Everybody is overlooking this developing trend in China’s yuan

‘If China’s policymakers play their cards right, there is a definite gap to fill if the dollar’s days are numbered’

The yuan might have made only a modest entry on the world stage as a global reserve currency but it marks the start of a Big Bang for China’s forex ambitions. The saying goes that “mighty oaks from little acorns grow”, but if China plays its cards right, in coming decades, the yuan could put a big dent into the US dollar’s status as the world’s leading official reserve currency.

Deeper market liberalisation, wider-ranging reforms and a fuller commitment to free-floating currency convertibility could lead the way for global investors eventually accepting the yuan on level pegging with the dollar, the euro and yen. It may take years, but at least China’s authorities have taken the first small step in what should be a giant leap forward for the currency over the future.

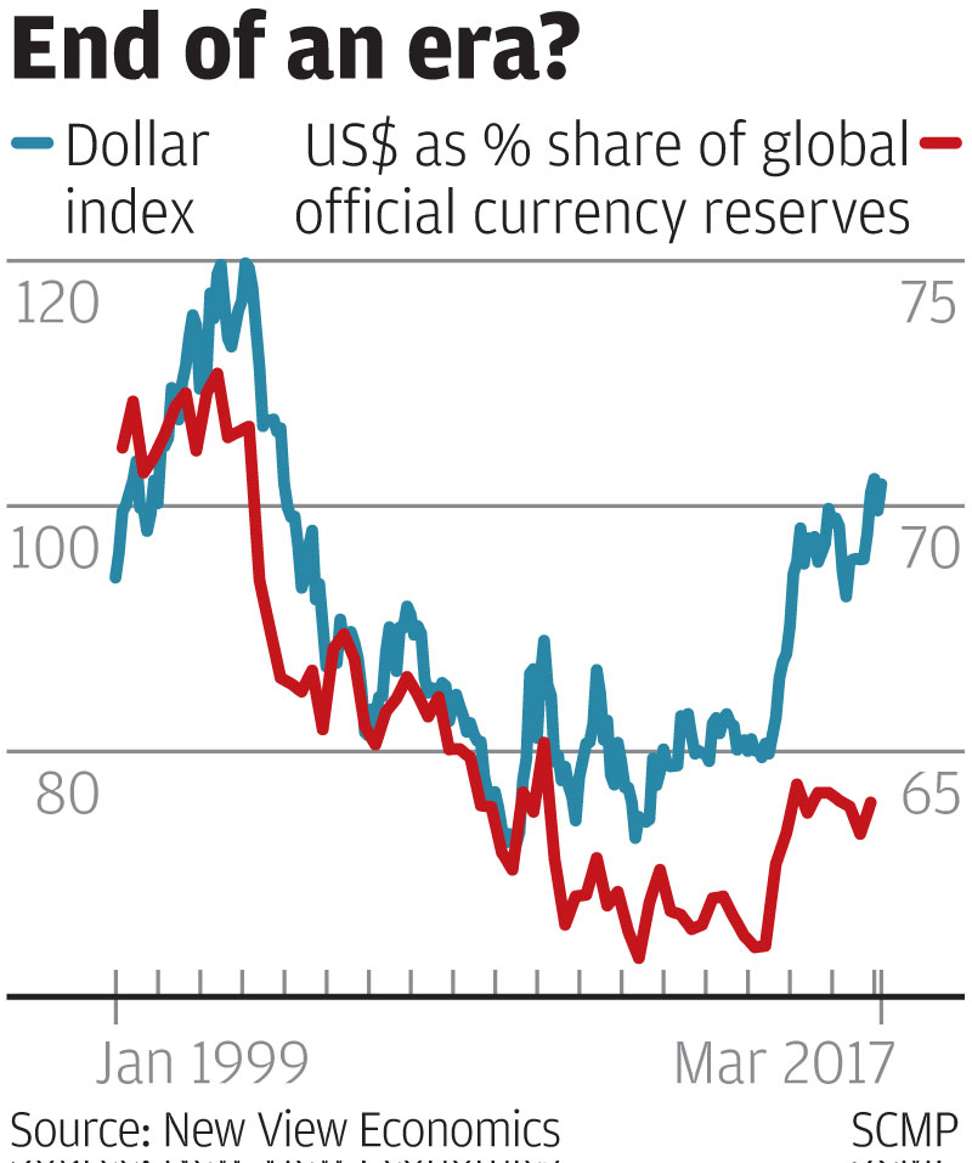

For the moment, the latest COFER report on official currency reserve holdings from the International Monetary Fund shows dollar demand continues to dominate by a long stretch. The latest data shows the dollar’s share of global reserves rose to a record US$5.05 trillion, nearly 64 per cent of all official holdings. The euro lags well behind to the tune of a 20 per cent market share.

Speculation about the dollar’s demise has been greatly exaggerated in the past, as it still remains the top pick among reserve asset managers. China’s renminbi came out of the starter’s blocks in the fourth quarter of last year, with its share of allocated currency reserves totalling just over 1 per cent, or US$84.5 billion. It may be small fry compared to the dollar but it is a fair bet great opportunities lie ahead.

There are good reasons why the US’ dominance could soon be on the slide – many of them to do with President Donald Trump. With Trump threatening to push America into a more isolationist and protectionist stance vis-à-vis the rest of the world, there could be serious fallout ahead for the dollar.

The US’s twin black holes – the budget deficit and trade gap – continue to pose dark shadows over the currency, requiring massive infusions of central bank and overseas money to keep the economy afloat. The US Federal Reserve has plied the system with an abundance of quantitative easing money – as much as 25 per cent of US GDP – to keep the economy flush with funds and avoid any “crowding out” effect on borrowers.

The US balance of payments continues to be bailed out by overseas money, inbound direct investment and investors attracted by America’s premier position as the world’s largest financial market. But it is all based on confidence that the domestic economy and markets are being soundly managed. In the next few years, those perceptions could be tested to breaking point.

Right now, the so-called “Trump Trade”, the market’s expectation that Trump’s economic policies will turbocharge US growth and job creation is on probation. America’s main stock indexes are already showing early signs of fatigue and the markets could soon be on a collision course with a reality check that Trump’s “America First” policy is never going to fully live up to the hype.

If Trump’s “house of cards” comes crashing down, global investors will want to give the US capital markets and the dollar a wider berth. Certainly, nations like China, already under the US administration’s spotlight for alleged “unfair trade practices” might choose to take a more retaliatory line on their official holdings of US reserve assets. Unless the US is careful, “America First” could backfire into a “Sell America” campaign.

The problem is there are few practical alternatives. The euro was once vaunted as the next major currency reserve asset in waiting, but the long succession of euro-zone troubles in recent years has put a serious dent in the euro’s credibility. Japan’s yen has a tarnished image thanks to decades stuck in deflation and low interest rates, while demand for the UK pound has been thumped by Brexit.

If China’s policymakers play their cards right, there is a definite gap to fill if the dollar’s days are numbered. It will take a huge leap of faith, but by cementing the yuan’s standing in international capital markets and facilitating its use in global trade transactions, China’s currency should gain wider acceptance as a medium of exchange and a respected reserve asset.

In time, a carefully crafted, confidence-building strategy for the yuan could give the dollar a good run for its money.

David Brown is chief executive of New View Economics