Hong Kong exchange counts on confidential application process to attract secondary listings by publicly traded companies

- The confidential process will be kept under wraps to shield applicants’ existing shares from volatility and speculation, according to the exchange’s listing rules

- The duration of the confidentiality works on a case-by-case basis

Hong Kong’s stock exchange is counting on a confidential application process for companies that are already listed in New York or London to raise funds on its bourse, part of the process to sharpen the city’s edge in the race to be the global fundraising hub, market participants said.

Unlike initial public offering (IPOs) applications that are publicly disclosed, the confidential process will be kept under wraps to shield applicants’ existing shares from volatility and speculation, according to the exchange’s listing rules. The duration of the confidentiality works on a case-by-case basis depending on needs, according to financial officials familiar with the matter.

The process, part of last year’s listing reforms by the Hong Kong Exchanges and Clearing Limited (HKEX) and the local securities regulator, is among the incentives for attracting global listed companies to consider Hong Kong as an additional source of funds.

“Confidential filings are an important aspect, because these companies are already publicly listed, and they don’t want any potentially market-sensitive information to be in the public domain,” said Stephen Chan Yiu-kwong, a partner at the international law firm Dechert in Hong Kong.

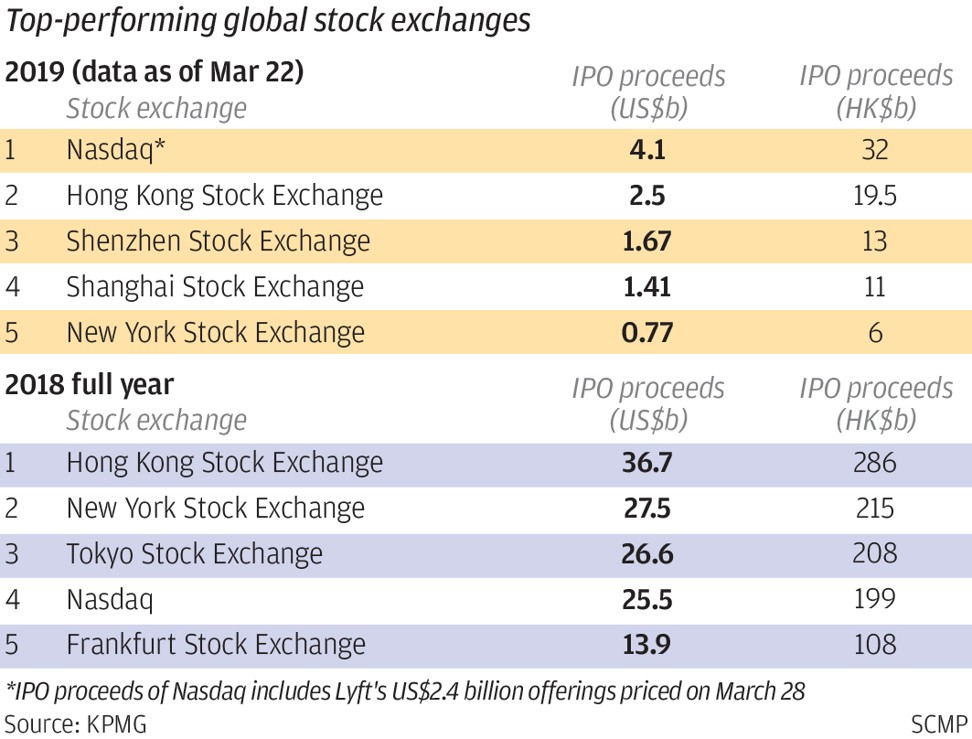

Hong Kong was the world’s number one destination for IPOs in six of the last 10 years, surpassing New York and Shanghai in the amount of funds raised locally. The competition is becoming particularly intense, as the mood in global capital markets soured after the US-China trade war spilled over into a stand-off over technology.

Secondary listings by New York or London-listed companies, especially Alibaba Group Holding, Baidu, JD.com or other Chinese technology giants, would be a shot in Hong Kong’s arm in the global race as the world’s preferred fundraising capital.

The process is part of the HKEX’s three-year strategic plan to develop the bourse, as it doubles down on its advantageous position as the offshore financial hub for the world’s second-biggest economy. The HKEX will widen several so-called Stock Connect schemes to let more capital flow into and out of the Shanghai and Shenzhen exchanges via Hong Kong, giving mainland Chinese investors access to US-listed companies through the city.

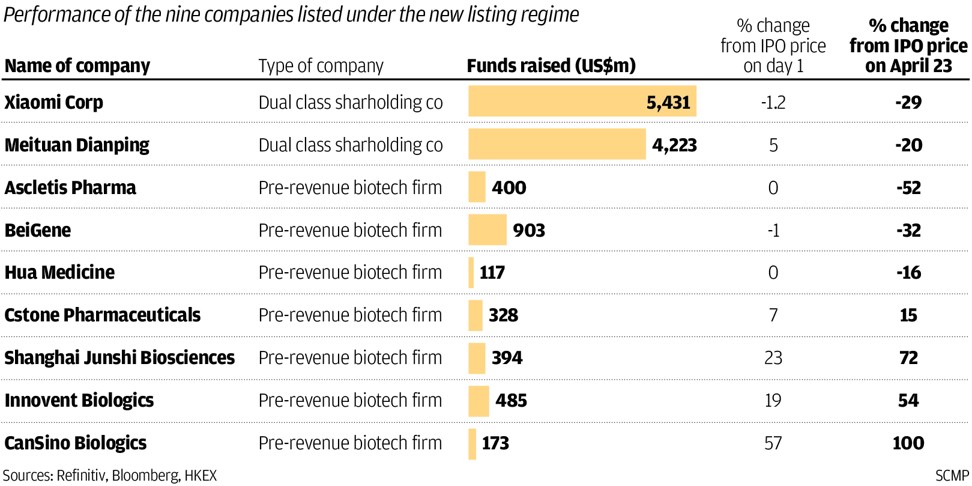

“We put more promotional efforts last year into attracting dual-class shareholding companies and biotechnology firms. We have seen a satisfactory number of new listings in these companies,” the HKEX chairwoman Laura Cha Shih May-lung said during a February press briefing. “This year, we will focus more to promote [HKEX] to enable overseas-listed technology companies to list in Hong Kong.”

The plan has been given the imprimatur by the China Securities Regulatory Commission (CSRC), where technology companies with multiple classes of shares such as smartphone market Xiaomi will be investible through the Connect channel in July, according to Hong Kong’s Secretary for Financial Services and the Treasury James Lau.

To qualify for a secondary listing in Hong Kong, an applicant needs no less than HK$40 billion (US$5 billion) in valuation, or a market capitalisation of HK$10 billion with HK$1 billion in annual revenue, according to the exchange’s rules.

In a secondary listing, the company is subject to the regulatory framework of the primary market where its shares are traded. Once the number of annually traded shares in Hong Kong exceeds 55 per cent of the company’s total shares turnover, the secondary listing is upgraded to become a dual listing. Then Hong Kong’s SFC regulations will also apply to the dual-listed company.

The confidential application can help promote more secondary listings in Hong Kong, said Johnny Lam, CPA Australia’s Greater China Councillor.

“This procedures can help attract big players to list here, which - [added to] other listing reform measures - can promote the status of Hong Kong as an international fund raising hub,” Lam said.

Alibaba, which owns South China Morning Post, dropped a Hong Kong listing in 2014 and chose New York as its destination to raise US$25 billion, which still holds the record as the world’s largest IPO. The Hangzhou-based company is in talks to raise up to US$20 billion in Hong Kong via a secondary listing, Bloomberg reported today, citing unidentified people familiar with the matter.

“We do not comment on market rumours,” Alibaba said in a statement. “We do not rule out any options on future listing. If we were to seek listing in Hong Kong, our decision would be based on a thorough review of all considerations that would be value enhancing for the company and our shareholders.”

Secondary listings by Chinese companies in Hong Kong come at a sensitive time in US-China ties, after US President Donald Trump ordered US technology companies to stop supplying their hardware, software and services to Chinese companies on national security grounds, seen as a thinly veiled assault on Huawei Technologies.

Semiconductor Manufacturing International Corporation (SMIC), the largest Chinese chip maker and a dual-listed stock in New York and Hong Kong, was the first to throw down the gauntlet. The Shanghai-based chip maker said last week it would delist its shares from New York, citing the lack of liquidity in US trading.

For its part, Alibaba’s choice of destination for a secondary listing “would never be impulsive and be hinged on US-China relation headline,” the company said.