Hong Kong set to lose IPO crown to Nasdaq, thanks to ride-hailing app Lyft

- Nasdaq is poised to become the leading IPO market worldwide in the first quarter

- The New York Stock Exchange could emerge as the world’s top market for listings later this year with an expected debut by Uber Technologies

- Cryptocurrency play Bitmain cancels share sale in Hong Kong amid lay-offs and leadership reshuffle

Nasdaq is set to dethrone Hong Kong as the world’s No 1 market for initial public offerings, thanks to Thursday’s US$2.4 billion listing of ride-hailing firm Lyft, just as the world’s biggest maker of bitcoin mining rigs, Bitmain Technologies, called off its application to list in the city on Tuesday.

Lyft, the second-largest ride-hailing company in the United States, would bring total funds raised through new share listings this year on the New York bourse to US$4.1 billion.

The firm could have a valuation of up to US$23.3 billion if its shares are priced at the top end of an indicated range, making it one of the largest US tech offerings in terms of valuation, according to Dealogic.

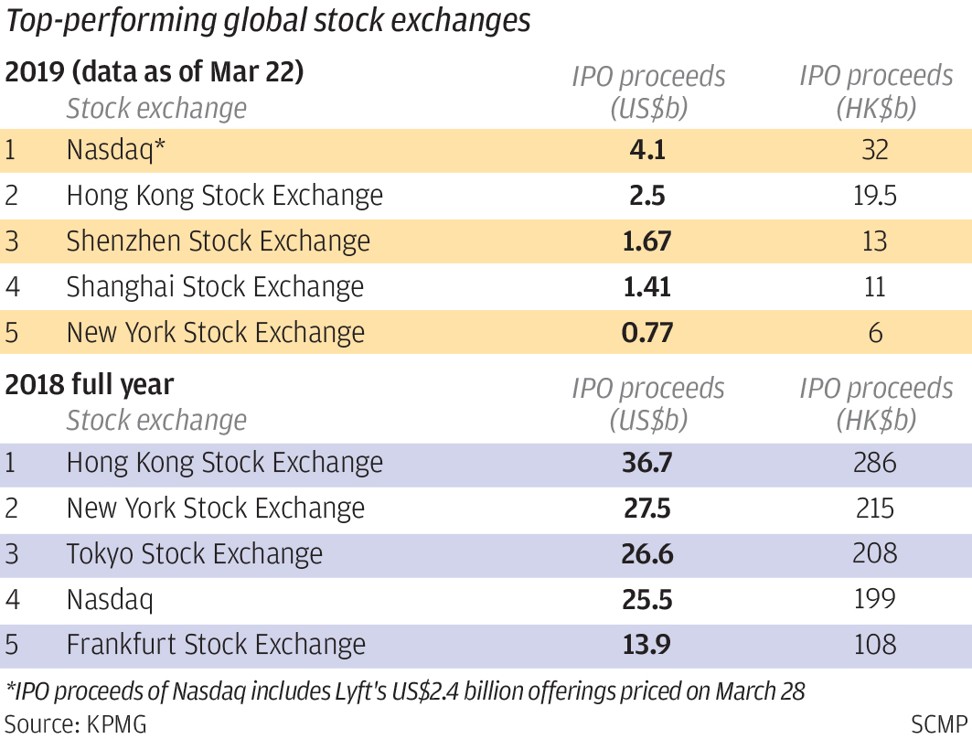

In comparison, Hong Kong‘s main board has raised the equivalent of US$2.5 billion in new listings, while the Shenzhen Stock Exchange took in US$1.67 billion and the Shanghai Stock Exchange US$1.41 billion, according to KPMG. Meanwhile, the New York Stock Exchange has seen US$770 million worth of listings this year.

Still, the New York exchange could emerge as the world’s top market for listings later this year when Uber Technologies, the largest ride-hailing company in the US, is expected to debut with a valuation as high as US$120 billion.

Hong Kong’s stock exchange could get a similar boost if the mainland’s ride-hailing company, Didi Chuxing, proceeds with a listing, as some observers expect.

“Didi is a big Chinese unicorn. Hong Kong has traditionally been a fundraising hub for Chinese companies. If we can get the company to list here, HKEX could compete with the US and Shanghai,” said Louis Tse Ming-kwong, managing director at Hong Kong-based VC Wealth Management.

Didi, which could have a valuation of US$70 billion to US$80 billion, last year delayed its listing plan in Hong Kong after the company temporarily suspended its late night services to overhaul its safety practises following two murders by two drivers.

KPMG said it was generally upbeat on Hong Kong’s listing outlook this year, noting there were 148 applicants as of mid-March, compared with 81 a year ago.

“We are positive towards the outlook of the Hong Kong IPO market in light of the strong pipeline of IPO applicants and the initiatives introduced by the HKEX,” said Paul Lau, partner and head of capital markets of KPMG China.

“The new listing regime launched in 2018 attracted a good quantum of new economy companies considering an IPO in Hong Kong and the momentum sustained through 2019. We are also seeing an increasing level of interest from established international firms looking into a listing in Hong Kong, which is anticipated to be another key market driver,” Lau said.

In April, HKEX unveiled its biggest listing reform for 25 years with the aim of turning the city’s stock exchange into a listing hub for technology and biotechnology companies.

The reforms helped to attract listing debuts by smartphone maker Xiaomi Corporation and food delivery company Meituan Dianping, lifting Hong Kong’s stock market into the No 1 spot worldwide in terms of funds raised.

For the first quarter, funds raised at IPO in Shanghai and Shenzhen totalled 27.4 billion yuan (US$4 billion), a drop of 31 per cent from a year earlier, according to KPMG.

In Hong Kong, five of the top 10 largest IPOs during the first quarter were new economy companies, including two pre-revenue biotech firms, according to the consultancy.

KPMG said IPO activity in Shanghai should rebound around mid year with the launch of the new tech board.

However, at Bitmain, the listing cancellation came as the firm struggled through mass lay-offs and a leadership reshuffle amid a prolonged bear market in the once-hot cryptocurrency sector.

In a statement, the Beijing-based company said its listing application filed in Hong Kong on September 26 had expired. “We will restart the listing application work at an appropriate time in the future,” the statement said.

It had been hoped the five-year-old firm would raise billions of US dollars, but prices fell 70 per cent and cryptocurrencies lost US$500 billion in value in a year.

Meanwhile, co-founders Wu Jihan and Micree Zhan Ketuan have stepped down as co-chief executives, replaced by Wang Haihao, a chip designer.

Additional reporting by Huang Zheping