02:08

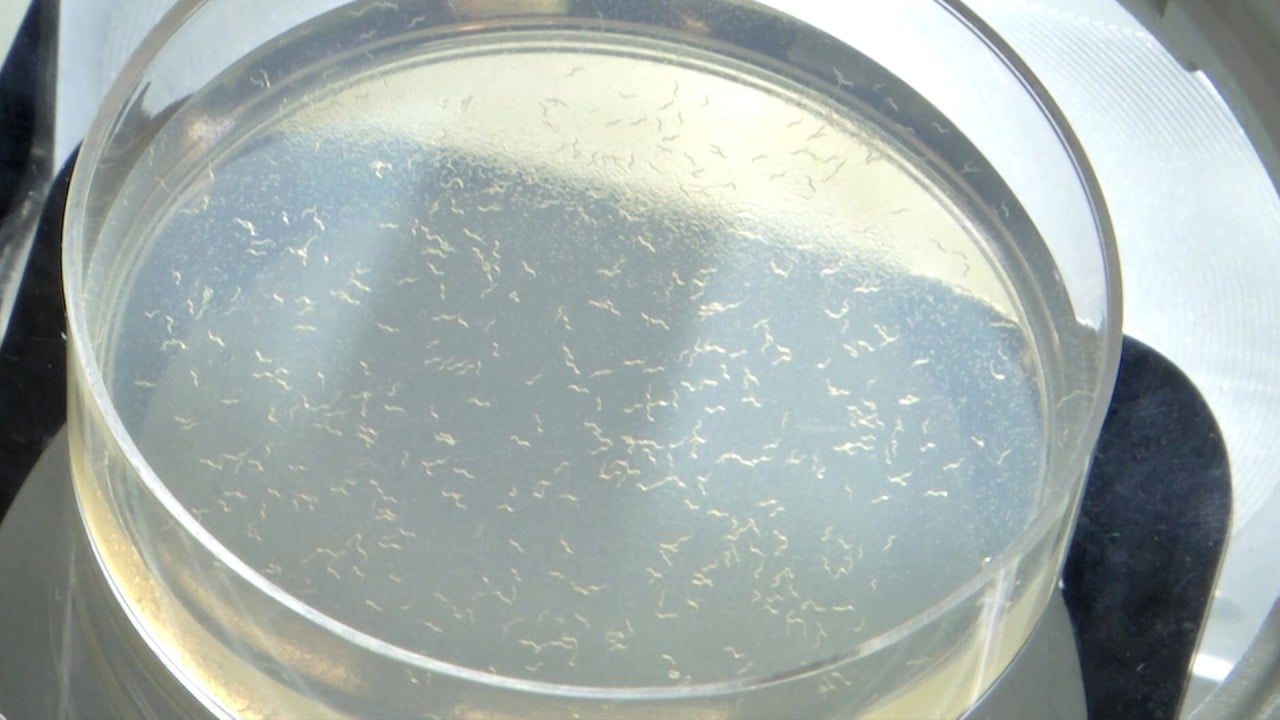

Japanese biotech firm uses roundworms in early screening for pancreatic cancer

HutchMed (China), which counts Hong Kong billionaire Li Ka-shing’s flagship company as its biggest shareholder, said it had reached a US$1.1 billion deal to license its colon cancer drug to Japan’s Takeda Pharmaceutical for markets outside China.

The exclusive worldwide licence agreement will allow a subsidiary of Takeda to develop, commercialise and manufacture fruquintinib outside mainland China, Hong Kong and Macau.

HutchMed will receive US$400 million upfront in a deal that could reach US$1.13 billion, with potential payments for reaching regulatory, development and commercial sales milestones, as well as royalties on net sales.

“This transaction is consistent with our strategic shift that we announced in November 2022 to accelerate our path to profitability,” said Weiguo Su, HutchMed’s CEO and chief scientific officer.

“We stated that we would focus on the innovative medicines in our pipeline, such as fruquintinib and others, that are most likely to generate near-term value, and that we would be uncompromising in our commitment to bringing our medicines to patients worldwide,” Su said. “Not only does the deal with Takeda accelerate this global ambition, but it provides us with more bandwidth and extended cash runway to advance other opportunities.”

HutchMed’s shares took a US$500 million hit in Hong Kong last May after the US Food and Drug Administration (FDA) declined to approve another one of its drugs, known as Surufatinib, for the treatment of pancreatic and extrapancreatic neuroendocrine tumours.

The company, which is also listed on Nasdaq in the United States, also faced pressure on its shares last year over concerns it could be among companies facing potential delisting in New York because of an audit row between the US and China. A deal was struck between Washington and Beijing last year, with US regulators saying they were able to inspect the audit firms servicing mainland Chinese companies listed in the US, removing the risk of delisting hanging over about 170 such firms.

HutchMed’s shares have more than doubled since hitting a 52-week low in Hong Kong in October. HutchMed’s shares rose 1.1 per cent to close at HK$27.60 on Friday, the last day of trading in Hong Kong before the Lunar New Year holiday.

Fruquintinib, which is orally administered and has the potential to be used across subtypes of metastatic colorectal cancer (CRC), was granted fast track designation by the FDA in 2020.

HutchMed initiated a rolling submission of a new drug application for fruquintinib with the FDA in December and the submission is expected to be completed in the first half of this year, Takeda said. That will be followed by the planned submission of a marketing authorisation application to the European Medicines Agency and a new drug application in Japan.

The deal is subject to customary closing conditions, including completion of antitrust regulatory reviews.

“Fruquintinib has the potential to change the treatment landscape for patients with refractory metastatic CRC who are in need of additional treatment options,” said Teresa Bitetti, president of the global oncology business unit at Takeda. “We look forward to utilising our development and commercial capabilities to expand the potential of this innovative medicine to patients beyond China.”