Hong Kong insider buying remains high while insider selling wanes

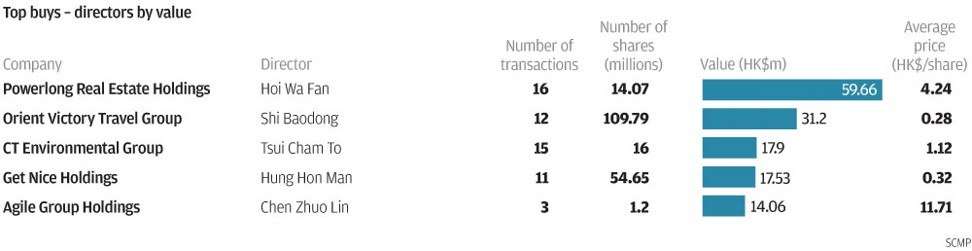

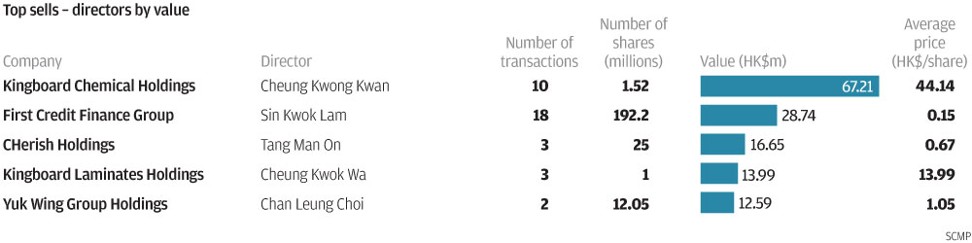

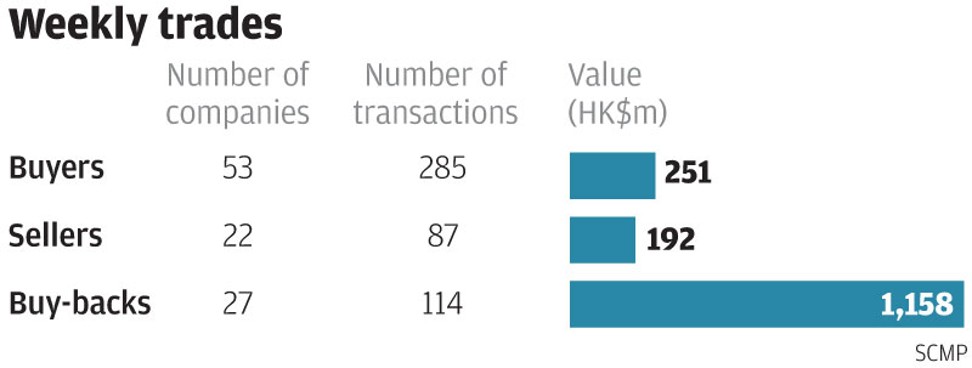

The buying remained high while the selling among directors fell based on exchange filing from September 18 to 22 with 53 companies that recorded 285 purchases worth HK$251 million versus 22 firms with 87 disposals worth HK$192 million. The number of companies on the buying side was down from the previous week’s 62 firms. The number of purchases and buy value, however, were not far-off from the previous week’s 276 acquisitions worth HK$262 million. On the selling side, the number of companies was consistent with the previous week’s 23 firms. The number of trades and sell value, however, were down from the previous week’s 101 disposals worth HK$378 million.

Aside from directors, the buy-back activity remained high with 27 companies that posted 114 repurchases worth HK$1.158 billion based on filings from September 15 to 21. The number of firms and trades were not far-off from the previous 5-day total of 25 companies and 118 transactions. The value, however, was sharply down from the previous week’s turnover of HK$1.55 billion.

There were several first-time trades last week with initial buy-backs in Fortunet e-Commerce Group, China Pioneer Pharma Holdings and insider buys in Cybernaut International and Amax International. Lastly, our stock of the week is Hopefluent Group with two of the Company’s co-founders recording buys at higher than their acquisition prices earlier this year.

Automotive parts manufacturer Fortunet e-Commerce Group bought back 2.057 million shares from September 19 to 21 at HK$1.13 to HK$1.05 each or an average of HK$1.08 each. The stock closed at HK$1.10 on Friday.

Significant Points

The group recorded its first buy-backs since listing in September 2010

The buy-backs accounted for 16 per cent of the stock’s trading volume

The buy-backs were made after the stock fell by as much as 43 per cent from HK$1.83 in December 2016

The company’s buy-back prices were lower than the IPO price of HK$4.00

Pharmaceutical products and medical devices marketing, promotion and channel management service provider China Pioneer Pharma Holdings bought back 3.7 million shares on September 20 at HK$2.68. The sentiment is not entirely positive this quarter as chief executive Zhu Mengjun sold 2.05 million shares on August 24 at HK$2.18 each, which reduced his holdings by 65 per cent to 1.100 million shares or 0.08 per cent of the issued capital. He previously acquired 181,000 shares on July 7 at HK$2.59 each. Prior to his trades this year, Zhu sold 11,000 shares in December 2015 at HK$3.30 each and purchased 1.13 million shares from July 2014 to July 2015 at an average of HK$5.03 each. The stock closed at HK$2.69 on Friday.

Significant Points

The group recorded its first buy-backs since listing in November 2013

The buy-back was made on the back of the 18 per cent drop in the share price since April from HK$3.28

Chairman Li Xin Zhou purchased 1.85 million shares in July at HK$2.67 each. He previously acquired 1.29 million shares in September 2015 at HK$3.08 each

Chairman Zhu Min purchased 17 million shares of industrial machinery products manufacturer and distributor Cybernaut International from September 5 to 15 at an average of HK$0.315 each. The trades increased his holdings to 706 million shares or 16.84 per cent of the issued capital. The counter closed at HK$0.305 on Friday.

Significant Points

The purchases are the chairman’s first on-market trades since the stock was listed in July 2010

The purchases accounted for 28 per cent of the stock’s trading volume

The chairman recorded buys on 7 out of the 9 trading days from September 5 to 15

The purchases were made on the back of the 34 per cent drop in the share price since February from HK$0.48

Chairman and chief executive Ng Man Sun purchased 3.574 million shares of gaming play Amax International from September 7 to 12 at HK$0.40 to HK$0.368 each, or an average of HK$0.385 each. The trades increased his holdings by 7.5 per cent to 51.235 million shares or 8.27 per cent of the issued capital. The counter closed at HK$0.35 on Friday.

Significant Points

The purchases are the chairman’s first on-market trades since his appointment in September 2012

The purchases accounted for 7 per cent of the stock’s trading volume

The purchases were made after the stock fell by as much as 50 per cent from HK$0.74 in October 2016

Co-founders chairman Fu Wai Chung and his spouse executive director Ng Wan acquired a combined 2.436 million shares of real estate agency and estate management services provider Hopefluent Group from August 31 to September 21 at HK$3.17 to HK$4.15 each or an average of HK$3.82 each. Chairman Fu Wai Chung purchased 1.2 million shares from August 31 to September 15 at an average of HK$3.59 each, which increased his holdings to 244.441 million shares or 36.59 per cent of the issued capital. He previously acquired 1.13 million shares from July 3 to 20 at an average of HK$2.99 each. Prior to his trades this year, the chairman acquired a net 11.8 million shares from April to December 2016 at average of HK$2.18 each. Executive director Ng Wan, on the other hand, purchased 1.236 million shares from September 19 to 21 at an average of HK$4.05 each, which boosted her stake by 50 per cent to 3.712 million shares or 0.56 per cent. She previously acquired 1.64 million shares from July 4 to 19 at an average of HK$3.04 each. The stock closed at HK$4.20 on Friday.

Significant Points

The purchases by the two directors were made at higher than their acquisition prices earlier this year

The purchases accounted for 13 per cent of the stock’s trading volume

The purchases by Ng since July are her first on-market trades based on filings on the exchange since 1993

Robert Halili is managing director of Asia Insider