Chinese biotechs, flushed with funds and armed with ideas, join the race to find a coronavirus cure as pandemic ravages the world

- I-Mab Biopharma will soon start clinical trial on a drug that shows promise against Covid-19, while Cansino Biologics’ trial on a vaccine has been approved by Chinese authorities

- Song Ruilin, the head of China Pharmaceutical Innovation and Research Development Association, says the policies launched in 2008 to support development of new drugs are now starting to pay off

Joan Shen Huaqiong was flying home to Shanghai from New York when a mysterious respiratory illness was spreading at an alarming rate in Wuhan, Hubei province – the original epicentre of the coronavirus pandemic.

Just hours earlier, the CEO of I-Mab Biopharma and her management team were at the New York Stock Exchange to ring the trading bell to mark the listing of the first Chinese biotech company in the US in over two years. They decided that something had to be done fast to get on top of the situation. Not only did the company donate money and equipment generously, but they also delved into the company’s drug candidates for a potential cure.

“We closely followed the case reports from Wuhan and realised there was a correlation between the severity of cases and the cytokine release syndrome (CRS),” the CEO of the Shanghai-based cancer and autoimmune disease drugs developer said in an interview with the South China Morning Post. “We reached out to a few hospitals in Wuhan where doctors were eager to find a good drug to treat CRS.”

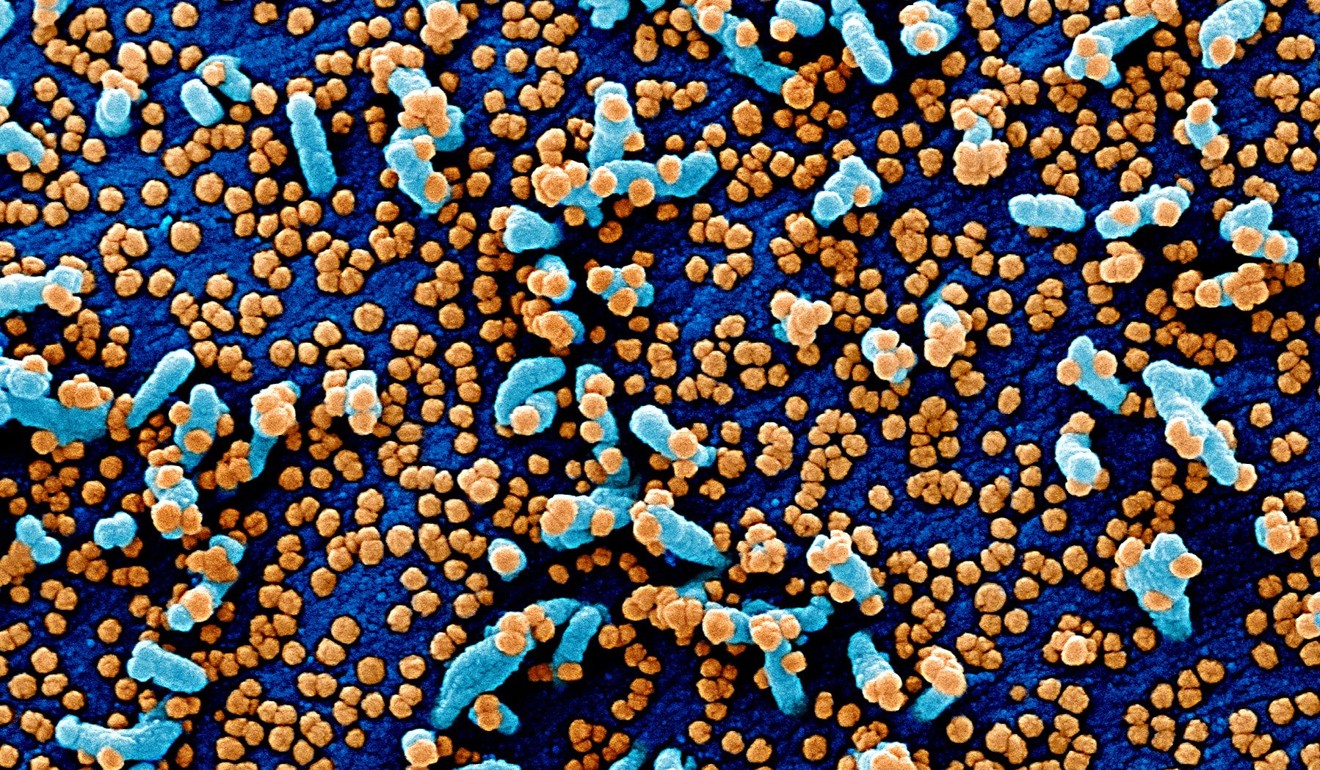

CRS is an overreaction of the immune system that afflicts one in every five patients infected with the Sars-nCov-19 virus, which could cause respiratory distress, circulatory collapse, multi-organ failure and death.

I-Mab swiftly decided to move one of its eight drug candidates under human clinical trials for rheumatoid arthritis and complications resulting from one type of cancer therapy to the top of its clinical programme as a potential remedy for severe cases of the Covid-19 disease caused by the coronavirus.

“During the extended Lunar New Year holiday [in early February], our research and development staff overcame home-isolation and disparate time zones to swiftly work out a strategy and deployed all necessary resources to support this project,” Shen said.

By mid-March, I-Mab had made sufficient progress and filed for regulatory approval to use the drug candidate TJM2 in clinical trials involving more than 100 patients in the United States to treat CRS.

TJM2 is an antibody designed to prevent or stem progress of the deadly disease by “neutralising” a substance secreted by immune cells, which plays a key role in causing inflammation and pneumonia.

I-Mab is not the only Chinese pharmaceutical company searching for a coronavirus cure.

Tianjin-based Cansino Biologics last week said its initial clinical trial on a genetically engineered vaccine candidate for the novel coronavirus – a joint effort with the Academy of Military Medical Sciences – has been approved by Chinese regulators and that they would soon start recruiting volunteers.

Hong Kong-listed Cansino has previously developed a vaccine against the Ebola virus, which has been approved by the Chinese government for national stockpile and emergency use.

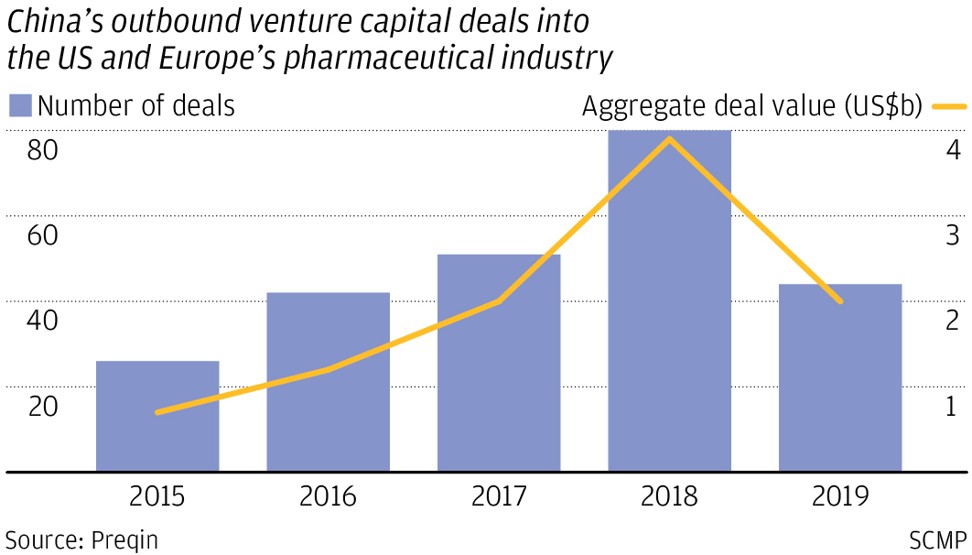

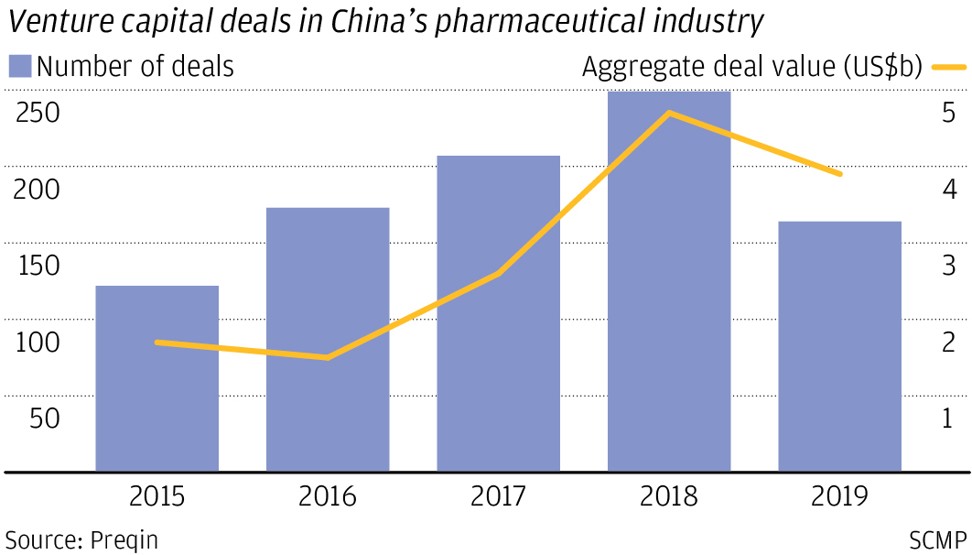

I-Mab and Cansino are among a growing number of start-ups founded in the past decade by accomplished Chinese scientists trained in the West. Armed with billions of dollars in venture capital investments and funds from initial public offerings, these companies are at the forefront of the Chinese pharmaceutical industry’s stunning rise from generic, off-patent producers to innovators and inventors.

China has been a major generic drugs manufacturer and exporter of raw materials for the past 15 years, with little investment in innovative drugs development until recently. Some 301 generics were granted marketing approval last year.

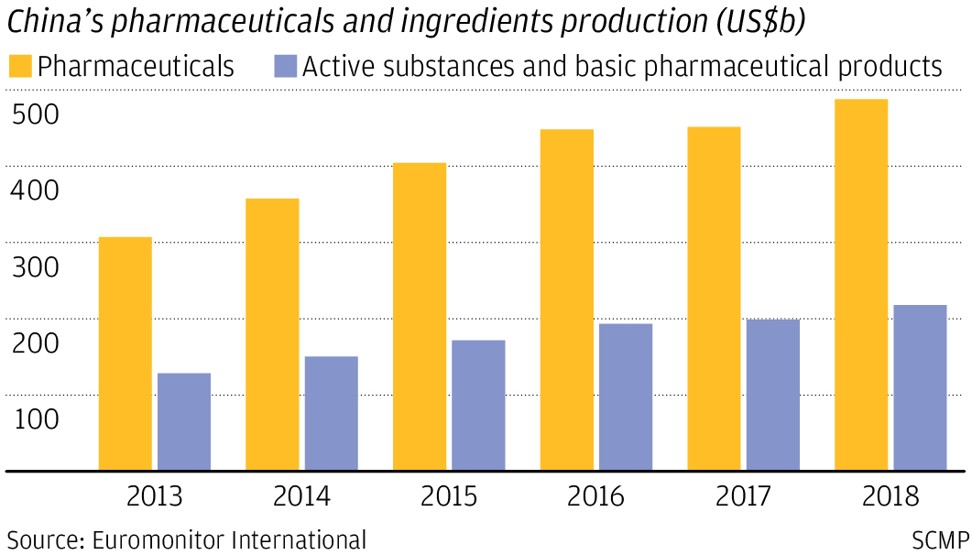

The industry produced 3.57 trillion yuan (US$504 billion) of pharmaceutical products in 2018, with 1.71 trillion yuan in domestic sales, according to China Pharmaceutical Innovation and Research Development Association.

Of the 51 innovative drugs approved in China last year, 10 were locally developed, an 11 per cent increase from 2018. Before that only 38 were developed in the decade up to 2017.

The entrepreneurs and their backers have been greatly encouraged by Beijing’s health care and drugs approval system reform in recent years. The state health insurance system now has more money to cover the cost of innovative drugs, approval for new drugs is greatly expedited and the financial viability of drug discovery projects has vastly improved.

The association’s chairman Song Ruilin said a few novel drugs developed by Chinese companies were noteworthy.

They include Nasdaq-listed FibroGen’s anaemia drug roxadustat for kidney disease patients. Clinical trials for the drug were completed and approval was granted in China ahead of Japan and US.

A seaweed-based natural medicine for treating Alzheimer’s disease developed by Shanghai Green Valley Pharmaceutical with Shanghai Institute of Materia Medica and Ocean University of China is another.

“This [Alzhheimer] drug’s success has been doubted by many people given China is a relative newcomer to novel drugs innovation,” he told the Post on the sidelines of the JPMorgan health care conference in January.

He added that China was now starting to reap the benefits after many years of investment and hard work, pointing to the Beijing’s policies launched in 2008 to support development of new drugs.

Sales of innovative drugs – sold by Chinese and multinational companies – could grow by 60 per cent between 2018 and 2025, up from a few per cent last year, Citi’s analysts have forecast.

“China’s rise as a contender in the global innovation landscape has clearly been noticed,” said Helen Chen, head of L.E.K. Consulting’s China biopharmaceuticals and life sciences practice.

She said that patents granted to Chinese resident researchers in the biological sciences grew to 327,000 in 2017 from 144,000 in 2013, while their research papers on oncology in the world’s top five scientific journals rose to 46 from in 2018 from 20 in 2015.

The nation’s young biotechnology industry has made major inroads into the oncology market, which is also where most of the innovation is focused globally.

“Chinese companies such as Akesobio, Alphamab Oncology and I-Mab have immuno-oncology drug candidates including bispecifics, which are at the same stage of development or even more advanced than their global counterparts,” Chen said. “In cell therapy, Chinese regulations allow faster studies in humans, giving Chinese companies a faster look at how their therapies work.”

Bispecifics refer to antibody drugs capable of simultaneously binding onto two different targets to restore immunity cells’ compromised capability to kill cancer cells, rather than one in previous generation products.

However, she said such examples are limited as there are more “fast-followers” rather than “first-in-class”.

Alex Zhavoronkov, co-founder and CEO of Hong Kong-based Insilico Medicine, a developer of artificial intelligence software for drug discovery, agreed.

“Most of the drug candidates in China today are either ‘in-licensed’ from overseas or ‘me-too’ copies,” he said. “This is because developing a new drug for a new target is very risky, with a failure rate in excess of 90 per cent, a development time of over a decade and billions of US dollars of investment. But some Chinese firms are becoming more innovative and some are going after novel and difficult targets,” adding that advances in artificial intelligence can make this process less risky, faster and cheaper.

Insilico this month signed a deal with Hong Kong-listed Sino Biopharmaceutical to create a “deep learning” model for Sino’s promising cancer drug targets.

A drug target is typically a protein in the body that is linked to a certain disease on which a drug can work to produce a desired treatment response.

In October, the pair had signed a service contract that could eventually be worth US$200 million. As part of the deal Insilico will develop AI software for “complex and difficult” targets of “triple-negative” breast cancer, for which drugs cannot be designed with traditional methods. This type accounts for 10 to 20 per cent of breast cancer.

In the hot field of immuno-oncology, almost 400 clinical trials in various stages of development have been registered, based on data from the Centre for Drug Evaluation and Chinese Clinical Trial Registry compiled by Chen.

The pipeline consists of 224 PD-1 and 51 PD-L1 antibodies and 121 CAR-T cell therapies, for which Chinese firms are most well-known for, with the number of clinical studies similar to that in the US.

CAR-T therapies involve the genetic engineering of T cells – a type of immune cell – so that they can recognise and destroy cancer cells.

The key to a successful cancer immunotherapy is precision and safety, according to Peter Luo Peizhi, founder and chief executive of Suzhou-based Adagene.

“Our technology allows us to identify antibodies that can act on the unique target that controls the functioning of the immune T cells, with the precision of a smart laser-guided missile,” Luo said.

Adagene, which has raised over US$150 million since 2014, is conducting phase one clinical trials in China and the US on its lead antibody therapy candidate ADG106 to demonstrate its safety and efficacy for multiple solid and blood cancers.

Luo, who co-founded the California-based antibody engineering and drug discovery firm Abmaxis that was acquired by US pharmaceutical giant Merck in 2006, expects a phase two trial on ADG106 to start later this year.

Different forms and generations of CAR-T treatment have been developed in the past few years. One type of treatment, approved by US regulators for some forms of aggressive lymphoma and leukaemia, sees blood drawn from patients, which is modified and reinfused into their bodies.

“Nowadays doctors speak of CAR-T as a viable treatment option,” said Brian Hall, co-founder of Nanjing-based IASO Biotherapeutics, a CAR-T treatment developer set up in 2017. “Still, this is a very complicated business and many people getting treated have relapsed.”

However, he added that the first subject of IASO’s current clinical study involving 23 patients suffering from multiple myeloma – a type of blood cancer – has been in “complete remission” for 17 months, after receiving their therapy.

The company, which this week completed a US$60 million fundraising round led by Hillhouse Capital, has received approval to conduct a phase two clinical trial. Hall expects it to start by June and involve between 60 and 100 patients.

Despite the enthusiasm for antibodies and cell therapies, one drug developer has chosen not to be distracted by peers’ race into immune-oncology biological drugs, as product differentiation and innovation in China have been limited.

“It’s not a bad thing as it made these therapies available to patients in China quickly and at low cost, although it’s not very efficient from a resource allocation standpoint,” said Christian Hogg, CEO of Hutchison China Meditech (Chi-Med).

Similar “herd investments” appeared in the early 2000s when multinational firms flocked into branded generic drugs production in China, on the “misguided” assumption that they would be able to charge more by marketing them under their name, he noted.

“Companies then went into biosimilar drugs in the last 10 years, and they realised it was very competitive and they need to innovate,” he said. “But as soon as they learned about the success of certain immunotherapies abroad, they went into PD-1 in droves and now you see the same approach to certain cell-based therapies like CAR-T.”

Biosimilars are generic versions of biological drugs made from substances produced by the body such as protein. They may differ from the original licensed drugs, but have nearly the same efficacy and safety profile.

Instead of following the trend to deploy large resources into biosimilar therapies, Shanghai and Hong Kong-based Chi-Med – 48.3 per cent owned by tycoon Li Ka-shing’s Hong Kong conglomerate CK Hutchison – has kept its focus on chemical drugs – the mainstay of the industry.

Set up in 2000 as a prescription drug maker, Chi-Med now has 500 scientists, half of them focusing on drug discovery.

“It takes discipline, organisation and time to design oncology small molecule therapies that are really unique. PD-1s – large molecules – are easier to design,” Hogg said.

It has taken the firm a decade to create and refine a lymphoma drug candidate now in early human clinical trials, he noted. Chi-Med has spent a similar amount of time cooperating with UK-based AstraZeneca to develop a lung cancer drug candidate. The company plans to submit an application for marketing approval this year.

In 2018, it claimed that its colorectal cancer drug fruquintinib was the first China-discovered and developed oncology drug to win unconditional marketing approval after completing clinical trials in the mainland.

Covid-19 has infected over 510,000 people globally, and killed more than 23,000, with Europe and the US becoming the latest hotspots.

Cities in China’s Hubei province are starting to ease quarantine measures as the number of new cases has dropped to near zero, while the lockdown in Wuhan will be lifted on April 8.

Working from home, I-Mab’s team of over 20 clinical development staff in Rockville, Maryland – a state with hundreds of coronavirus cases – are preparing for the US trial of TJM2.

The company is also making plans to start more studies in some European and Asian countries including South Korea.

“While this project was initiated in response to the needs of Covid-19 patients in China, where the disease has been quickly brought under control, our China and US teams are now working full speed remotely on the US trial,” Shen said. “None of our employees has been infected.”

Purchase the China AI Report 2020 brought to you by SCMP Research and enjoy a 20% discount (original price US$400). This 60-page all new intelligence report gives you first-hand insights and analysis into the latest industry developments and intelligence about China AI. Get exclusive access to our webinars for continuous learning, and interact with China AI executives in live Q&A. Offer valid until 31 March 2020.