Some American companies are seeking to cut their reliance on China as coronavirus outbreak disrupts production, crimps revenue

- Revenue in China will fall in 2020 if the coronavirus continues to disrupt work through April, said half of the respondents in AmCham China’s survey

- Some US companies are shifting out of China, with 28 per cent polled saying they are setting up, or using alternative supply chains, according to a separate survey by AmCham Singapore

American companies expect their 2020 revenue to take a beating in China, as the ongoing coronavirus outbreak disrupts production and crimps consumption, prompting some of them to seek alternative supply chains to reduce their reliance on the “world’s factory,” according to separate surveys by the American Chambers of Commerce in China, and Singapore.

Sales in China will fall in 2020 if the coronavirus continues to disrupt output through April, said half of the respondents in AmCham China’s survey of 169 members between February 17 and 20. One in five companies polled see their 2020 revenue sliced by more than 50 per cent if the outbreak extends through August.

Some US companies are shifting out of China, with 28 per cent of respondents in AmCham’s Singapore survey saying they are setting up, or using, alternative supply chains to reduce their reliance on China. The Singapore poll, released a day before AmCham China, covered 225 members between February 12 and 18.

The two readings underscore how the coronavirus outbreak, which has sickened more than 82,137 people and killed 2,800 around the world – 95 per cent of the afflicted are in mainland China – has further unsettled a global economy that is still trying to adjust to the year-long US-China trade war.

China’s economy, the world’s sixth-largest with 4.3 per cent of global output in 2003 when the severe acute respiratory syndrome (Sars) outbreak starting from Guangdong province sickened 8,098 people in 17 countries, has since grown into the second-biggest, making up 16.5 per cent of worldwide production last year, according to IHS Markit.

As China’s labour force gradually returns to work from an extended Lunar New Year holiday ordered by the government to contain outbreak, production of everything from clothing to electronics components, machine parts and toys has been disrupted.

About 40 per cent of US companies surveyed are revising their annual budgets, with a third of them cutting costs and considering adjustments to their 2020 business plans. Microsoft Corporation, Apple and HP are the latest to announce cuts in their quarterly earnings outlook, citing the coronavirus outbreak that disrupted their production of computers, smartphones and other electronic devices. Even Walt Disney Company is suffering, as a two-month closure at its Shanghai theme park – its largest in Asia – would wipe US$135 million off its second-quarter operating income.

One in 10 companies surveyed by AmCham China said they are losing at least half a million yuan (US$71,200) every day from the disruptions to their businesses. Travel disruptions, reduced staff productivity are the most significant impacts, while increased operational costs and disruptions to supply chains are some of the other factors playing a part, according to the survey, without identifying the respondents among its membership of 900 companies and 4,000 individuals.

The outbreak’s shock to the Chinese economy and its spillover to other countries “is much larger than expected,” said Aberdeen Standard Investments’ senior emerging market economist Robert Gilhooly.

American companies have been the largest group of foreign investors - excluding Hong Kong and Taiwan investors - in China, starting from the 1980s when the country began experimenting with market capitalism and opened its doors to global capital.

US companies invested US$6.8 billion in China during the first half of last year, as companies either relied on the country’s manufacturing prowess, or were tapping the nation’s growing middle class to sell products and services to. General Motors has been producing cars in China since 1997, while Starbucks is opening more cafes in China than anywhere else, and Tesla in December completed its first overseas assembly, the US$2 billion Gigafactory, in Shanghai.

The outbreak this year is more virulent than Sars in 2003, even if the mortality rate is lower and the recovery rate is higher.

As many as 3,600 people have caught the virus in 48 regions and countries outside mainland China at last count, including a cruise ship moored in Yokohama with more than 600 confirmed cases.

Confirmed new cases outside China in the last 24 hours surpassed afflictions on the mainland for the first time today, according to World Health Organisation (WHO) data, including a case in California of unknown origin.

Earlier this month, CICC Research’s chief economist Liang Hong said the number of new cases could “plateau” in mainland China by the end of February or in early March. China could see a “return to normal by businesses by the end of March,” Matthews Asia’s investment strategist Andy Rothman said in a podcast produced by independent think tank Official Monetary and Financial Institutions Forum (OMFIF).

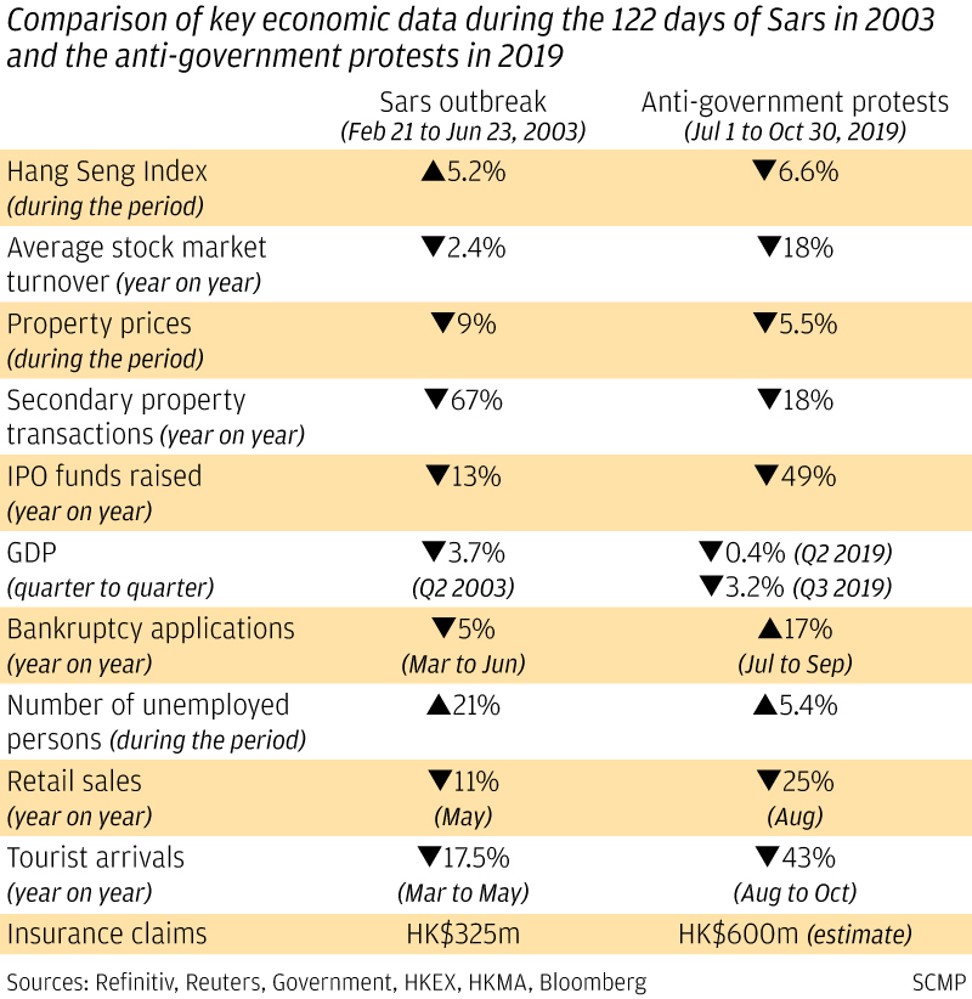

“If we look back at what happened in Sars, there was a really sharp deep hit to the Chinese economy, but just for one quarter and then it snapped back pretty quickly. I think we are likely to see something along those lines here,” Rothman said. “If my base case holds on the virus that over the next month, by the end of March, the economy gets back to normal, people are going about their normal lives, I think we are going to see a really significant rebound in the consumer part of the economy.”

Still, any rebound will help but won’t make up for all economic losses, particularly for service-based companies, said Rothman. Corporate earnings for the first half of the year will “be dismal”, he said.

That view is echoed by Aberdeen Standard’s Gilhooly, who expects the impact of the coronavirus will hurt the services industry more than in manufacturing.

Chinese manufacturing will return to January levels by April, and “to its previous trends by the middle of the year,” he said. Services will only “modestly improve” through June and only fully recover in early 2021, Gilhooly said.

Purchase the China AI Report 2020 brought to you by SCMP Research and enjoy a 20% discount (original price US$400). This 60-page all new intelligence report gives you first-hand insights and analysis into the latest industry developments and intelligence about China AI. Get exclusive access to our webinars for continuous learning, and interact with China AI executives in live Q&A. Offer valid until 31 March 2020.