Li & Fung delists from Hong Kong’s bourse after 28 years as supply chain manager is privatised while global trade roils

- Shares of Li & Fung were delisted today

- The majority of shareholders agreed at a May 12 meeting for Li & Fung’s controlling shareholders to take the company private, at HK$1.25 a share

The curtain came down on the publicly traded shares of Li & Fung Limited after 28 years on the Hong Kong stock exchange, as the century-old supply chain manager and logistics company is privatised by a consortium including its controlling shareholders.

Shares of Li & Fung, which rose 2.5 per cent to HK$1.24 two days before their May 15 trading halt, were delisted today from the local exchange, closing another chapter in the 114-year-old company’s history. The stock was listed in Hong Kong in July 1992.

“Today marks the start of a new journey for Li & Fung as we focus on achieving a fundamental transformation of our business,” said chief executive Spencer Fung, the great-grandson of Li & Fung’s founder in a statement. “Our commitment to our retail and supply chain partners remains as strong as ever.”

The privatisation of Li & Fung, which made its fortunes as the middle man between mainland China’s factories and the world’s consumers, highlights Hong Kong’s struggle to redefine its strategic role as technology and smartphone-enabled online shopping upended bricks-and-mortar commerce.

More recently, the city’s status as the staging ground for China has also been shaken as the US-China trade war tore global supply chains asunder. The global economic havoc wreaked by the coronavirus pandemic has also pushed many manufacturers to replace their just-in-time supply chains with a multitude of just-in-case alternatives to hedge against any disruptions from putting every egg in one basket.

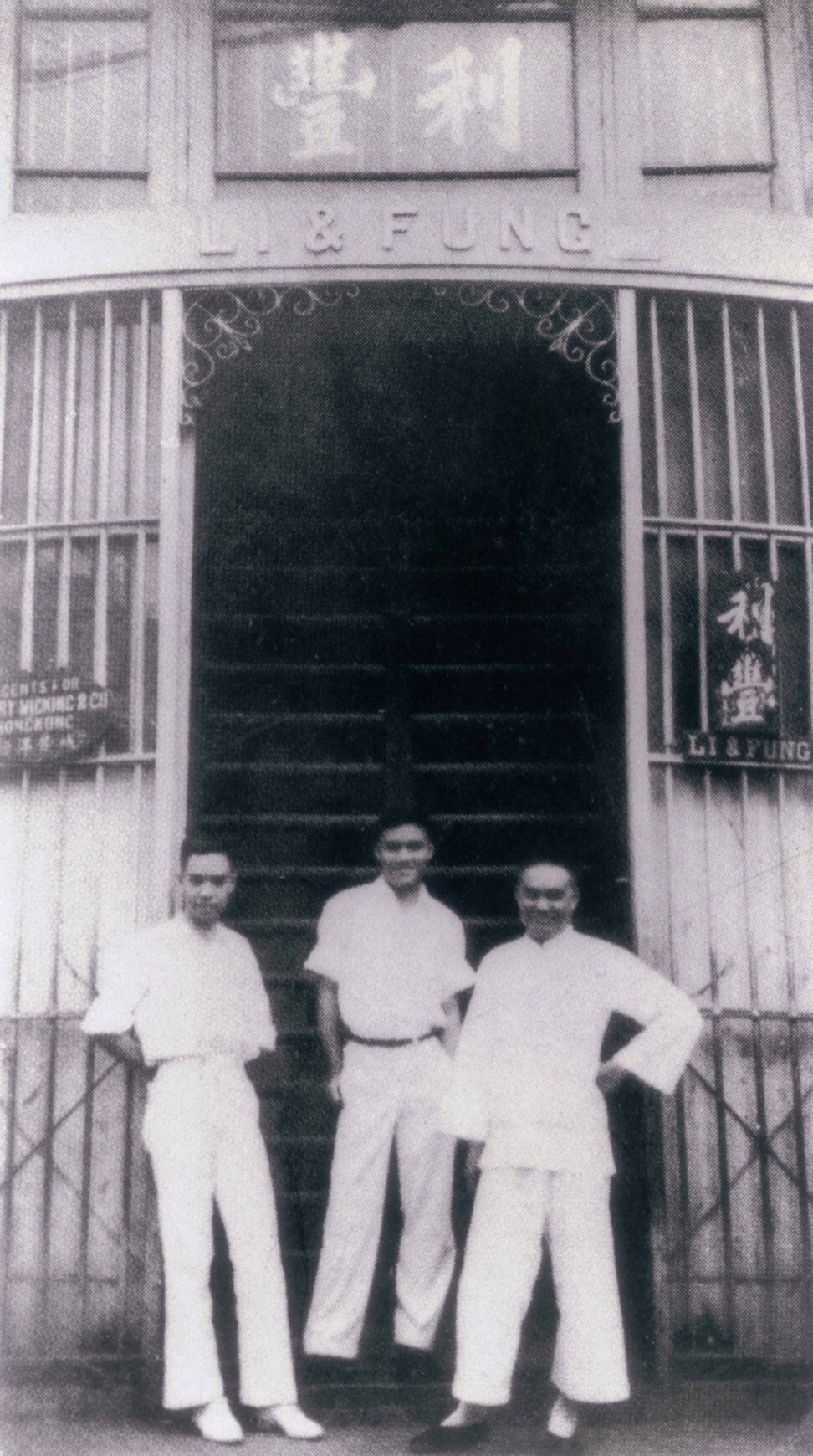

Li & Fung was founded in 1906 during the twilight of the Qing dynasty in southern China’s Guangzhou, then known as Canton. The two founders were porcelain merchant Li To-ming and English teacher Fung Pak-liu, who began their business by exporting ceramics, fireworks, handicraft and silk to the United States and Europe. They later became compradors for the British colony when Fung’s son opened Li & Fung’s first branch in Hong Kong in 1937.

During the 1990s, Li & Fung took over several of its competitors and became the lead consolidator of Hong Kong’s merchandise sourcing industry, acting as the go-between for the manufacturers of mainland China, Southeast Asia and South Asia with retail stores in the US and Europe. By 2015, the company had expanded to 250 offices in 40 markets, working with 15,000 suppliers to serve 8,000 retailers, including Macy’s and JC Penny.

In the subsequent decade, Li & Fung grew to become the world’s largest supply chain manager for consumer goods, helped by the acquisition of dozens of firms that own brands or have product design and sourcing expertise. But online shopping progressively eroded the market share and profitability of traditional bricks-and-mortar retailers – the core of Li & Fung’s customer base.

Management has embarked on a multi-year strategy to digitalise the supply chain management processes – spanning order processing, raw material procurement, samples production and approval, production, quality control, financing and logistics. But the effort could not match the pace of market shifts and was unable to stop its business volume and profit from sliding. Core operating profit fell to US$228 million last year, a quarter of the US$882 million in 2011, while revenue almost halved to US$11.4 billion.

Li & Fung told shareholders its business transformation, which requires “deeper restructuring” and further investment in technology, infrastructure and talent, would entail execution risk and the benefits will take a relatively long period to realise.

“The [take-private deal’s] offerer believes [this] will be more effectively implemented away from the public equity markets,” it said when it first unveiled the buy-out offer.

The offer, announced in March by a consortium of the Fung family – led by group chairman William Fung Kwok-lun and honorary chairman Victor Fung Kwok-king – and Singapore’s logistics assets investor GLP, sought to take the company private at HK$1.25 per share. The offer was accepted by minority shareholders on May 12, with 97.1 per cent of ballots cast voting in favour.

Some minority shareholders who opposed the deal felt betrayed. The take-private price, although more than double the 50 Hong Kong cents that the stock last traded at before the offer’s announcement, was a fraction of what they paid for, some shareholders said.

“Like many loyal shareholders of Li & Fung, we did not sell our shares even when the company's business was on a downtrend,” said Danny Chan Chung-cheung, a shareholder for 19 years. “We believe the company's restructuring plan in recent years will result in a bounce back.”

Chan said he is convening a concern group of minority shareholders to ask Hong Kong’s Securities and Futures Commission (SFC) to investigate whether Li & Fung’s May 12 shareholders meeting was conducted in accordance with regulations. A meeting has been scheduled on Thursday. The SFC and Li & Fung declined to comment.

Help us understand what you are interested in so that we can improve SCMP and provide a better experience for you. We would like to invite you to take this five-minute survey on how you engage with SCMP and the news.