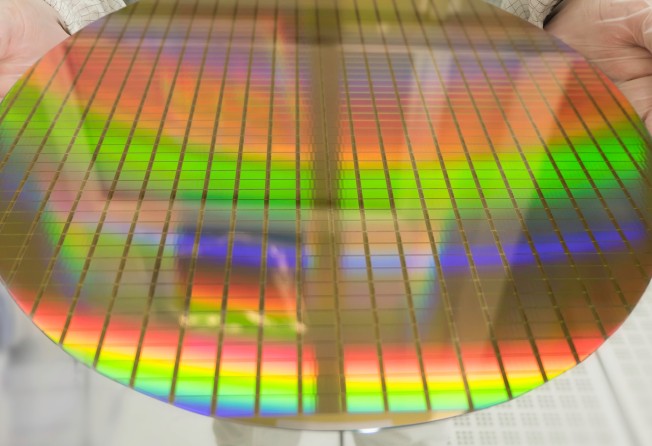

China’s e-commerce start-ups lose favour with private equity funds as Beijing-backed chip makers steal their thunder, study finds

- The number of private equity funds targeting China’s e-commerce and internet businesses has fallen dramatically, according to a Bain & Co survey

E-commerce and internet-related companies have lost their lustre with private equity (PE) funds as Beijing’s support for chip makers and high-end equipment businesses, considered the backbone of the country’s manufacturing sector, have made them more appealing to investors, according to Bain & Co.

A survey carried out by the global consultancy found that only 15 per cent of private equity funds focusing on China picked online retail and internet businesses among their top three investment choices for 2019. Across the Asia-Pacific region, that number rose to 29 per cent.

Last year, about half of the US$94 billion in PE investment in China was derived from the sector, Bain said.

“PE investors are shifting their focus from the internet to consumer-related businesses, pharmaceutical companies and those players dealing with high technologies such as machinery manufacturing and chip making,” said Zhou Hao, a partner at Bain. “Internet business has been growing at a rapid pace in China for a while and the growth will slow down.”

The findings by Bain came ahead of the launch of China’s eagerly-awaited Technology Innovation Board, via which Beijing hopes to grant funding access to the country’s most promising start-ups.

As of last week, 90 companies had applied for initial public offering (IPO) on the new Nasdaq-style board at the Shanghai Stock Exchange. They are mainly engaged in basic science, chip making, computing, robotics, new material and life science, with no e-commerce or internet firms in the running.

“If the technology innovation board sees lofty valuations, those sectors will attract even bigger capital influx from PE funds,” said Kelly Pu, another Bain partner.

Beijing hopes the creation of the new technology board – expected to debut in the middle of this year – will eventually lead to the birth of the country’s own global tech powerhouse in the mould of Apple or Microsoft.

The establishment of the board, initiated by President Xi Jinping in November, is touted as a drastic reform of the mainland’s stock market, since it will allow unprofitable companies and pre-revenue biotech firms to raise funds on the Shanghai exchange for the first time.

Only those firms that have passed through the regulator’s pre-assessment are eligible to submit IPO documents.

The Shanghai exchange began accepting listing applications in late March, and the 90 applicants so far are a reflection of Beijing’s determination to buoy firms whose core technologies can enhance China’s innovative capabilities and manufacturing might.

Beijing wants to give those companies easier access to funding and has encouraged local governments to support them through land distribution and tax incentives to help them grow fast.

Giant e-commerce and online service providers including Alibaba, owner of the South China Morning Post, and food delivery service Meituan-Dianping have played a dominant role in the country’s digital realm, with the increasing penetration of mobile phones redrawing the commercial landscape and changing people’s shopping habits.

“China is already the global leader in e-commerce and mobile payment,” said Yin Ran, a Shanghai-based angel investor. “It is not unusual for the government and PE investors to set their eyes on chip making and computer sciences because it’s the firms in those fields that can further drive digitalisation in the country.”