Hong Kong’s insider and buyback activity sharply up during last week of March

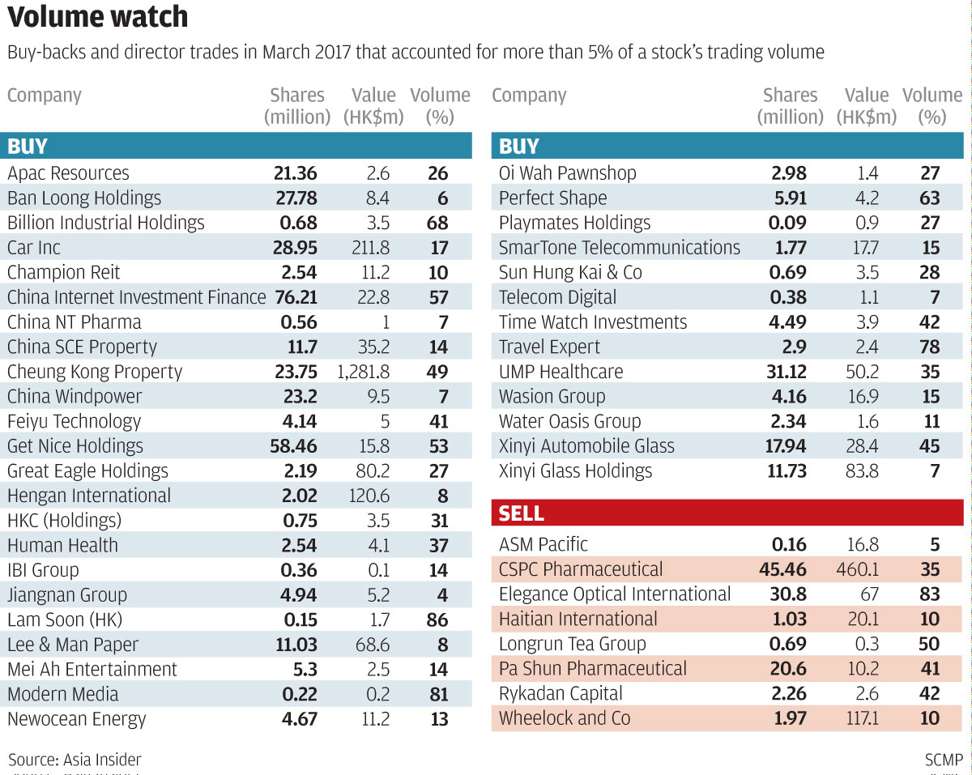

The insider and buyback activity exploded with 55 companies recording 250 transactions worth HK$1.06 billion (US$136.4 million) based on filings to the Hong Kong stock exchange in the last week of March.

The figures were sharply up from the previous week’s 31 firms, 132 trades and HK$444 million. A total of 40 companies recorded 162 purchases worth HK$332 million on the buying side and 15 firms with 88 disposals worth HK$728 million on the selling side.

On the buyback front, a total of 25 companies posted 94 repurchases worth HK$2.215 billion based on filings from March 24 to 30. The figures were up from the 11 firms, 41 trades and HK$1.99 billion in the previous 5-day period.

There were several rare buybacks and director purchases in the last week of March, some of which were made following sharp gains in share prices. There were buybacks in Karrie International, Wisdom Sports Group, Allied Group, Evergrande Real Estate Group and Gome Electrical Appliances and insider buys in Shougang Fushan Resources, Jacobson Pharma Corp and Zhongzhi Pharmaceutical.

Computer casings and office automation products manufacturer Karrie International bought back for the first time since 2008 with 516,000 shares purchased on March 30 at HK$0.90 each. The trade was made on the back of the 57 per cent rise in the share price since September 2016 from HK$0.57. The counter is also up since June 2012 from HK$0.16. The Group previously acquired HK$406,000 worth of shares in October 2008 and HK$356,000 worth of shares from June 2000 to March 2001. The counter closed at HK$0.92 on Friday.

Financial services provider and property investor Allied Group recorded its first buyback since October 2016 with 20,000 shares purchased on March 29 at HK$50.00 each. The trade was made on the back of the 28 per cent rise in the share price since December 2016 from HK$39.20. The acquisition was also made after the company announced on March 27 a 96.7 per cent gain in annual profit to HK$3.263 billion. The group previously acquired 1.39 million shares from September to October 2016 at HK$40.00 each and 34,000 shares from January to May 2016 at HK$37.71 each. Prior to the repurchases since 2016, the company acquired 5.1 million shares from January to December 2015 at HK$32.00 to HK$44.20 each or an average of HK$38.05 each, 24 million shares from November 2011 to June 2014 at HK$17.00 to HK$34.90 each or an average of HK$20.48 each and 16.7 million shares from February 2005 to February 2009 at HK$34.05 to HK$8.80 each or an average of HK$15.32 each. The stock closed at HK$52.00 on Friday.

Consumer electronic products retailer Gome Electrical recorded its first buyback since July 2016 with 60 million shares purchased on March 29 at HK$1.04 each. The trade was made on the back of the 14 per cent rebound in the share price since December 2016 from HK$0.91. The buyback was also made after the company announced on March 27 a loss of 54.2 million yuan versus a profit of 936.5 million yuan in the previous year. The group previously acquired 494 million shares from May to July 2016 at HK$0.93 each, 74.5 million shares from April to May 2014 at an average of HK$1.37 each and 519 million shares from January to February 2008 at HK$4.31 each. The stock closed at HK$1.06 on Friday.

Executive director Yim Chun Leung recorded his first trades in generic drugs and proprietary Chinese medicines manufacturer Jacobson Pharma Corp since the stock was listed in September 2016 with 350,000 shares purchased from March 28 to 29 at HK$1.59 each. The trades increased his holdings to 9.350 million shares or 0.51 per cent of the issued capital. The purchases were made on the back of the 14 per cent drop in the share price since January from HK$1.84. Despite the fall in the share price, the counter is still up since November 2016 from HK$1.45. The director’s purchase price was lower than the IPO price of HK$1.72. Yim joined the group in September 2008. The stock closed at HK$1.60 on Friday.

Chairman Lai Zhi Tian recorded the first corporate shareholder trades in Chinese medicine and herbal medicines developer and manufacturer Zhongzhi Pharmaceutical Holdings since the stock was listed in July 2015 with 679,000 shares purchased from March 28 to 29 at HK$1.70 each. The trades increased his holdings to 526.039 million shares or 65.75 per cent of the issued capital. The acquisitions were made on the back of the 28 per cent drop in the share price since June 2016 from HK$2.38. The chairman’s purchase price was lower than the IPO price of HK$3.08. The stock closed at HK$1.68 on Friday.

Robert Halili is managing director of Asia Insider