Two more companies set to raise up to US$250 million as Hong Kong marches ahead in retaining IPO crown

- SinoMab BioScience, a home-grown Hong Kong biopharma company, is aiming to raise up to HK$1.75 billion

- China PengFei Group, the world’s largest supplier of rotary kilns used to make construction materials, is seeking to raise up to HK$197.5 million

A Hong Kong biopharma company and the world’s largest supplier of rotary kilns used to make construction materials have unveiled plans to tap up to HK$1.95 billion (US$250 million) from the city’s stock market to fund their business plans.

SinoMab BioScience is aiming to raise up to HK$1.75 billion by selling 182.1 million shares at HK$7.6 to HK$9.6 each, while China PengFei Group aims to raise up to HK$197.5 million by selling 125 million shares between HK$1.05 and HK$1.58 each.

The pair has joined a string of other companies to launch initial public offerings in the city, at a time when its economy – especially tourism and hospitality related sectors – has been battered by nearly five months of anti-government protests.

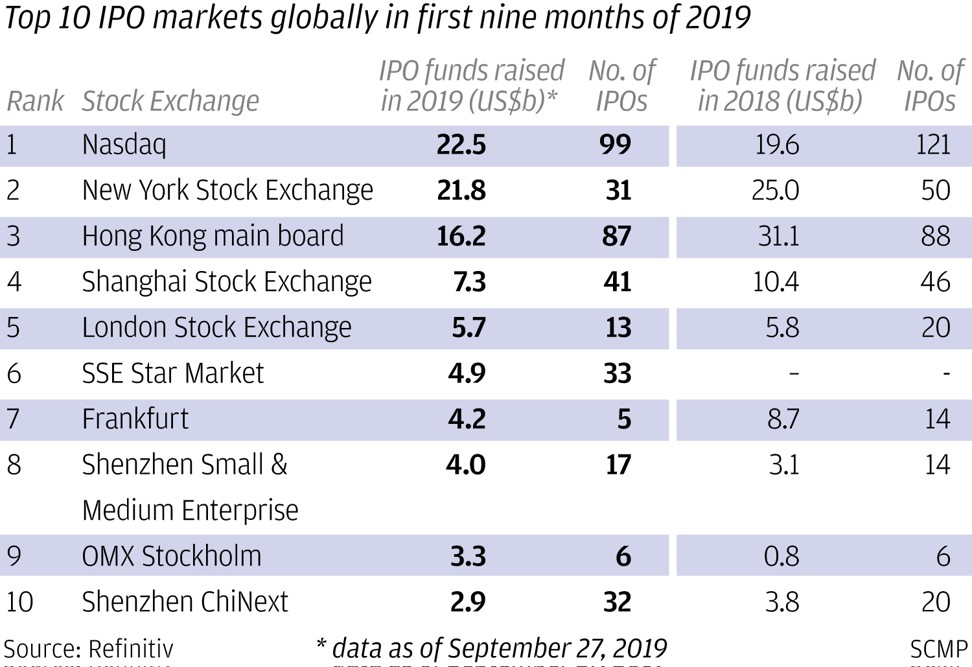

Their fundraising plans come after Hong Kong regained its top position in the global IPO ranking league table in this year’s third-quarter, edging out Nasdaq and New York Stock Exchange in first-time share sales.

However, Hong Kong’s deal volume of US$20.5 billion trailed Nasdaq’s US$24.1 billion and NYSE’s US$22.5 billion so far this year, based on data provider Refinitiv’s tally. Hong Kong was No 1 last year.

SinoMab BioScience was founded by Leung Shui-on, a former managing director of clinical trial facilities provider and start-ups incubator Hong Kong Institute of Biotechnology.

Leung is one of 17 members on Hong Kong stock exchange’s biotech advisory panel who assist in reviewing biotech listing applications and assess their suitability to be listed, since the exchange first allowed unprofitable biotech firms to list in April last year.

SinoMab has two products under clinical trial and four others under pre-trial research.

Its most advanced drug candidate for rheumatoid arthritis is in the final stage before marketing approval.

SinoMab aims to seek approval to market the drug in the mainland next year and launch it by mid-2021, Leung said.

The mainland’s rheumatoid arthritis therapeutic market is expected to grow from 11.5 billion yuan (US$1.6 billion) last year to 83.3 billion yuan by 2030, according to Frost & Sullivan, a consultancy hired by SinoMab to help provide research for its listing prospectus.

But it will face keen competition from eight drugs already in the market, and potentially 17 others undergoing or have completed phase three trials.

Only two of the eight – priced much cheaper than the others – are covered by state health insurance reimbursement schemes.

“We believe [our drug], once commercialised, will fulfil a long term unmet medical need and

[act] as either a complementary, or an alternative treatment to currently available treatment options,” SinoMab said in its listing prospectus.

Comparing its therapy’s phase two trial data with rivals’ historical publicly disclosed data, its therapy was shown to have “similar” efficacy to six drugs available on the market, “while maintaining a superior” safety profile compared to two drugs in the market.

No head-to-head studies have been done for a more objective comparison.

TNF-alpha dominates the mainland’s rheumatoid arthritis drug market, but 20 to 40 per cent of patients fail to achieve satisfactory improvement and over 40 per cent relapse.

Chief financial officer Jason Hua Jianping said the firm aims to compete with a “superior performance-to-price” offering if it succeeds in getting regulatory approval.

Meanwhile, Jiangsu province based China PengFei Group said more than 87 per cent of its revenues were generated outside China between 2016 and last year, especially from nations covered by Beijing’s Belt and Road Initiative.