01:04

China lights up first 100MW solar power plant as part of a green-energy push

The initial public offering (IPO) of China Three Gorges Renewables Group has received a strong response from investors looking to profit from China’s push for carbon neutrality by 2060.

The online retail tranche of the company, which is a unit of China Three Gorges Corporation, was oversubscribed 190 times, which has led it to allocate more shares to this portion.

“Investors are quite enthusiastic about the prospects of the renewable energy sector, as China has been encouraging its development, in line with the country’s long-term goals,” said Stanley Chan, director of research at Emperor Securities.

Chinese President Xi Jinping set the country its carbon neutrality goal in a speech at the United Nations General Assembly last September. He followed that up – in a speech at the UN’s Climate Ambition Summit in December last year – with a plan to nearly triple China’s capacity to generate electricity from wind and the Sun to more than 1,200 gigawatts (GW) by 2030, increasing the share of non-fossil fuels in China’s energy mix.

The renewable energy space in China also has the advantage of facing less regulatory risks than the country’s fintech and e-commerce sectors, which have come under pressure after China’s antitrust clampdown on monopoly practices, Chan said. “If China Three Gorges Renewable does well on its IPO debut, it could give the renewable energy sector a boost,” he added.

01:04

China lights up first 100MW solar power plant as part of a green-energy push

Online retail investors have a 1.28 per cent chance of getting the shares, according to the company’s filing with the Shanghai Stock Exchange on Wednesday. The company’s 8.57 billion shares will be listed in China’s financial capital and were priced at 2.65 yuan each, allowing the company to raise up to 22.7 billion yuan (US$3.55 billion), according to its prospectus released last month. Its total assets, mainly solar and wind farms and some small hydropower plants, are valued at more than 140 billion yuan.

The company plans to use most of the listing’s proceeds to develop seven wind farms with a total capacity of 2.5GW. As of the end of September last year, China Three Gorges Renewables controlled about 11.9GW of generating capacity, including 6.9GW of wind capacity, 4.8GW of solar capacity and 0.2GW at small hydro units. Its total capacity has grown 83 times over the past 12 years.

The company accounted for about 3.3 per cent of China’s total wind power generation and around 2.4 per cent of the country’s total solar power generation as of end of September, according to its prospectus. It is 75 per cent owned by the state-owned China Three Gorges Corporation, the world’s largest hydropower projects developer.

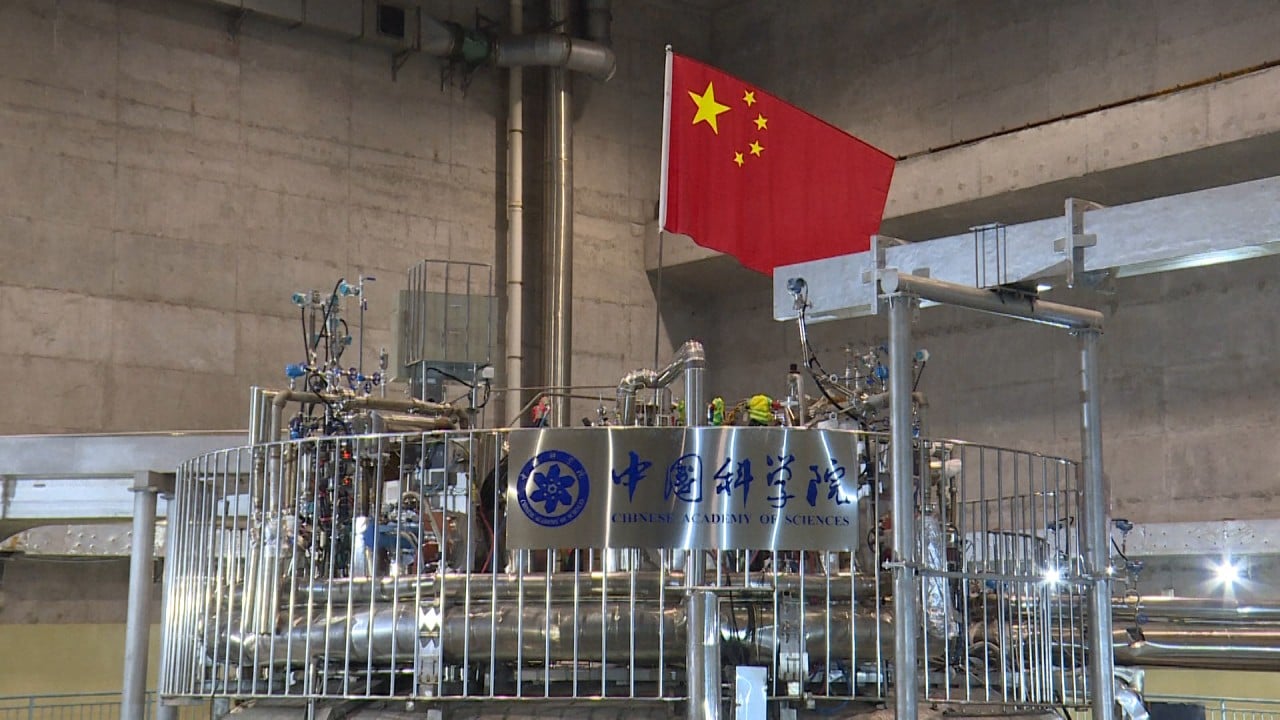

01:03

Chinese scientists experiment with gaining limitless clean energy through fusion reactions

Last year, China Three Gorges Renewables’ net profits grew 26.4 per cent to 3.59 billion yuan from 2019, while its revenue grew 26.3 per cent to 11.3 billion yuan.

For China to reach its carbon neutrality goal by 2060, its solar power generation capacity will need to expand by 14 times in the next four decades, and that of its nuclear and wind power sectors by seven times each, said Elaine Wu, JP Morgan’s head of environment, social and governance and utilities research in Asia excluding Japan. This will see the share of coal in China’s energy mix fall from 60 per cent currently to near zero, while that of non-fossil fuel energy will rise from 15 per cent to 85 per cent, Wu said.

This brisk expansion was possible because after over a decade of production expansion and subsidisation of renewable energy, the cost of generating each unit of solar power has already fallen to around the same as that of coal-fired power, she added.

02:52

How does China generate its energy?

“In one to two years’ time, wind power will also no longer require subsidies due to cost reduction. And five years from now, solar energy will be even cheaper than coal power,” Wu said.

However, challenges to rapid wind and solar power expansion remain, including the need to upgrade power grids and energy storage. These are needed to balance between demand and supply due to the intermittency of renewable energy.

“The sizeable buildout of renewables increases the need for grid connections and management solutions to handle the intermittency – smart grids,” Zhang Liutong, director of WaterRock Energy Economics, said in a report published last week by brokerage Jefferies. “Lack of flexible capacity may become a key constraint to continued rapid expansion of intermittent solar and wind capacity,” he said.