Xi open to growth below 6.5pc on debt risks

Leaders at a gathering agree the US$11 trillion economy will remain stable with slower growth as long as employment stays firm

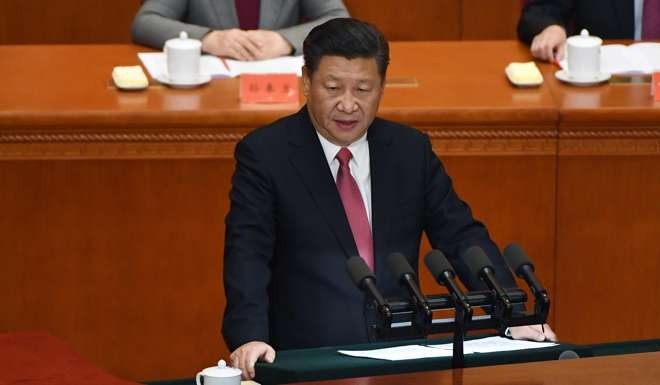

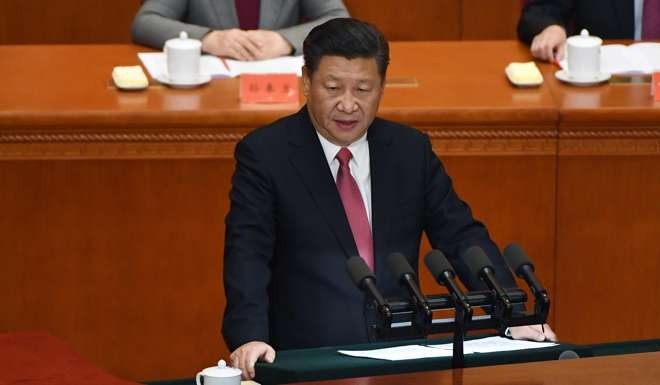

President Xi Jinping isn’t wedded to China’s 6.5 per cent economic growth objective due to concerns about rising debt and an uncertain global environment after Donald Trump’s election win in the US, according to a source familiar with the situation.

Xi told a meeting of the Communist Party’s financial and economic leading group this week that China did not need to meet the objective if doing so created too much risk, said the source, who asked not to be named because the discussions were private. Leaders at the gathering agreed that the US$11 trillion economy would remain stable with slower growth as long as employment stayed firm, the source added.

Below-target growth would be in line with analyst projections that the expansion will keep decelerating in coming years from an estimated pace of 6.7 per cent in 2016. The slowdown coincides with the nation’s broad shift from an export-led economy to services, which accounted for more than half of growth last year for the first time, and domestic consumption.

Last year, policymakers pledged an annual growth rate of at least 6.5 per cent for five years to 2020. Some economists criticise the growth objective for motivating officials to take risks that may jeopardise financial stability. The International Monetary Fund is among those that have recommended a lower target.

“This is a sign of positive change,” said Yao Wei, chief China economist at Societe Generale in Paris. “The arbitrary growth target of 6.5 per cent has become not only an impediment to the necessary structural adjustments, but also a culprit for rapidly rising debt risk.”

Some meeting participants sounded the alarm about unsustainable debt, noting that other nations had experienced crises after borrowing climbed to about 300 per cent of gross domestic product, the source said, adding that China’s debt-to-GDP ratio rose to about 270 per cent this year. The source of the ratio was unclear.

At another meeting last week, Xi and his top economic policy lieutenants pledged to make preventing and controlling financial risk to avoid asset bubbles a top priority for 2017. They also said they planned prudent and neutral monetary policy and proactive fiscal policy next year, according to a statement after the three-day central economic work conference.

Rising populist sentiment in the US and Europe pose another risk for Xi’s government, which has warned of the dangers of a trade war. Xi also warned China should avoid the so-called Thucydides Trap, the source said, referring to the theory attributed to the eponymous ancient Greek philosopher that says a rising power will clash with an established force.

Being open to tolerate slower growth for the sake of an altered growth model is a very important signal

The State Council Information Office did not immediately respond to faxed questions on Friday about the growth target and debt levels.

Policymakers said they were aiming for the 6.5 per cent average pace to achieve the party’s promise of building a “moderately prosperous society” by that year with GDP and income levels double those of 2010.

“A slower pace in the medium to long term will help adjust the economic structure and dissolve the risks,” said Zhu Qibing, chief macroeconomy analyst at BOCI International (China) in Beijing. “That will boost the long-term health of the economy.”

The world’s second-largest economy has defied bears this year with three consecutive quarters of 6.7 per cent growth. Economists have raised projections for China’s growth in 2017 to 6.4 per cent from 6.3 per cent in September, a survey shows. Forecasters expect 6 per cent growth in 2018.

Trump has threatened to slap tariffs on Chinese products while also questioning America’s policy on Taiwan, which mainland China considers its territory. Frothy property markets and a falling yuan also pose challenges to the economy.

Too much emphasis on meeting growth objectives is increasing financial risk, according to Huang Yiping, an adviser to the People’s Bank of China. The higher the short-term growth target, the more difficult it would be to rebalance the economy to favour long-term growth, Huang, also an economics professor at Peking University, said in Beijing this week.

Last year’s 6.9 per cent expansion was the slowest since 1990. For this year, the government set a 6.5 to 7 per cent target range, slower than last year’s goal of about 7 per cent. International Monetary Fund managing director Christine Lagarde said earlier in February that the fund strongly recommended China set a growth target range of 6 to 6.5 per cent.

“Being open to tolerate slower growth for the sake of an altered growth model is a very important signal,” said Frederik Kunze, chief China economist at Norddeutsche Landesbank in Hanover, Germany. “It seems like making a virtue out of the obvious because the current economic activity happens at the cost of future growth.”