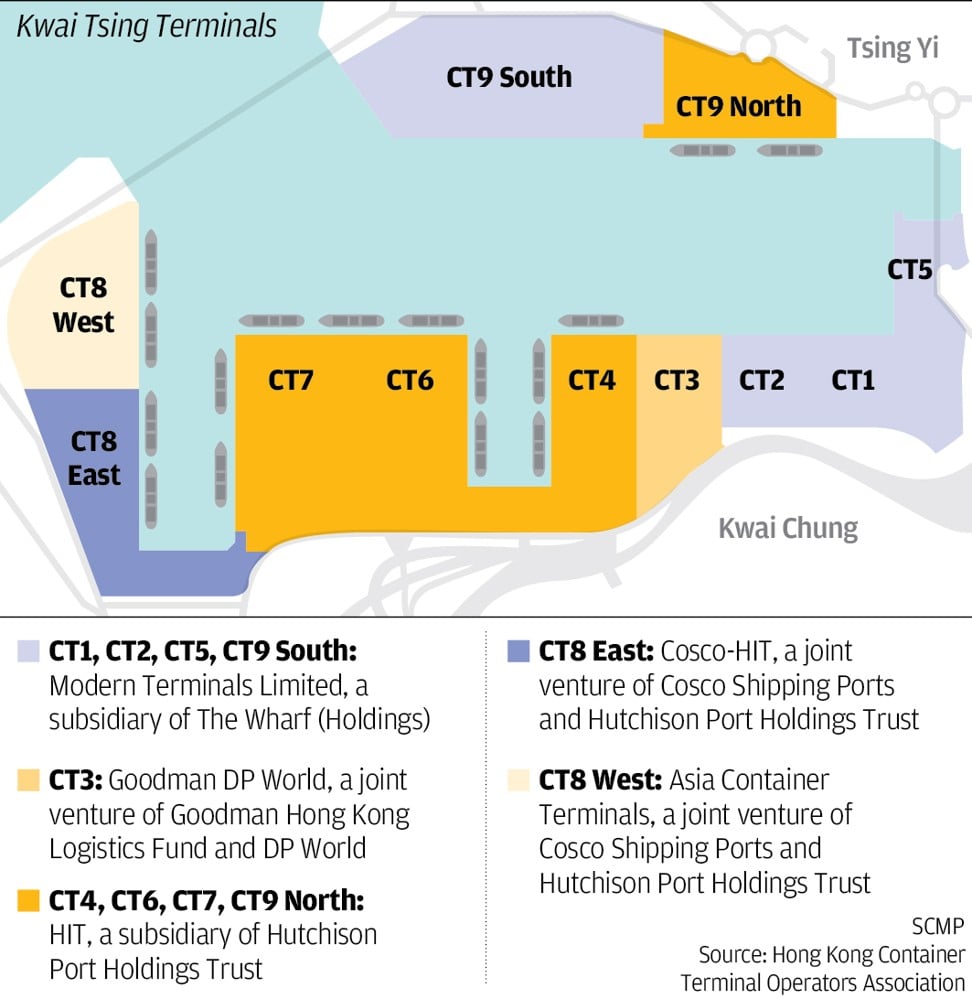

The Kwai Tsing Container Terminal in Kowloon is effectively controlled by five companies and responsible for roughly 80 per cent of the container traffic that enters Hong Kong each year.

In its announcement on Tuesday, Cosco Shipping Ports said the Hong Kong Seaport Alliance would allow the companies to operate their facilities in Hong Kong in a “more cost effective and efficient manner,” particularly in light of strategic alliances that have been formed between some of the world’s largest shippers in recent years and the use of ever larger container ships.

Goodman DP World, a joint venture of Goodman Hong Kong Logistics Fund and the Dubai-based port operating giant DP World, was the only operator not to join the alliance. It controls one berth, but also has the largest warehouse storage area on site, accounting for 620,000 sq m.

The container terminal has the capacity to handle the equivalent of 21 million twenty-foot shipping containers a year. It handled the 16.2 million twenty-foot equivalent units (TEU) in 2017, according to the Hong Kong Container Terminal Operators Association.

The largest number of berths – 12 in total – and more than 377,000 sq m of warehouse space is controlled by a unit of Hongkong International Terminals (HIT), a subsidiary of Singapore-listed Hutchison Port Holdings Trust.

Hutchison Port Holdings Trust is part of the CK Hutchison Holdings, the conglomerate formerly controlled by Li Ka-shing, Hong Kong’s richest man. Li Ka-shing retired last year at age 89 and handed over the reins to his oldest son, Victor Li Tzar-kuoi.

The CK Hutchison empire includes the drug stores Watsons and Superdrug, the ParknShop and Fusion by ParknShop grocery stores, the Fortress electronics chain and the mobile phone provider 3.

HIT also is part of two joint ventures with Cosco Shipping Ports, a Hong Kong-listed arm of China’s Cosco Shipping Holdings, that control another four terminals at the port. Those joint ventures are Cosco-HIT and Asia Container Terminals.

In addition to its Hong Kong holdings, Hutchison Port Holdings Trust also holds ownership stakes in container terminals in Shenzhen and Huizhou in Guangdong province.

Hutchison Port Holdings Trust said that its revenue declined 6.1 per cent in the first nine months of 2018 to HK$3.03 billion (US$386 million). Its profit declined 5.6 per cent to HK$640.4 million in the first nine months of the year, down from HK$678.5 million in the year-earlier period.

The company said its combined container throughput at the Kwai Tsing terminal was down by 8 per cent as compared with the same period in 2017.

Modern Terminals employed about 930 people in Hong Kong last year and handled the equivalent of 2.6 million TEUs in the first half of 2018, down 2 per cent from 2017.

It accounted for about 40 per cent of the market share at the Kwai Tsing terminal in the first half of 2018, according to Wharf.

In addition to its berths at the Kwai Tsing terminal, Modern Terminals holds a majority stake in the DaChan Bay Terminals in the Pearl River Delta, as well as equity stakes in the Shekou Container Terminals and Chiwan Container Terminal in the Greater Bay Area.

It reported consolidated revenue of HK$1.25 million in the first six months of 2018. The company’s operating profit fell by 31 per cent to HK$242 million in the first half of 2018, down from HK$349 million.

Hong Kong Air Cargo Terminals, the operator of the air cargo terminal at Hong Kong International Airport, also is a 20.8 per cent associate of the group.