Cigna makes a beeline for Greater Bay Area’s growth opportunity with its online insurance partner OneDegree

- Cigna sells its insurance policies in Hong Kong through the online platform of OneDegree

- The Greater Bay Area’s combined economic output of US$1.5 trillion in 2017 may more than double to between US$3.2 trillion and US$4.1 trillion by 2030, according to an estimate by Morgan Stanley

Cigna, the American insurance giant, said it is considering a push into the Greater Bay Area, where the estimated population of 70 million people across 11 cities could be a bonanza for the insurance products sold through its digital insurance partner OneDegree.

The US company, which already sells medical insurance products in Hong Kong through OneDegree’s platform, is poised to expand into mainland China when the Greater Bay Area formally allows cross-border medical and motor insurance products.

“It is definitely very positive to see China opening up the Greater Bay Area,” said Cigna Worldwide Life Insurance Company’s chief executive Yuman Chan, in an interview with South China Morning Post. “We will be exploring the opportunities after the authorities clarifies the details of the regulation.”

Insurance has turned out to be one of the biggest winners in China’s latest attempt at economic liberalisation, especially after last week’s announcement that Hong Kong-based insurers would be allowed to develop health care and motor insurance policies for sell in the 11 cities in southern China’s Greater Bay Area.

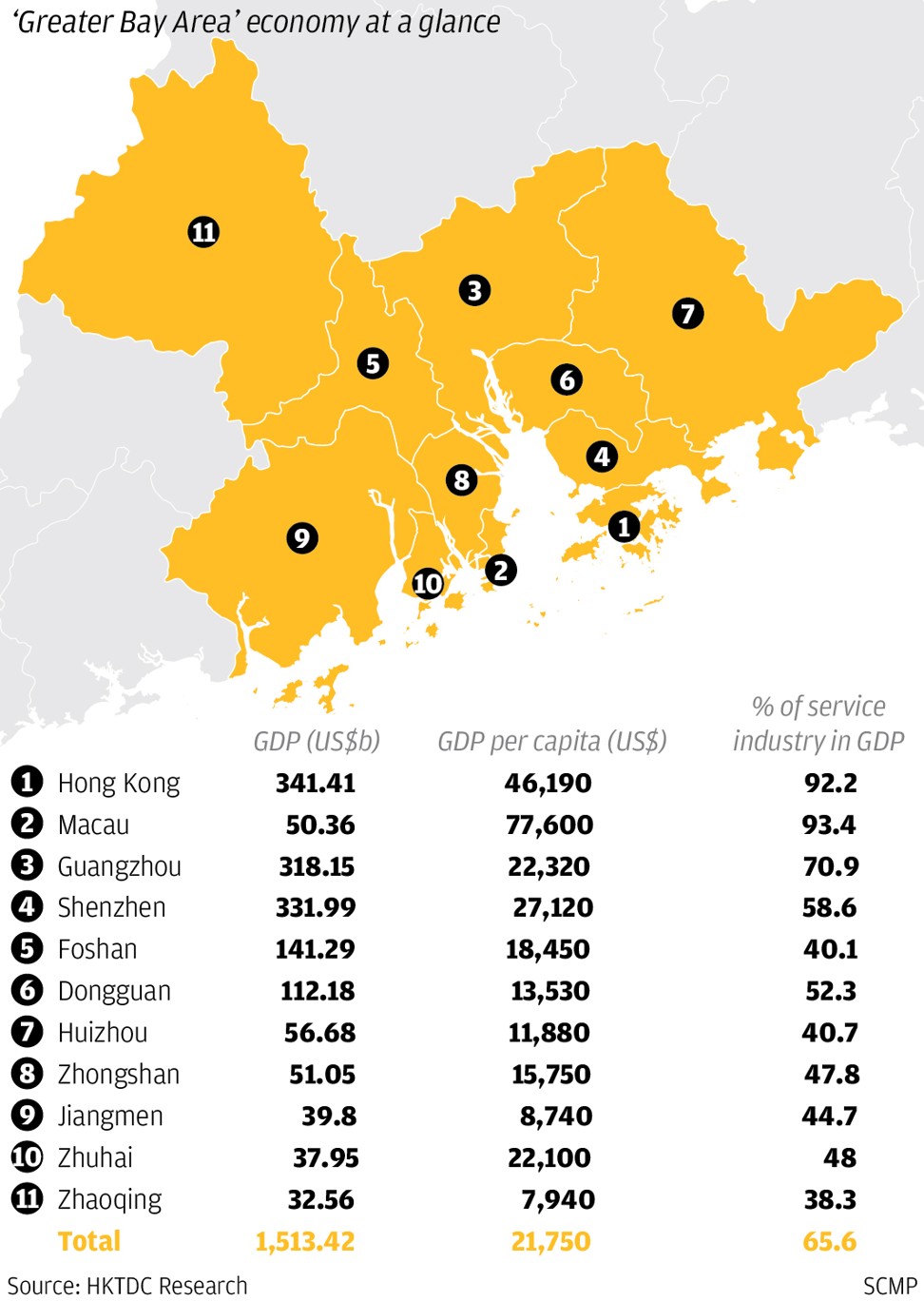

The region refers to the Chinese government's plan to link Hong Kong and Macau with Guangzhou, Shenzhen, Zhuhai, Foshan, Zhongshan, Dongguan, Huizhou, Jiangmen and Zhaoqing in an integrated economic and business hub.

The region, with a combined economic output of US$1.5 trillion in 2017, could more than double in size to between US$3.2 trillion and US$4.1 trillion by 2030, bigger than Britain’s economy, according to an estimate by Morgan Stanley’s chief China economist Robin Xing.

Cigna, headquartered in Bloomfield, Connecticut, has a venture with China Merchants Bank called Cigna-CMB since 2003. The company will consider sell its insurance products in Greater Bay Area in future including an option to sell through the OneDegree platform.

“We believe in partnership as the most cost-effective way to expand,” Chan said.

Cigna now uses insurance brokers, telephone sales and OneDegree’s platform to sell its medical insurance policies in Hong Kong. The Hong Kong government’s voluntary medical that kicks off in April, which offers up to HK$8,000 in tax incentives to encourage people to be insured, will boost demand for health care policies, amid a heightened awareness and consciousness about health coverage, he said.

Hong Kong’s medical insurance is a rising pie, with the net premium of health and accident insurance rising 11.5 per cent in the first nine months of 2018 to HK$10.7 billion, according to the Insurance Authority’s data.

The OneDegree platform works as an online agent for Cigna to sell its products, while also providing online insurance claims without the need for any paperwork. The company is also applying for a digital general insurance license in Hong Kong to provide coverage for pets.

“After we are licensed by the Insurance Authority, we will cross-sell our products with Cigna,” said OneDegree’s co-founder and chief insurance officer Alex Leung Te-yuan. “Some customers who buy policies from Cigna may also consider our policies for their dogs or cats.”