00:47

Vehicle number 10,000 rolls off the assembly line for Chinese electric carmaker XPeng

Tesla’s China challengers want to replicate the world’s best-selling electric carmaker’s success at home. But the road to success is long and arduous, which even the American company took nearly a decade to surmount and eventually become viable.

Notwithstanding challenges like the Covid-19 outbreak that briefly slowed down sales of new-energy vehicles, Chinese start-ups are pressing ahead with their plans to grab a share of the mainland’s growing NEV market and unseating Tesla from its lofty perch.

The plans are in different stages for the handful of potential Tesla challengers. In the past couple of months some have unveiled upcoming production models that have longer driving ranges. Some are working on expanding production facilities to lower costs, while others have undertaken massive fundraising exercises and come up with innovative battery-swapping schemes.

However, mainland consumers remain far from convinced, as analysts say the market is yet to see a real Chinese-made electric car model that can stem the early dominance Tesla, whose Model 3 outsells its nearest competitor by three to one.

00:47

Vehicle number 10,000 rolls off the assembly line for Chinese electric carmaker XPeng

“Competition is getting heated, but Tesla enjoys an overwhelming advantage,” said Chen Jinzhu, chief executive of Shanghai Mingliang Auto Service, which sells car insurance and deals in second-hand vehicles. “The grim reality is that Chinese drivers would choose Tesla now as the cars are priced attractively.”

Earlier this month, Evergrande Health Industry Group, the electric vehicle arm of mainland property developer China Evergrande Group, unveiled six car models under its Hengchi brand. The company has made its ambitions clear that it wants to become the world’s largest NEV manufacturer over the next three to five years, even proposing to change its name to China Evergrande New Energy Vehicle Group.

The company has spent more than 20 billion yuan (US$2.9 billion) on developing an entire NEV industry chain, complete with car, batteries, motors and power systems, with plans to invest another 25 billion yuan to bring its car-making plans to fruition. It is also building two plants in Guangdong and Shanghai with a capacity to produce 200,000 vehicles a year. While the company says it plans to start mass production of the Hengchi-branded cars next year, details such as pricing and availability have not been revealed.

Investors seem to be caught up in the excitement, propelling the company’s shares nearly 285 per cent higher this year, valuing it at more than HK$258 billion (US$33.3 billion) on Friday.

Li Auto, a five-year-old start-up backed by mainland online services delivery giant Meituan Dianping, is clear in its plans. It raised US$1.1 billion in an initial public offering (IPO) on Nasdaq at the end of July to support its long-term plans of focusing on the SUV segment. The company has a plant in Changzhou, Jiangsu province, where its manufactures the Li ONE SUV. It has sold 10,400 units since its launch in November to June this year.

Guangzhou-based Xpeng, another start-up and potential Tesla challenger, is planning on raising up to US$1.1 billion in an IPO in New York to take on rivals for a slice of the NEV market, according to a filing overnight. In December 2018, Xpeng launched its first production model, the Xpeng G3 SUV, and followed it up with the P7 sports sedan, in April this year.

“Tesla, as the most established NEV brand worldwide with the most mature technology, is ratcheting up pressure on the Chinese rivals as it reported buoyant sales of Model 3 cars,” said Yale Zhang, managing director of industry researcher Automotive Foresight. “It is not an easy job to unseat it from the leading position.”

The threat to Tesla’s dominance is practically negligible right now. Even Tesla, which reported a profit of US$104 million for the quarter ending June, has struggled for a large part since its founding in 2003. As a publicly listed company for over 10 years, Tesla has been profitable for only a few quarters, and turned its first annual profit in 2019.

Tesla’s other advantage is its wholly owned Gigafactory 3 in Shanghai, which began delivering its Model 3 cars to mainland buyers at the start of this year. The US$2 billion factory, its first outside the US, has revved up production since February even as extensive lockdowns were put in place to contain the Covid-19 outbreak.

01:20

Tesla starts delivery of made-in-China cars

Tesla has struck a chord with the Chinese middle class after the government’s 25,000 yuan subsidy and price cuts, making it their environment-friendly car of choice. The price of a locally built Model 3 with a standard-range battery pack was lowered in April to 271,550 yuan from 299,050 yuan. It was initially priced at 355,800 yuan before the company started production.

The prices of its competitors’ models start from 229,900 yuan for Xpeng's P7 sedan to 328,000 yuan for Li Auto’s Li ONE SUV. NIO’s ES6 SUV starts at 343,600 yuan after subsidies.

It is Tesla’s pricing of under 300,000 yuan that is proving irresistible to most car buyers.

“We will choose a domestic brand NEV only if it is priced at least 30 per cent lower than Tesla,” said Chen Yong, a Shanghai native who is in the market for an electric car. “Some of the Chinese models do have longer range or more advanced digital technology than Tesla cars, but those advantages are not enough to convince me that their products are superior.”

It is this reputation that has made Tesla the No 1 NEV brand in China by a wide margin.

In June, it delivered 14,954 Model 3 cars, representing 23 per cent of the total sales of pure electric vehicles, according to the China Passenger Car Association. BYD was a distant second, selling 4,106 Qin EV3 units.

Analysts say the pieces are slowly falling in place for the Chinese start-ups.

“The start-ups that are now flush with funds will now expand production capacity to lower prices, giving them scope to cut prices and compete with Tesla,” said Gao Shen, a Shanghai-based independent analyst covering the manufacturing sector.

He added that as the market is big and growing, the competition is good for consumers.

The China Association of Automobile Manufacturers forecast that NEV sales this year would fall 9 per cent to 1.1 million units as sales continue to rebound sharply in the second half. Between January and June, NEV sales on the mainland slumped 37.4 per cent to 393,000 units as the coronavirus outbreak hugely disrupted production and dented consumers’ buying interest in big-ticket items.

But the setback should not come in the way of Beijing’s long-term sales target of 3 million NEVs a year by domestic carmakers by 2025, about 10 per cent of the country’s overall sales. This is again a part of the government’s wider goal to promote the country as a world leader in green car technology and boost its status as the world’s largest manufacturer of NEVs.

Under the “Made in China 2025” industrial strategy, an ambitious plan first unveiled in 2015 to bring the country on par with global leaders in terms of technological developments, NEV is among one of the 10 areas that the country hopes to become self- sufficient in.

The MIC2025 strategy also states that China’s top two NEV makers should sell 10 per cent of their production overseas, but it did not specify which companies.

Before 2018, most of China’s domestically designed electric vehicles had driving ranges of under 300km, lagging behind Tesla’s 500km, because of battery limitations. Today, more than a dozen Chinese-made models have a driving range of more than 400km, showing initial signs of challenging Tesla.

Li Auto’s Li ONE has a range of 800km and NIO’s ES6 can travel 420km on a single charge.

This was made possible after the Chinese government announced a cut in subsidies granted to buyers of electric cars with a driving range of more than 400km by 50 per cent to 25,000 yuan. The move was aimed at steadily increasing the energy density threshold for the NEV power battery system while extending the driving range of electric cars.

Across the mainland, a total of 100 billion yuan has been invested in the NEV battery industry, according to Eefocus, an online tech consultancy. Additionally, existing plants have a combined annual capacity of 5 million batteries, nearly 70 per cent more than Beijing’s targeted sales of 3 million EVs a year by 2025.

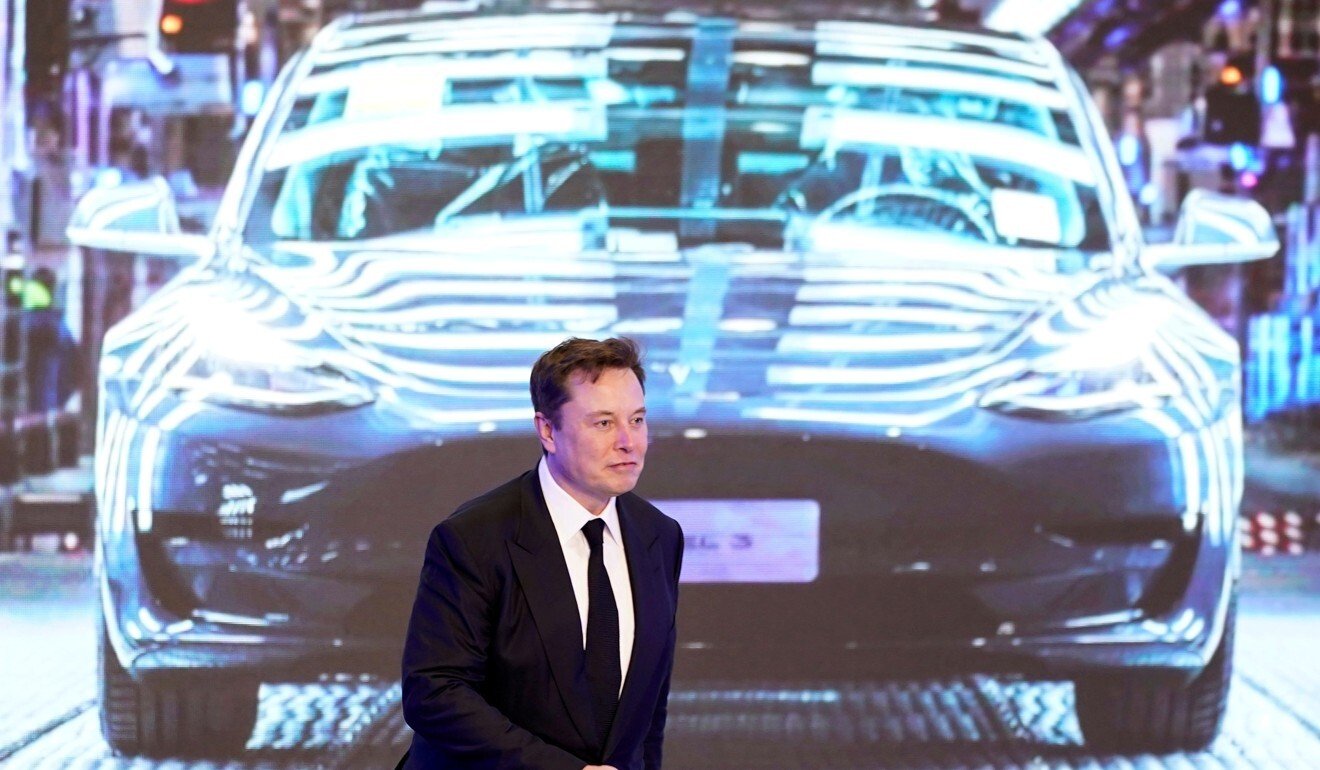

Elon Musk, Tesla’s chief executive, has shown that innovative start-ups with the right technology can become industry pioneers. He also proved that an entrepreneur without a car industry background can run a next-generation carmaker.

Much like Musk, the founders of Xpeng, NIO and Li Auto, have a point to prove. But can the minnows take on a giant like Tesla in their own backyard and turn their fledgling companies into industry powerhouses remains to be seen.