HNA Group halts trading of its note in Shanghai as a hasty plea for time caused panicking investors to flee its debt issues

- HNA Group halted the trading of its 5.99 per cent, 3 billion yuan note in Shanghai, after its price plunged by as much as 31 per cent

- The company apologised for a hastily called teleconference overnight to announce the postponement of payments on a separate tranche of 1.15 billion yuan bond, due today

HNA Group, a former asset acquirer that is trimming its loans under de facto state ward, halted the trading of one of its notes in Shanghai after panicked investors fled, as the economic aftermath of the coronavirus pandemic throws a wrench into one of China’s biggest debt workouts.

Trading of HNA’s 5.99 per cent 3 billion yuan (US$425 million) note was halted in Shanghai until 2:57pm, after its price plunged by as much as 31 per cent in early transactions, according to a statement to the Shanghai Stock Exchange, where the debt issue is traded.

Investors fled HNA’s debt after the aviation conglomerate, based in the Hainan provincial capital of Haikou, hastily called a teleconference overnight with creditors to postpone paying the principal and interest by 12 months on a separate tranche of 7-year bonds worth 1.15 billion yuan due today. The bond had been suspended from trading since April 9.

The meeting was hastily arranged “because the number of investors is relatively large,” HNA said in a statement, adding that it “sincerely apologises” for the “lack of preparation.” Chinese media said invitations were sent out 30 minutes before the meeting’s commencement, and many creditors failed to receive the notice.

“Due to the coronavirus pandemic, the Group’s core businesses including aviation, tourism, hotel and commercial [operations] are significantly impacted,” HNA said. “Although we made various efforts to resume work and production, it is hard for the operations and management to recover in the short term, and the pressure on cash flow is tremendous.”

Shares of Hainan Airlines, the HNA Group’s flagship and China’s fourth-largest carrier, fell by as much as 1.3 per cent in a declining market to 1.55 yuan in Shanghai.

Last week, creditors agreed to postpone exercising 292 million yuan of put options on another HNA Group unit West Air, giving the indebted group much-needed breathing space to work out its debt.

The 13-year old low-cost carrier, operating 35 aircraft from its base in Chongqing in central China, eventually paid 235.9 million yuan of bonds on April 7, according to the statement.

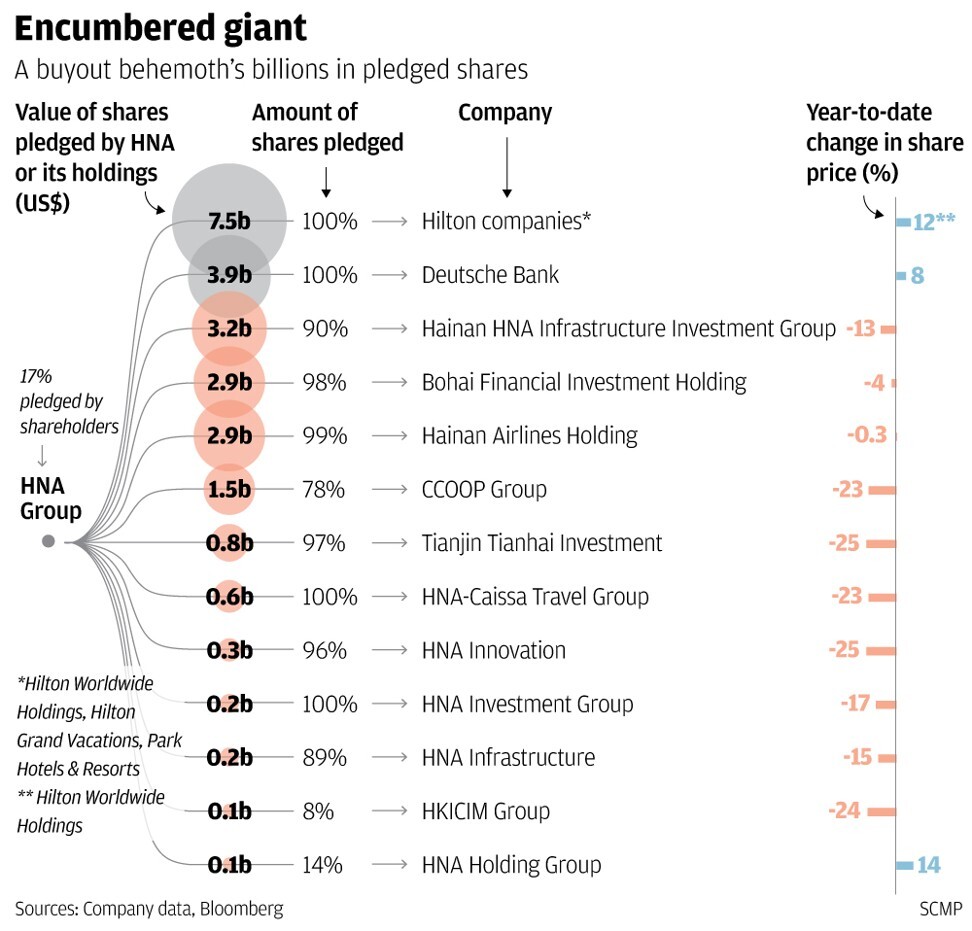

The deferment on West Air’s put options is a relief for HNA, one of China’s biggest global asset acquirers to emerge in the past two decades. China’s largest private-sector aviation conglomerate, HNA is under de facto state ward by the local authorities of Hainan province to trim its debt burden, as the government tries to prevent its financial collapse from hurting the broader banking system while the nation’s economic growth slows to its slowest pace in four decades.

Sign up now and get a 10% discount (original price US$400) off the China AI Report 2020 by SCMP Research. Learn about the AI ambitions of Alibaba, Baidu & JD.com through our in-depth case studies, and explore new applications of AI across industries. The report also includes exclusive access to webinars to interact with C-level executives from leading China AI companies (via live Q&A sessions). Offer valid until 31 May 2020.