Hazard investing? Here are 10 stocks to buy, if and when Hong Kong protests end, according to Morningstar

- A “V-shaped recovery” is possible for Hong Kong’s key stock index, which has fallen 12 per cent in six months

- Hang Seng stock index was the third-biggest loser out of 94 global benchmarks in the past six months, surpassed only by Kazakhstan and Zambia

The Hang Seng Index, the world’s third-biggest loser in the past six months, stands to recover its lost ground if Hong Kong can put a quick end to the four months of street protests that are pushing the city’s economy into recession, according to research by Morningstar.

“The question is how quickly the government can reinstate confidence,” said Morningstar’s equity research analysts Philip Zhong and Michael Wu, in an emailed report. “We believe that confidence can return quickly, and a V-shaped recovery is possible given past response.”

Morningstar’s bullish forecast is in stark contrast to the sense of doom that has gripped one of the world premier fundraising hubs, as the worst political crisis in Hong Kong’s history drives the city’s economy to a technical recession in the fiscal third quarter ending in December. Visitors have stayed away from the city, causing retail sales and consumption in the services-dependent economy to plummet.

The Hang Seng Index has fallen 12 per cent in six months, while the China Enterprises Index fell 11.2 per cent. Only the benchmarks of Kazakhstan and Zambia did worse than Hong Kong during the period, according to Bloomberg analytics. Real estate developers, which make up 11.4 per cent in combined weight on the Hang Seng Index, were the biggest drivers of the benchmark’s decline, Morningstar said.

Help may be at hand, after the Hong Kong Monetary Authority (HKMA) cut a capital buffer to release an estimated HK$300 billion into the financial system to help small and medium enterprises withstand the impending economic downturn. Nine of the city’s largest commercial banks were scheduled to meet with the city’s de facto central bank to find a process to make it easier for small businesses to obtain financing to tie them over during the slump.

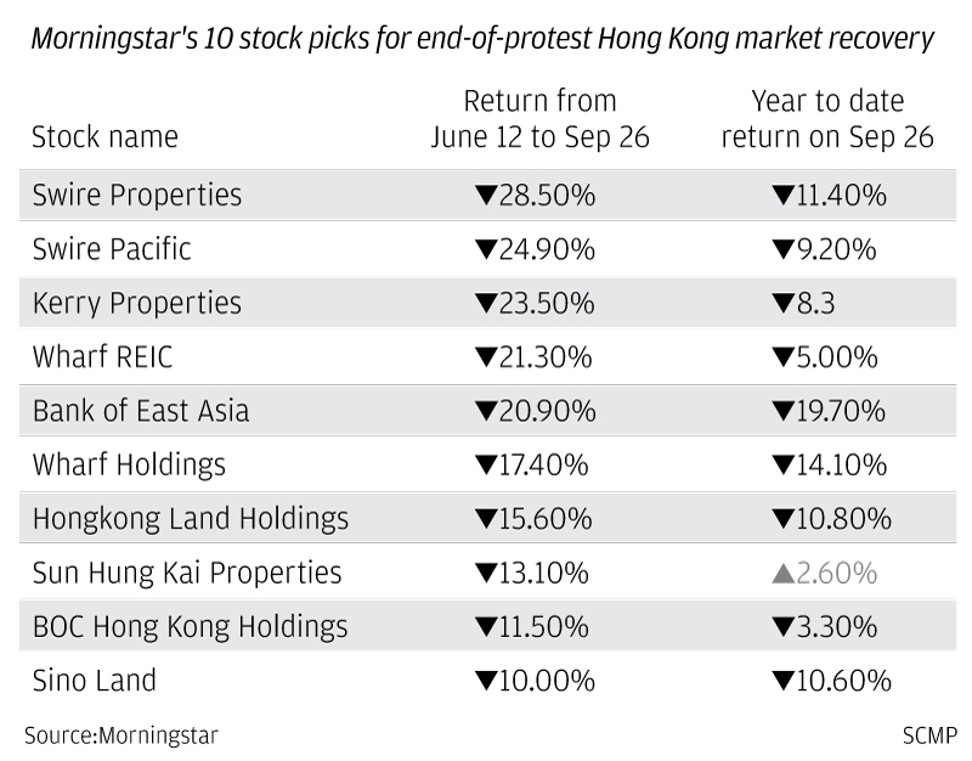

When the city’s public order does resume, 10 stocks including the largest real estate developers would stand to gain, Morningstar said, because of their “well-managed exposure to development properties, along with a significant portion of investment properties in China.”

Swire Properties, one of the biggest owners and managers of high-end shopping centres and office blocks in Hong Kong, may benefit. The stock has fallen 14 per cent in six months.

Sun Hung Kai Properties (SHKP), Hong Kong’s largest developer by market capitalisation, may also be a winner. Shares of the company, owned by the city’s third-wealthiest family, have fallen 16.5 per cent during the period.

“We do think that the laggards hit by the protest concerns will recover once protests end, and there are some buying opportunities among these names,” Morningstar said.

Bank of China (Hong Kong), a local unit of China’s largest bank and one of three currency issuers in the city, is also a good buy, said Morningstar, owing to Hong Kong’s status as the main financial gateway to the mainland.

BOC Hong Kong, whose branches have been vandalised in four months of street mayhem, have fallen 24.5 per cent in six months, the fourth-biggest loser out of 50 stocks on the Hang Seng Index.

Not everybody agrees. The optimism may be premature, as a clear solution to Hong Kong’s chaos and mayhem appear to be illusive, said Bocom International Holdings’ managing director Hong Hao.

In a sign of the challenges that remain, the city’s Chief Executive Carrie Lam Cheng Yuet-ngor had to abandon her original plan to deliver her much-anticipated policy address in the city’s legislature, after opposition lawmakers heckled her speech. Instead, she switched to a video delivery via broadcast television.