Taiwan’s tech-led growth hardens resolve against Chinese squeeze

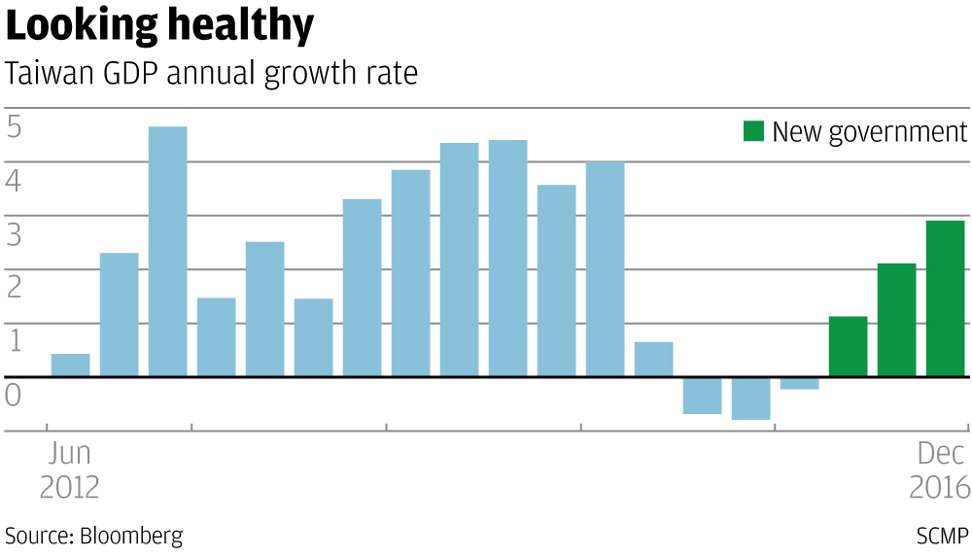

Taiwan’s economy grew for three straight quarters in the first nine months of Tsai Ing-wen’s administration, putting paid to the narrative that mainland China’s economic might and tourist spending can bend the island into submission.

Orders are pouring in again for Taiwan’s component suppliers amid the cyclical recovery in global demand for consumer electronics and technology products, reinforcing the signs that the island’s economy is back on the mend.

Exports, the bellwether measure for an economy that depends on overseas shipments for two-thirds of output, jumped by the most in six years in February, rising 27.7 per cent from last year and topping economists’ estimates. Foreign reserves rose to a record, while the benchmark stock index touched a 12-month high in February.

The economy looks healthy for the self-ruled island of 23 million residents, even as the number of mainland Chinese tourists – their spending contributes to 0.2 per cent of Taiwan’s economy – shrank for the ninth month in February.

“Taiwan’s macro outlook could be better than expected this year,” said DBS Bank’s economist Ma Tieying in Singapore. “The short-term exports outlook is positive, as the cyclical tailwinds outweigh the structural headwinds.”

Three successive quarters of growth are putting paid to the dominant narrative that the Chinese Communist Party can use the financial might and shopping budget of the world’s second-largest economy to bend Taiwan’s government into submission.

Mainland tourist arrivals plunged to a three-year low since May, when the newly inaugurated President Tsai Ing-Wen snubbed what’s considered a cornerstone policy of Taiwan’s relations with China.

As many as 3.4 million mainland Chinese tourists visited Taiwan in 2015, each spending an average of US$232 per day. The total tourism revenue of US$788 million is a fraction of 1 per cent of Taiwan’s economy.

Growth returned to Taiwan in late 2016 because of the cyclical pickup in consumer demand in major markets such as China and the US despite threats of trade protectionism by Donald Trump since he became president.

Orders for Apple’s new iPhone components and demand for other electronics before last year’s Christmas shopping season contributed to the late 2016 advances, said Liang Kuo-yan, president of Polaris Research Institute in Taipei. The middle class of China continued to be avid shoppers both online and in physical stores, which contributed to the bumper sales for Taiwan’s exporters.

“Things were weak for a while, then inventory came along,” Liang said. “We saw the effect of iPhone replacements and that process will go on.”

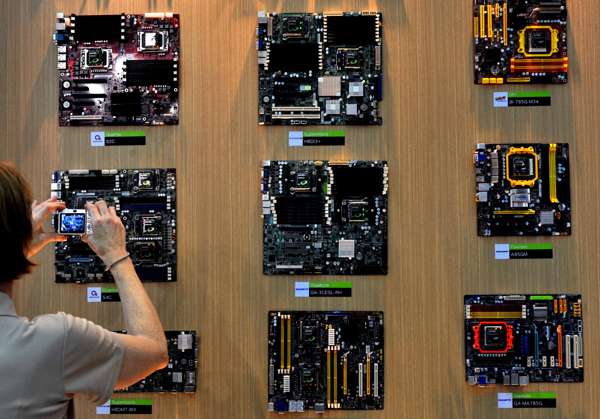

As a geographic source, Taiwan ranks with mainland China as the second-largest components supplier to the iPhone, after the US. The hi-tech industry makes up about a fifth of Taiwan’s US$519 billion economy.

Simplo Technology, Unimicron Technology, Largan Precision and TPK Holding make printed circuit boards, screens and optics for the iPhone, while Foxconn Technology assembles the devices.

The government is spending US$358 million this year on an internet network, mobile broadband and other initial stages on a business park called Asian Silicon Valley. The zone near Taipei will nurture start-ups, allow foreign talent and promote companies that work in the internet of things – seen by officials as a growth driver.

Tsai will unveil details of her May 20 inauguration pledge to foster stronger trade ties and investments in India and Southeast Asia – two populous, fast-growing markets.

Stronger economic relations in those two spots will ease Taiwan’s decades-old economic dependence on mainland China, a political rival since 1949, and hedge any risk of trade protection in the US.

China and Hong Kong bought 41 per cent of Taiwan’s February exports by value, while the US bought 10 per cent.

Details of the plan are sparing so far, but in December, Tsai called 2017 a “year of action” for this goal, which will take shape in three phases of six countries apiece. Some Taiwan firms are already testing Southeast Asia, with a population of about 600 million.

“Since 2015, internet companies that got started in Taiwan have started to enter markets around East Asia,” said Lin Tahan, chief executive of the Founder-Backer, a Taipei company that helps start-ups raise money.

“If they can establish a beachhead, experience that’s passed on to them can help internet entrepreneurs approach new markets with quick expansion. Once there are successful examples, they can foreshadow a new wave of expansion.”

Taiwan needs to steer its IT sector away from contract hardware, an old bedrock of the economy, towards software and software-hardware inventions such as the internet of things, economists warn. Otherwise they risk losing global consumer demand to mainland China, Liang said.

The mainland had reached an 18.3 per cent growth rate in research and development spending in 2016, UNESCO found, putting it in the world’s top five R&D nations.

“You need to depend on brain power,” Liang said. “Taiwan’s innovation has a lot of limiting conditions. You need people and you need money. Most often that takes time. But everyone’s KPIs are pegged to short-term goals.”

Taiwan’s tech firms should pursue “services” that can vie with mainland China on quality and added value, said Chris Hung, director of the Marketing Intelligence & Consulting Institute in Taipei. He cites contract chipmaker Taiwan Semiconductor Manufacturing Co as an example because of its “quality” chips and services tailored to individual customers.

“Mainland China is using its market and policy advantages and status as a big nation to rise up, and that’s been a given from early on,” Hung said. “For Taiwan’s vantage, it’s actually facing a high level of competition in terms of unequal resources.”