Alibaba’s mega IPO attracts 200,000 retail applications, including one bid for HK$1.1 billion worth of shares

- The number of applications ranks among the highest in the city’s IPO history, but trails bids in MTR Corp, ICBC and LinkREIT retail offerings

- Retail investors are assured of getting one lot for every five they applied for, sources say

Alibaba Group Holding received about 200,000 applications from investors in the retail portion of its mega stock offering in Hong Kong, including one whopping bid for HK$1.1 billion (US$140 million) worth of shares, according to sources who are familiar with the deal.

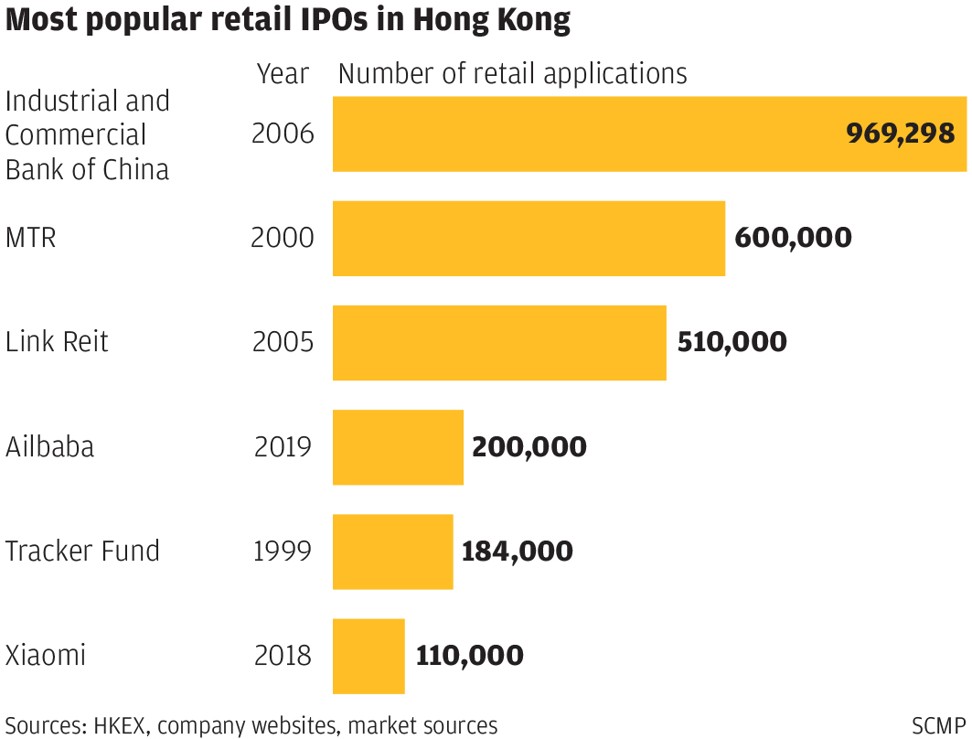

The size of the applications for the e-commerce giant’s stock ranks among the highest in the city’s retail offerings, according to exchange data. There were 184,000 retail bids in the Tracker Fund IPO in 1999 and 110,000 in mainland smartphone maker Xiaomi offering in 2018. The three highest retail applications are still held by Industrial and Commercial Bank of China in 2006 (969,298), MTR Corp in 2000 (600,000) and LinkREIT in 2005 (510,000).

The Hangzhou-based e-commerce giant raised HK$101.2 billion from its secondary listing plan by selling up to 575 million new shares at HK$176 each, the biggest stock offering globally this year. Ten per cent of the shares were set side for the public in Hong Kong. An initial portion of 12.5 million shares was oversubscribed by 40 times and locked up a record HK$94 billion in the banking system, people familiar with the listing said earlier this week. The retail portion is thus increased to 50 million shares, or 10 per cent of the total offering while the rest is taken by international placement.

Retail investors can be assured of getting one lot of shares for every five they applied for, people involved in the allocation said. About 80 per cent of applications for a minimum lot of 100 shares will be successful, they said, compared with a success rate of about 50 per cent in other popular IPOs in the city.

Alibaba, the owner of the South China Morning Post, will start trading on November 26 under stock code number 9988.

“Alibaba is popular with Hong Kong retail investors as it is a successful technology company with a number of well known e-commerce retail platforms and cloud computing businesses. Retail investors in Hong Kong tend to like to invest in household names which explain why MTR, ICBC and Alibaba can attract retail investors,” said Gordon Tsui Luen-on, chairman of the Hong Kong Securities Association.

Alibaba, which listed on the New York Stock Exchange five years ago in what was the record highest IPO worldwide at US$25 billion, kicked off the offering last week for its secondary listing in Hong Kong.

“Hong Kong lost out to New York in 2014 when Alibaba listed its shares. This is another reason that led retail investors to appreciate the chance to invest in the company as it now finally returns to list here,” Tsui said.

The offering ended on Wednesday at noon and has led Hong Kong to reclaim the crown as the top IPO market worldwide in term of funds raised. Including Alibaba’s IPO, Hong Kong Exchanges and Clearing’s main board has raised US$34.05 billion this year, bypassing the Nasdaq at US$24.73 billion and New York Stock Exchange at US$22.59 billion, according to data from Refinitiv.

China International Capital Corporation and Credit Suisse are the sponsors for the secondary offering in Hong Kong.