China’s war chest of rare earth patents give an insight into total domination of the industry

- US lobbyists lament the lack of a governmental effort to cut reliance on Chinese supply of elements widely used in consumer electronics and military equipment

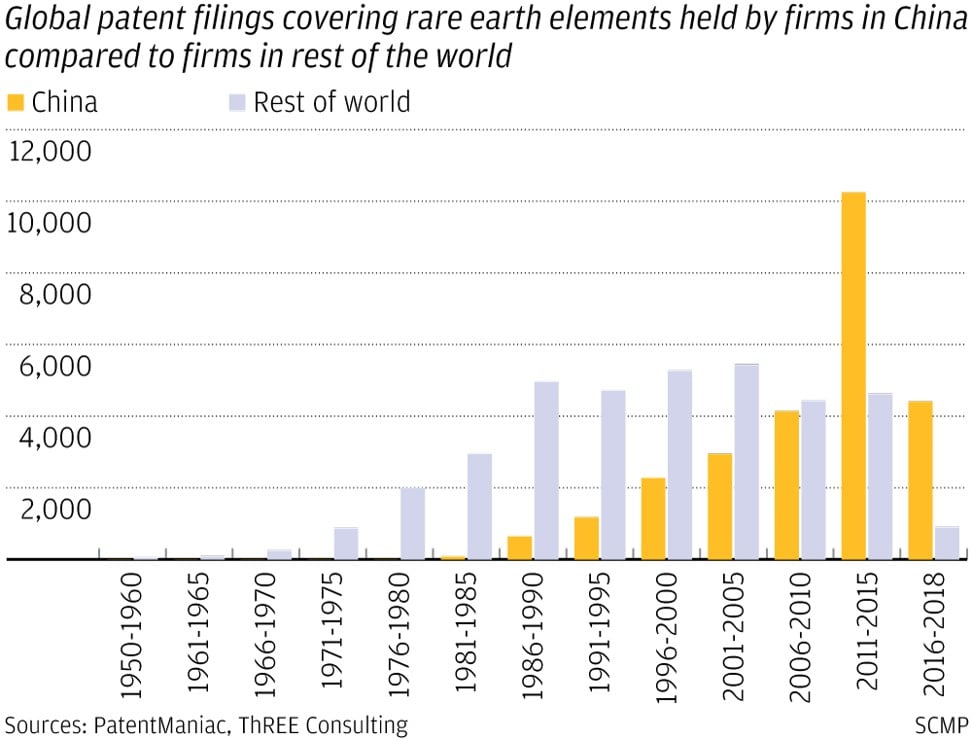

- China had filed for 25,911 rare earth patents compared to 9,810 from the US as of October last year

China is strengthening its grip on the rare earths supply chain and could use its dominant position as a bargaining chip in its trade war with the US.

China has been investing heavily on facilities to do the bulk of the dirty and environmentally damaging mining and ore processing work for the world, systematically turning its know-how and methodologies into patents that could give it a competitive edge against its rivals.

The country, which already supplies more than 80 per cent of the world’s rare earth metals, is rapidly amassing patents related to the elements, says James Kennedy, president of St Louis, Missouri, based ThREE Consulting, who last year initiated a global patent search to back up his lobbying effort to the US government.

As of October, China had filed for 25,911 patents on all the rare earth elements, far ahead of 9,810 by the US, 13,920 by Japan and 7,280 by the European Union since 1950 when the first US filing was made, based on data from Kennedy’s research supplier PatentManiac.

The number of Chinese patents filed on rare earths has jumped since 2011, accounting for more than half its accumulated total and more than double that of the rest of the world combined.

Five general patent data sources including Google Patent and World Intellectual Property Organisation as well as 47 country databases were used in the search.

“The reason I commissioned the work was to alert the US government [about] China’s relative investment and commitment to [the] material science, technology and mining industry of China,” Kennedy said. “Sadly there was literally no interest or response from anyone [in the US].

“I have repeatedly warned members of Congress, the Pentagon and the administration that China will use its war chest of patents and intellectual properties against the US in the future.”

Kennedy has long advocated that the US government build a full domestic supply chain for rare earth materials, through the creation of a federally sanctioned cooperative and a centralised rare earth refinery.

He is not alone in lobbying the US government to reduce reliance on a Chinese supply of 17 elements that are widely used in consumer electronic products such as televisions and DVD players, electric cars, wind turbines, medical and military equipment and oil refineries.

The Washington-based lobby group Strategic Materials Advisory Council has been urging the US government to nurture a domestic rare earth supply chain after China banned exports to Japan following a territorial dispute in 2010.

A rare earth price index compiled by the China Rare Earth Industry Association spiked by as much as 38 per cent following Washington’s move to raise tariffs on US$200 billion worth of Chinese goods from 10 per cent to 25 per cent in May. The index has since fallen 5.5 per cent since it peaked in late June.

While details on China’s advantages in patent filings were short, anecdotal evidence from companies and analysts’ observations suggest it has gained a competitive edge upstream and downstream in the supply chain.

“There is no doubt that China is far ahead than anybody else in the world in terms of intellectual property and knowledge with respect to rare earths, both on the materials processing side and downstream applications,” said Ryan Castilloux, managing director of rare earth and electric battery metals consultancy Adamas Intelligence.

“This is partly because China has become the largest producer and such research is needed to support the development of new usages to help the industry grow,” said Castilloux, citing new uses for oversupplied elements such as cerium and lanthanum as examples.

There is no doubt that China is far ahead than anybody else in the world in terms of intellectual property and knowledge with respect to rare earths

Chinese scientists have also done a lot of research on the expensive and highly sought-after magnetic rare earth elements like praseodymium and neodymium that are used in electric motors.

“It enables China to focus on the part of the value chain that generates more value and is also environmentally friendlier,” he said.

“It also helps China to be more self-sufficient with a complete supply chain from metals to magnets to motors to batteries and electric vehicles.”

China Minmetals Rare Earth, one of the nation’s largest miners and producers of the elements, said in its latest annual report that it had won four new patents last year, including one for a piece of software.

“[Our] key core technologies include rare earth elements separation systems, ultra-high purity rare earth production technology and materials recycling know-how,” it said.

The Ganzhou, Jiangxi province-based subsidiary of state-backed metals mining and trading giant China Minmetals Group did not provide details on the patents and did not respond to queries.

Also based in Ganzhou in southern China, known as the nation’s “capital of medium and heavy rare earth,” is Shenzhen-listed JL Mag Rare-Earth, a major maker of rare earth permanent magnets used heavily in wind turbines, speakers and computer hard drives.

The company said it has built up a database of different rare earth formulations, which led to its success in lowering rare earth elements content while maintaining its products’ magnetic power.

Together with advances in newly developed heat-resistance and anti-corrosion coating know-how and a new production process letting it cut heavy rare earth consumption in the production process, it has won three patents in China and one in the US.

Between April 2010 and the end of last year, JL had obtained 22 patents in China, one in Europe and one in the US. Of the total, 13 were added last year.

Also in downstream operations is Hong Kong-listed rare earth-magnesium alloys producer REMT Group, a subsidiary of Century Sunshine Group Holdings controlled by mainland businessman Chi Wenfu.

REMT owns 22 patents – two in the US and the rest in China – relating to the production process and application of magnesium alloys.

Half the patents pertain to the use of rare earth elements in the production process of the alloys, a company spokesman said.

In 2017 REMT acquired 12 patents related to the production process from the Chinese Academy of Sciences and Changchun Institute of Applied Chemistry, which has been working with its parent on developing alloy technology. Roughly half its revenue last year was from alloys containing rare elements.

The patents give it market exclusivity protection for 10 to 20 years, and were valued at HK$40 million (US$5.1 million) at the end of last year, according to REMT’s annual report.

Some of its alloys have been successfully applied to aerospace vehicles, said the company, whose production facilities are located in the northwesters Xinjiang autonomous region and northeastern Jilin province.

Being light, strong, vibration and noise-abating and resistant to electromagnetic radiation, the alloys find use in cars, railway equipment and electronic and communication gadgets like mobile phones and computers.

Besides being easy to recycle, magnesium alloys are up to a third lighter than those of aluminium.

As a superior alternative to aluminium alloys, some 70 per cent of the world’s magnesium alloys are used in the transport sector, 20 per cent are found in electronic products and the rest in other sectors such as military and biomedical, according to a spokesman for REMT.

“By adding rare earth elements such as lanthanum, praseodymium, cerium and yttrium to magnesium alloys based on customer requirements, we can enhance their tenacity, strength, corrosion resistance and ease of casting,” he said.

According to Dierk Raabe, a director at Germany’s Max-Planck Institute for Iron Research – which focuses on microstructure physics and alloy design – adding rare earth elements to magnesium alloys “drastically” improves their ductility and strength in high temperatures.

Castilloux noted that if the US-China trade war worsens and Beijing decides to restrict rare earth and downstream product exports as a tool to fight US sanctions, trade and investments barriers, it could have major supply implications for US firms that need the products.

And even if US companies could buy some motors or magnets from Japan or Europe, those products are likely to be made from Chinese rare earths and suppliers may be worried about getting caught in the crossfire.

Meanwhile, US government reports have noted that it would take years for the US to build enough domestic processing capacity to match China’s.

Castilloux said given that the Mountain Pass rare earth mining project in California has restarted and is aiming to have its downstream processing plant operational by the end of next year, it may only take the US three to five more years to build up a supply chain for permanent magnets.

Two other processing projects have been planned but are not expected to be operational until 2022 the earliest, according to a Reuters report.

Lynas, an Australian mining company focused on rare earths, has joined forces with Blue Line, a Texas chemical company, to develop a rare earths separation facility in the US.

“Once the processing facilities are operational, there is nothing stopping a magnet maker from starting production in the US for the domestic market,” Castilloux said.

Until then, US companies will have to keep their fingers crossed, hoping there is no further escalation in the trade war that could possibly disrupt rare earth supplies.