The markets are crying out for stronger US leadership

US financial markets cannot be blamed if they are feeling perplexed right now. American policymakers are being as clear as mud and leaving stock, bond and currency markets struggling for direction.

There are too many blurred lines coming from America’s political, fiscal and monetary elite. Time is running out and markets need much better guidance to stop the situation turning into a complete fiasco.

The US stock rally is running out of steam, the bond market is drifting rudderless and the US dollar has hit the doldrums. It is no surprise, because US fiscal, monetary and currency policy is fast becoming a “Mexican standoff”, with some fast resolution needed to break the market tensions.

President Donald Trump needs to get his “strategy for growth” back on the rails, the Federal Reserve must stay committed to fast-tracking rate policy normalisation and the US Treasury needs to get its act together on what it really wants for the dollar. Unambiguous, strong action is required, not vacillation.

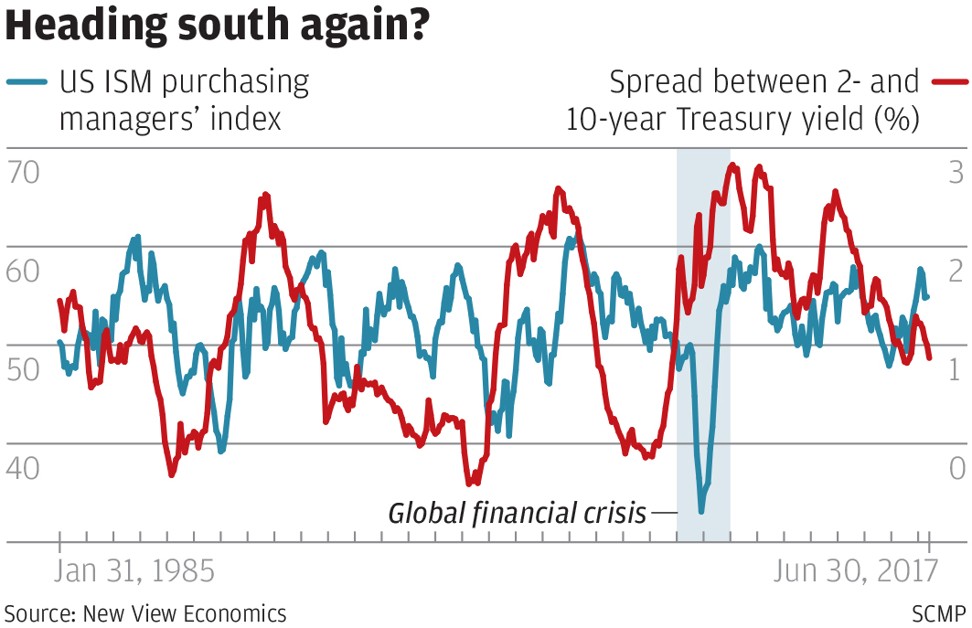

Much of the confusion is plain to see in the US Treasury curve, which has reverted to a flattening trend this year, much more consistent with expectations of slowdown in the economy. The 10-year minus two-year Treasury yield spread has narrowed from 140 basis points in December to 80 basis points last week.

It is still a long way off discounting US recession – when the curve tends to turn negative – but still shows all is not well with the stronger growth story. It is a different picture from the end of last year when the US bond market was all fired up and the curve was steepening sharply on hopes that Trump would stoke up stronger growth with higher inflation in fast pursuit.

First of all, Trump needs to get his focus back on the economy and stop fighting unnecessary political battles with the press, the civil service, the opposition and his own party. It is in everyone’s best interest to rebuild the US economy, secure faster growth and ensure sustainable job creation for the future. It is all about statesmanship, leadership and uniting the nation.

The economy is not doing too badly as it is, with underlying growth running between 2 and 2.5 per cent per annum, but how much better it would be for his political legacy if he could keep his manifesto pledge and elevate economic growth to a 3 to 4 per cent range. He has the tools and the acumen in Washington to pull it off. But it will depend on good inter- and intraparty consensus between the Democrats and the Republicans.

Global savings can accommodate additional Treasury financing requirements, especially once the Fed’s quantitative easing programme finally ends this year

If the US budget deficit presses moderately higher, no matter. Global savings can accommodate additional Treasury financing requirements, especially once the Fed’s quantitative easing programme finally ends this year. The Fed also needs to press on with its interest rate normalisation and ignore the political flak.

The US economy should be able to live with US short-term interest rates running at 3 to 4 per cent in the long run while US 10-year Treasury yields levelling out in a 5 to 6 per cent range should be no big deal. It should be a boon to global investors, savers and reserve managers who have been hamstrung by quantitative easing and low bond yields for almost a decade.

And if the dollar starts to rally against the administration’s wishes, then it just has to be upfront about what it wants from the US currency. If the US wants a weaker dollar to boost export-led recovery, then so be it. Better to be honest about it rather than slagging off Europe, China and Mexico for currency manipulation.

The return of a much steeper US yield curve should be a blessing, not a market anathema.

David Brown is chief executive of New View Economics