SK Innovation to invest US$490 million to build a second assembly in China to supply batteries for electric vehicles

- SK Innovation said it plans to invest 579.9 billion won (US$488.30) million to build its second factory in China to supply batteries for EVs

- The company did not elaborate on its Chinese partner, the site or the capacity for the proposed plant

South Korea’s SK Innovation said on Wednesday that it plans to invest 579.9 billion won (US$488.30 million) to build its second China factory for electric vehicle batteries, in a bet that China will open up its market to Korean battery makers.

The latecomer to the battery market is aggressively expanding its production capacity globally, starting to build new factories in Hungary, China and the United States since last year with a total investment of 5 trillion won.

SK Innovation said its second China factory aims to meet rising orders for EV batteries globally, without elaborating on its Chinese partner, the site and capacity of the proposed plant.

Shares of SK Innovation, South Korea’s biggest oil refiner, rose 2.7 per cent in Wednesday morning trade, in a wider market that was up 0.1 per cent.

Reuters reported last month that SK Innovation was in talks to set up separate battery-making joint ventures with Chinese partners and Volkswagen, citing the president of the Korean company’s battery business.

Currently, vehicles equipped with South Korean batteries are not eligible for government subsidies in China, the biggest auto and EV market in the world.

But Korean battery makers including LG Chem have in recent months announced investment plans to expand capacity in China, hoping that China’s plan to phase out subsidies by 2020 would create a level playing ground.

SK Innovation broke ground in August on its first Chinese plant under a joint venture with Beijing Electronics Holding and BAIC Motor Corp, with investment set to reach 5 billion yuan (US$744.30 million) by 2020.

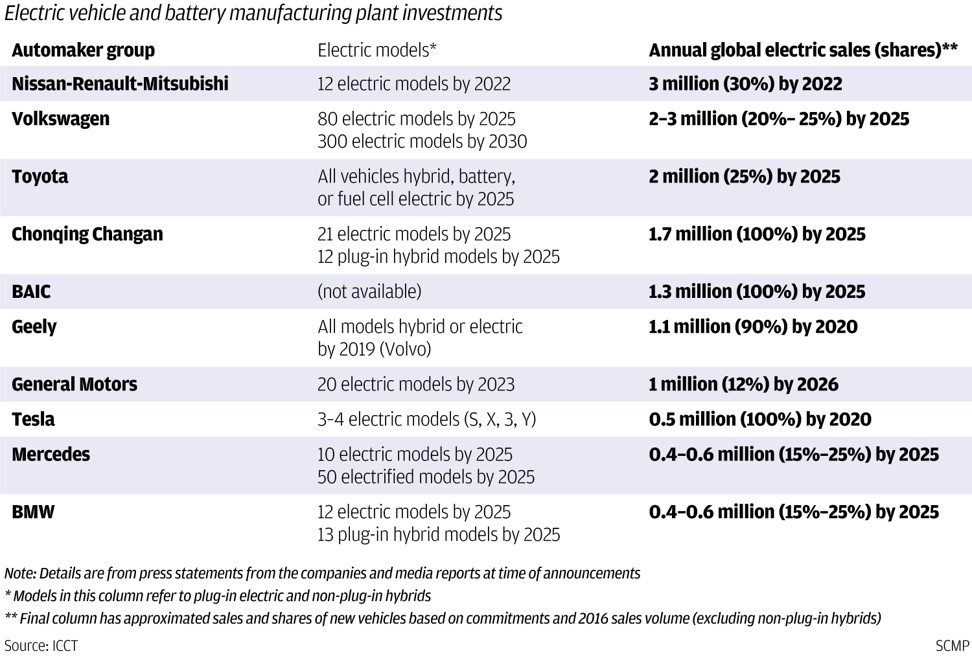

Carmakers are under pressure to deliver EVs as China set quotas for sales of new energy vehicles (NEVs). China wants NEVs - which also include hybrids, plug-in hybrids and hydrogen fuel cell vehicles - to account for a fifth of auto sales by 2025 compared with 5 per cent now.

SK Innovation’s customers include Germany’s Daimler AG and Volkswagen and South Korea’s Hyundai Motor

SK Innovation was sued in April by its bigger rival LG Chem in the United States for alleged theft of trade secrets. SK Innovation has denied the allegations.